Leading indicators in the precious metals universe suggest silver will outperform in 2025 and 2026. Gold is the driving force behind the bull market, silver qualifies as the future outperformer.

RELATED – Gold Forecast for 2025 to 2030.

As we approach 2025, the precious metals universe is about to change.

While gold has traditionally been the metal of choice for investors seeking portfolio stability and long-term growth, silver is expected to become the outperformer by 2025.

This article outlines thoughts about which precious metal to buy before 2025. We lay the 3 reasons why silver will outperform the other precious metals:

- Speculators are giving up what a bullish indicator is – more details below.

- Secular silver chart dynamics suggest that silver is the precious metal to buy – see charts below.

- Bull market dynamics: Silver tends to react with a delay compared to gold – see historical evidence below.

This is why silver should be a consideration for investors in 2025.

Precious metals outlook for 2025

The precious metals market is influenced by a complex array of economic data, market sentiment and other leading indicators.

Recent trends suggest that silver is preparing for a big rebound. This may not start anytime soon, but it looks like an acceleration phase will occur in 2025.

Silver is expected to be driven by historical patterns, chart dynamics and market dynamics.

Silver’s unique characteristics and current indicators suggest that silver is not only a valuable addition to an investment portfolio. Potential, Silver could become the juiciest opportunity in the precious metals sector in 2025In this article we explain why we think that.

Again, we recommend staying away from the news. This kind of information is useless: Gold falls from near record levels as US jobs data clouds the interest rate outlook. If we want to understand which precious metal to buy before 2025, we need reliable material leading indicator facts. That is what we will focus on in this article.

1. Speculators Give Up – A Bullish Indicator

One of the most compelling reasons to consider silver for 2025 is the current state of speculators in the world silver futures market.

Managed money traders, who are usually considered speculators in the market, have significantly reduced their long positions.

This trend is particularly notable because it aligns with historical patterns that have preceded major rallies in the price of silver.

Historically, substantial rallies in silver have often been preceded by a reduction in speculative positions. The historical silver rally of 2010/2011 serves as a good example. During that period, a similar decline in speculators’ long positions was observed, which was followed by a dramatic increase in the price of silver. The current decline in speculator activity suggests that silver could be on the verge of a similar breakout.

This phenomenon can be attributed to the fact that speculators tend to enter and exit positions based on short-term trends and market sentiment. If they reduce their positions, this can create a more favorable environment for continued price increases, as the market becomes less sensitive to speculative volatility and more driven by fundamentals.

For investors, this decline in speculative activity is a strong indicator that silver could be in for a significant and sustained rally.

2. The dynamics of the secular silver charts suggest that silver is the precious metal to buy

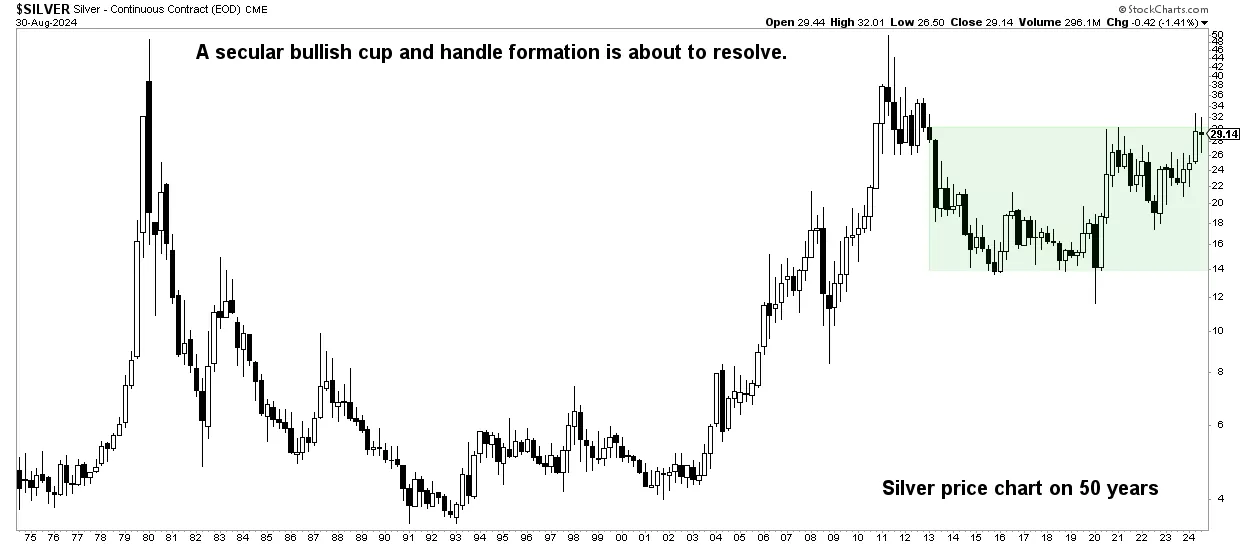

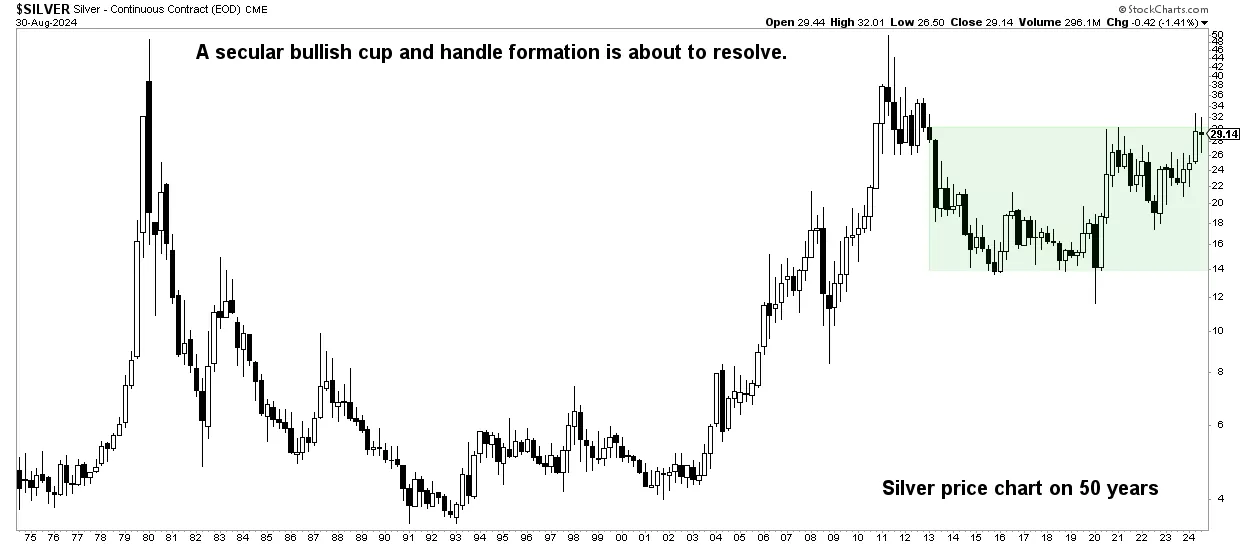

Silver’s technical charts are showing exceptionally bullish signals, further strengthening Silver’s potential in 2025. Two major patterns stand out: the 50-year cup-and-handle pattern and the 14-year bullish triangle.

Silver has been around for 50 years optimistic cup and handle pattern

The cup and handle pattern is a classic technical analysis formation that signals a potential upside breakout. In the case of silver, this pattern has developed over an impressive period of fifty years.

SOURCE – The 50-year silver price chart

The “cup” portion of the pattern represents a period of consolidation and price decline, followed by a gradual upward move. The ‘handle’ is a shorter period of consolidation that typically precedes a breakout to new highs.

This long-term cup and handle pattern indicates that silver has consolidated and is preparing for significant upward movement. The fact that this pattern spans 50 years reinforces its potential significance, suggesting that silver could be on the cusp of a major bullish trend.

In all honesty, this one chart above alone is more than enough evidence that silver is the precious metal to buy for 2025, even without all the other compelling data points.

Silver is 14 years old optimistic triangle

In addition to the cup and handle pattern, the silver price chart also shows a 14-year bullish triangle formation. A bullish triangle is characterized by converging trend lines that form a triangular shape on the chart. This pattern generally means that the market is in a period of consolidation before a breakout.

SOURCE – Silver reached $30 per ounce in 2024. How Much Higher Can Silver Go in 2025?

The fourteen-year duration of this bullish triangle increases confidence in its potential impact. Since the pattern has recently broken out, this suggests that silver is likely to experience significant upward movement. This technical analysis supports the idea that silver is well positioned for substantial growth in the coming year.

3. Bull Market Dynamics: Silver’s Reaction to Gold

Another critical factor in silver’s potential for 2025 is its historical relationship with gold. Gold has long been the leading indicator in the precious metals market and has often driven long-term bull markets.

Silver, on the other hand, tends to follow gold’s lead, but with a delayed response that can lead to even more pronounced gains.

The bull market for gold started on March 4, 2024, as explained in Gold is expected to reach new all-time highs (ATH). The bull market has only just begun, we are in the early stages of the gold bull market.

During a gold bull market, silver often lags behind at first, but eventually takes revenge.

This dynamic is rooted in the nature of the market behavior of both metals. Gold typically experiences early gains that attract attention and interest from investors, while silver’s gains are a secondary effect, often resulting in more substantial price increases.

As gold’s bull market matures, silver tends to follow with stronger momentum, capitalizing on the positive market sentiment generated by gold’s performance.

This delayed response has historically led to silver outperforming gold in the later stages of a bull market.

If gold continues to perform well, silver is likely to experience a strong rebound in 2025, making it an attractive investment opportunity.

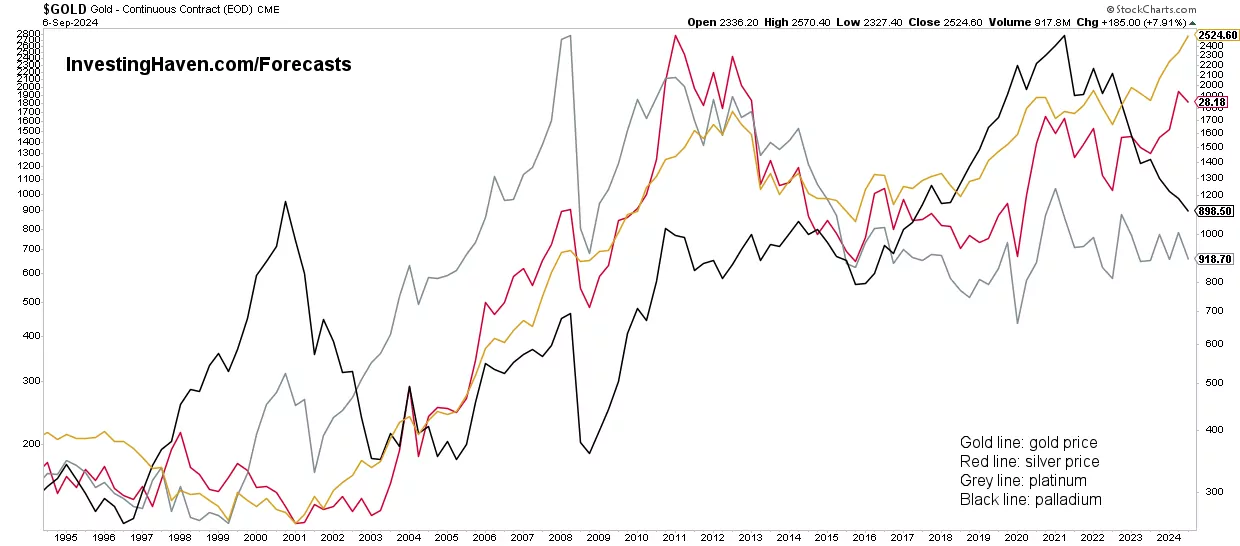

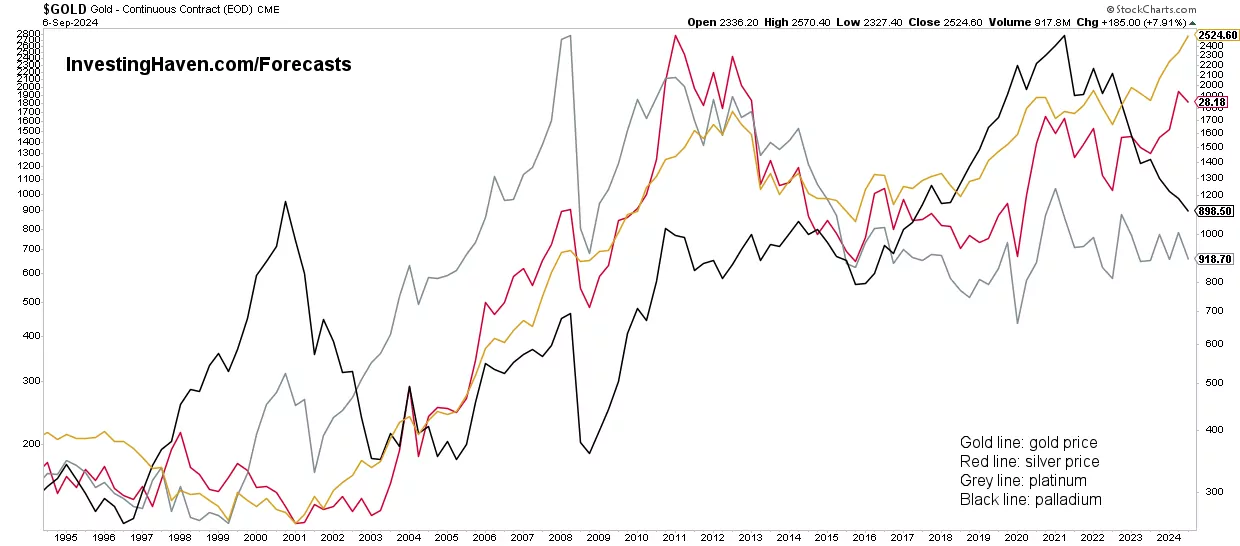

Four precious metals, long-term view

To fully understand why silver is the best precious metal to buy in 2025, it is essential to consider the long-term evolution of all four major precious metals:

- Gold.

- Silver.

- Platinum.

- Palladium.

Understanding how these metals have performed over an extended period of time provides context for assessing their current and future potential.

Long-term performance chart for precious metals

The chart below illustrates the historical price movements of gold, silver, platinum and palladium over several decades. This comprehensive overview highlights each metal’s unique market dynamics and performance trends.

Gold: Historically, gold has been the leader among precious metals, often seen as a safe haven during economic uncertainty. Over the long term, gold has shown consistent gains, driven by its role as a hedge against inflation and financial instability.

Silver: Silver’s performance was more volatile than gold’s. While silver often follows gold’s lead, its price movements can be more pronounced due to the dual role it plays as an investment asset and as an industrial metal. Recent trends indicate that silver is quite resilient in the grand scheme of things.

Platinum: Platinum has experienced fluctuations largely due to its industrial applications, especially in the automotive industry, where it is used in catalytic converters. Over the long term, the price of platinum has been affected by changes in industrial supply and demand dynamics. In recent years, platinum’s performance has lagged behind that of gold and silver.

Palladium: Palladium has seen dramatic price increases over the past decade, driven by its crucial role in controlling auto emissions and supply constraints. However, like platinum, its performance is closely linked to industrial demand. While palladium has been strong, its recent decline is truly concerning.

Which precious metals for 2025?

As of September 2024, the current status of each metal reflects their respective market conditions:

- Gold remains a dominant force, with its price reflecting ongoing economic uncertainties and its role as a financial safe haven.

- Silver is showing promising signs of a secular breakout, although not visible on the latest chart but visible on silver’s secular chart, driven by favorable chart dynamics and a decline in speculative positions.

- Platinum And Palladium have shown mixed performance, with platinum lagging and palladium recently volatile.

In this context, silver’s potential for significant growth becomes even clearer. While gold continues to lead the market, silver will sooner or later experience a substantial rebound.

Why silver is the precious metal to buy in 2025

Which precious metal to buy before 2025? The answer we explored in this article is silver for three reasons:

- The reduced positions of speculators.

- Silver bullish chart dynamics.

- Silver’s historical response to gold’s bull markets.

These three reasons make a compelling case for silver as the most important precious metal to invest in in 2025. These factors suggest that silver is well positioned for significant growth and could deliver substantial returns to investors.

Understanding these indicators can help predict future trends, recognizing that forward-looking thinking may not turn out as expected (there is always a risk involved in thinking about future states).

As always, it is essential to consider all relevant factors in the context of your overall investment strategy and consult financial advisors to align your investments with your financial objectives.