As of September 13, 2024, the gold price target of $3,000 per Ounce is officially a forecast target for 2025. Gold can and will reach $3,000.

RELATED – A Gold Price Prediction for 2024 2025 2026 – 2030.

September 13, 2024 – While gold may not reach $3,000 by 2024, that is virtually impossible. It is clear that the fundamental conditions are right for gold to reach $3,000 per Ounce by 2025. Our previous time frame for gold to reach $3,000 is February-August 2026. We are adjusting now to April-May 2025.

Gold has long been revered as a store of value, a safe haven in times of economic uncertainty.

In recent years, the gold price has seen fluctuations influenced by a variety of factors, from geopolitical tensions to shifts in global economic policy.

Amid this volatility, however, one path seems very clear based on the current gold price chart: Gold is on track to reach $3,000 per Ounce. In this post we try to find out if and when gold will reach $3,000 per Ounce.

We start with our own proprietary gold chart analysis. We move on to fundamental analysis.

Will Gold Reach $3,000 per Ounce? The golden card answers.

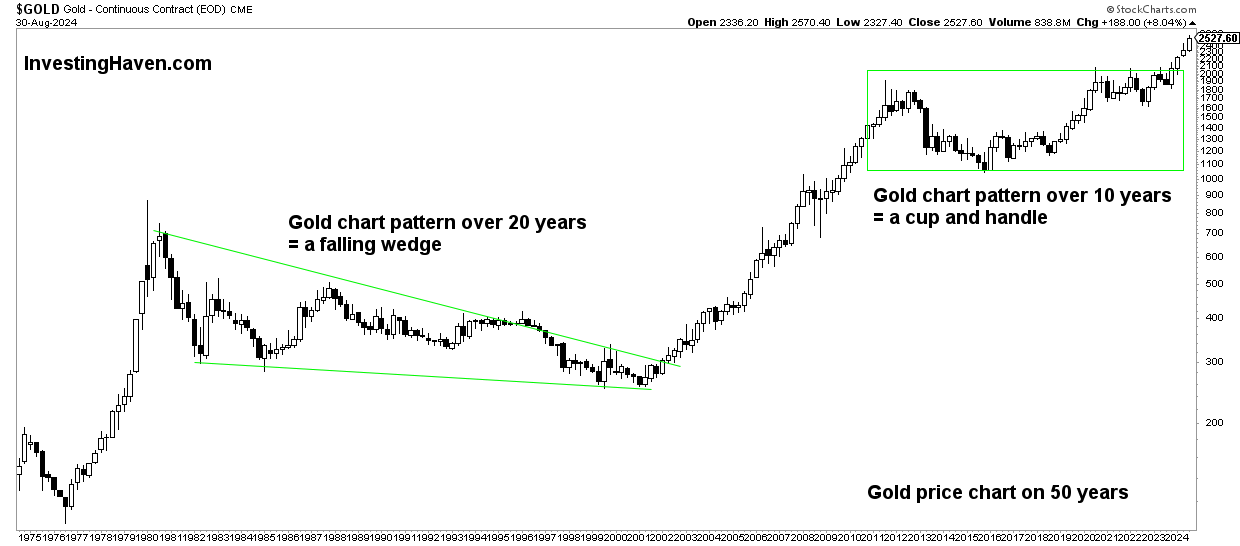

Taking a classic top-down approach, we look at the 50-year gold chart. From our 50-year gold analysis:

From 2024 onwards, a new phase will be visible on the 50-year gold price chart.

If we carefully analyze the secular phases on the 50-year gold chart, we see that the 10-year consolidation will be completed in 2024.

This means that gold entered a new bull market, especially on March 1, 2024, when it cleared its previous bull market. ATH. We agree: 2024 marks the start of gold’s third secular bull market.

The main conclusion is that gold has entered a ten-year consolidation period. This consolidation takes the form of a cup-and-handle structure, a bullish formation.

A key insight from this chart is that gold will reach higher prices, and gold may reach $3,000 sooner or later..

September 13, 2024 – The secular gold price chart is looking more and more powerful every month. While gold is not far from the $3,000 mark, there is still a way to go. Of interest rate cuts are looming around the worldthe gold card seems to be proactively adapting to this new reality.

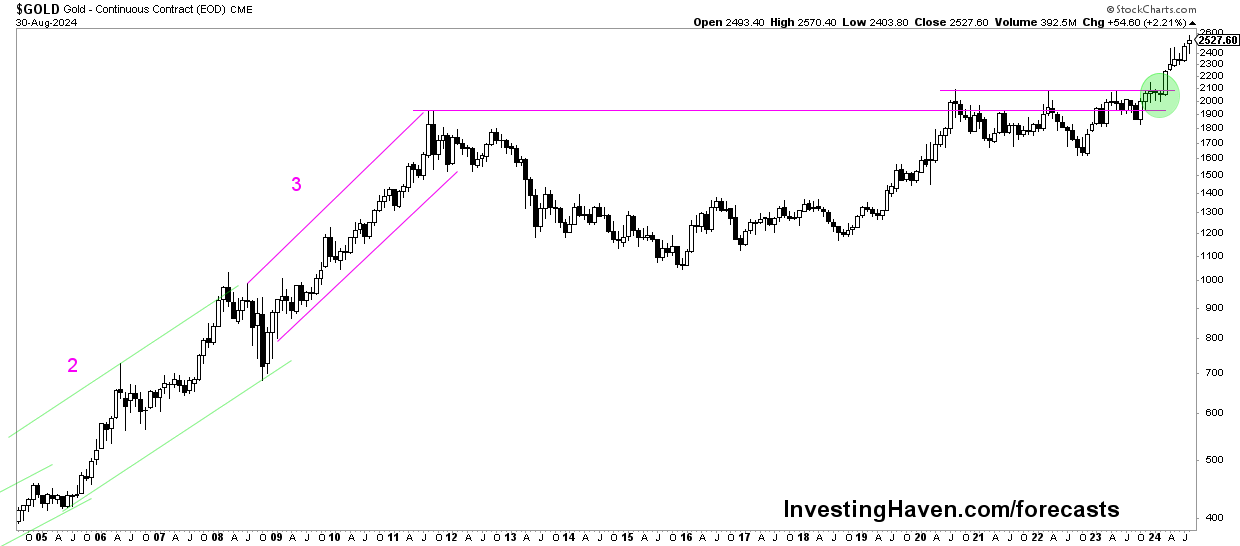

If we zoom in on the same chart and focus on the 20-year gold chart, we can clearly see that the breakout is happening.

This breakout, which started on March 1, 2024, has so much upside potential simply because of the long (and therefore strong) bullish pattern that gold created over a 10-year period!

September 13, 2024 – Gold’s 20-year price chart says it all – a powerful breakout after a 10-year base and bullish reversal pattern was completed in March 2024.

Both gold charts suggest that gold to $3,000 is a reasonable price target.

Remark – here’s to another 50 years of gold graphic on Twitter (X), which is consistent with our conclusions.

When Will Gold Reach $3,000 an Ounce? A likely scenario.

The question of WHEN gold will reach $3,000 can be answered by looking at the current chart structure.

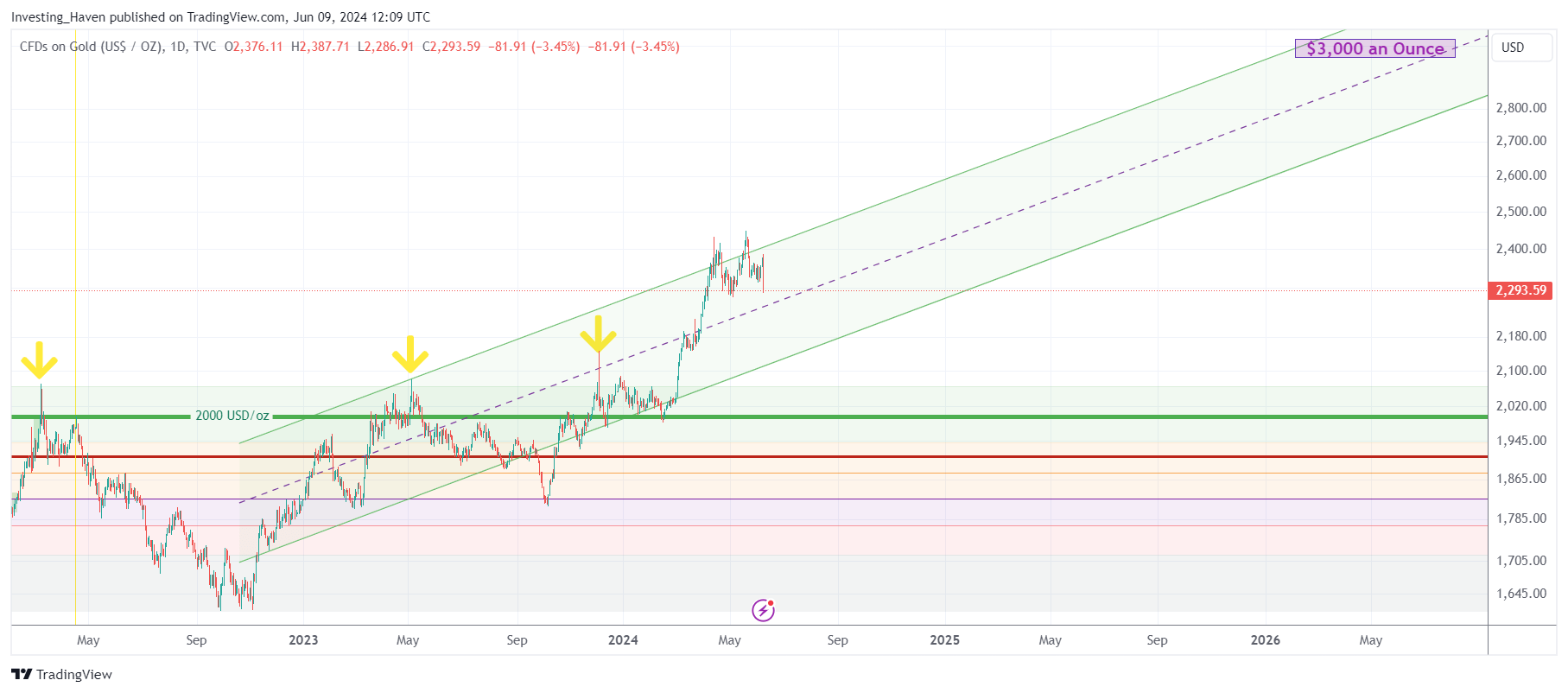

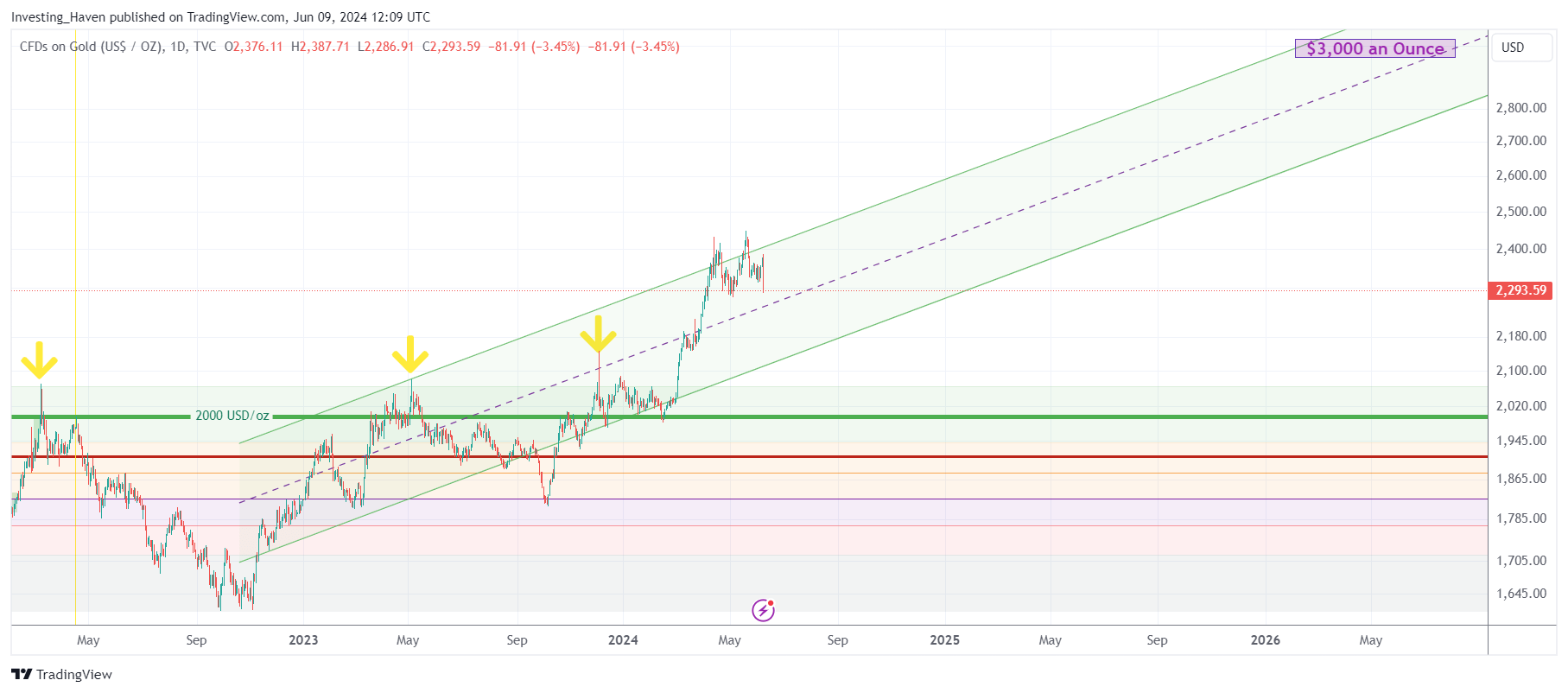

As seen below, the gold price started moving in an ascending channel from 2023 onwards.

This price channel is pretty perfect.

If gold (and that is a big IF) continues to respect this rising channel, it will reach $3,000 in the period February – August 2026.

Granted, this is just one scenario. Other outcomes are possible.

But given the current state of the gold market, with the available data, we believe that the above projection has a high level of confidence. This is especially true because we know exactly when this projection becomes invalid, i.e. when gold falls outside its ascending channel.

Gold to $3,000 per ounce – the fundamental picture

The price dynamics of gold are deeply intertwined with several fundamental factors.

- Let’s first look at the dynamics of supply and demand. Gold production is relatively stable, with new discoveries offsetting the depletion of existing mines.

- However, the demand for gold fluctuates based on several factors, including jewelry, industrial use, and investment demand.

- Recently, there has been a sharp increase in investment demand due to economic uncertainty. Central banks in particular have hoarded large amounts of physical gold.

- Geopolitical tensions also play an important role in gold price movements. Any escalation of conflict or geopolitical uncertainties tends to drive investors towards safe havens such as gold.

- Furthermore, central bank policies, especially regarding interest rates and quantitative easing measures, have a major impact on investor sentiment towards gold. With many central banks pursuing accommodative monetary policies, concerns about inflation and currency depreciation are strengthening gold’s appeal.

Many of the gold price influencers mentioned above have been supporting gold since 2023.

The new golden playbook

In recent times, the gold market has witnessed significant shifts, marked by structural changes in the financial system and geopolitical landscape. These transformations require a new approach for investors (h/o Ronald Stoeferle).

Shifts in demand: Traditional Western financial investors are no longer the main drivers of gold demand. Central banks and emerging markets, especially China, have emerged as dominant players in the market, fundamentally changing its dynamics.

Another piece from @RonStoeferle:

“The second is that China has reopened the gold window in Shanghai with the Shanghai Gold Exchange.”https://t.co/FuKEaSUzpB

– Jaime Carrasco June 8, 2024

Eastward gold flows: Central banks in emerging markets, especially in Asia, have played a crucial role in supporting the gold price. Demand for gold jewelery in the region, led by China, India and the Middle East, underlines the significant shift in gold consumption patterns.

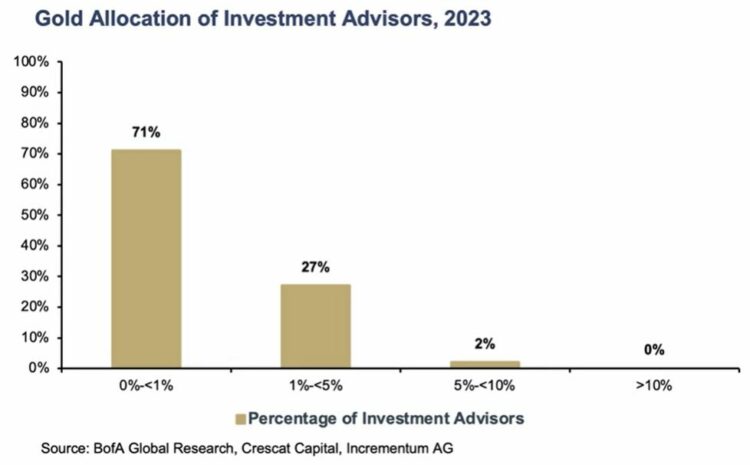

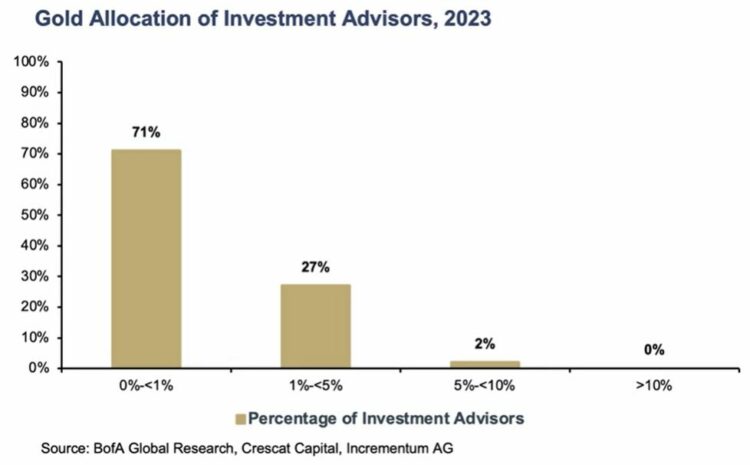

Western investors lag behind: Despite these changes, Western financial investors have been slow to adjust their portfolios, with a substantial portion still underexposed to gold. However, rising inflation and the looming possibility of recessions could lead to a shift in sentiment towards gold as a hedge.

Unsustainable Debt Levels: Global debt has reached unprecedented levels, with the US alone accumulating more than $11 trillion in debt since January 2020. This alarming trend, coupled with projections that interest payments will become the largest federal budget category, underscores the urgency of alternative investment strategies.

Gold-backed currencies: Efforts by countries such as China, Russia and their allies to reduce dependence on the US dollar in international trade have led to discussions about the potential of gold-backed currencies. This geopolitical maneuvering could have profound consequences for the global financial landscape.

Conclusion

In conclusion, while predicting the exact trajectory of the gold price is inherently uncertain, a combination of fundamental and chart analysis provides valuable insights for investors.

Fundamentals point to a supportive environment for gold, with continued economic uncertainties and accommodative monetary policy driving investor demand.

September 13, 2024 – We are adjusting our timeline so that gold will reach $3,000 from early/mid 2026 to mid 2025.

Furthermore, chart analysis shows that gold’s recent price movements have shown a clear bullish path, suggesting that it can and will head towards $3,000 per Ounce.