Speculators are exiting their long positions on the silver futures market. This should be music to the ears of long-term-oriented silver investors. This is why it’s bullish for speculators to give up on silver.

RELATED – Silver Prediction 2025

In this short post we look at one of the leading indicators in our silver price analysis methodology. Our research service provides detailed analysis of leading indicators every week.

Speculators – you have to love to hate them

Speculators are just that: speculators.

However, when we look at speculators as one of several trading groups in the futures market, the picture changes. This group has specific characteristics. Above all, they are trend followers.

Technically, this group is called the “managed money” category.

There is nothing wrong with trend followers. Many traders follow the trend.

The ‘problem’ with the silver futures market is that it tends to fluctuate speculators. They are getting burned and experts have emphasized time and time again that their trend following trading strategy, especially in the silver futures market, is ineffective.

Silver: the most difficult market to trade

The above comments make sense.

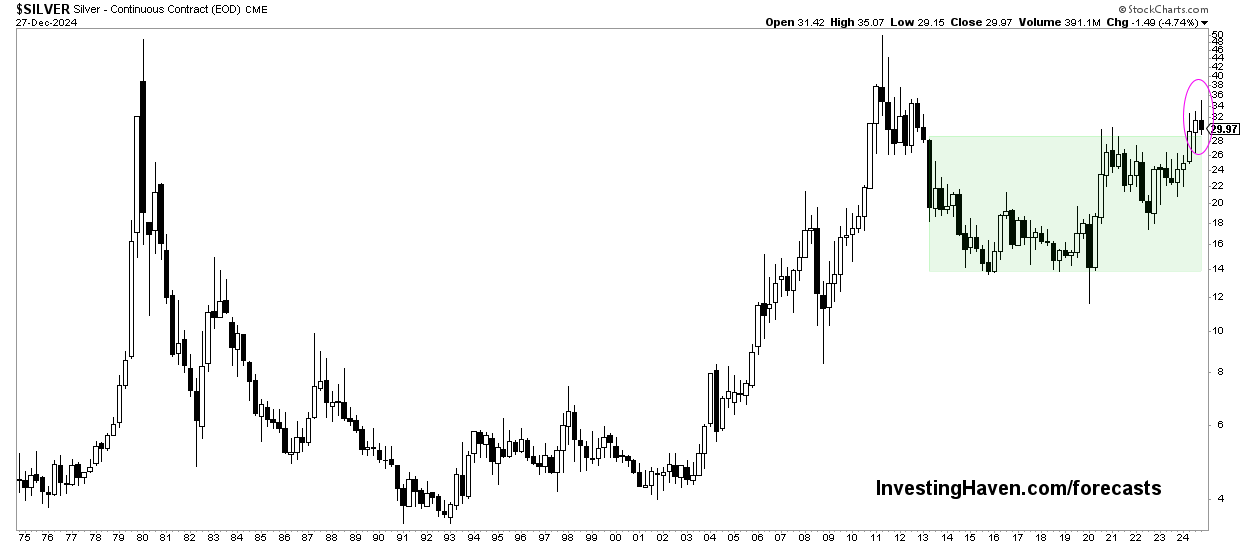

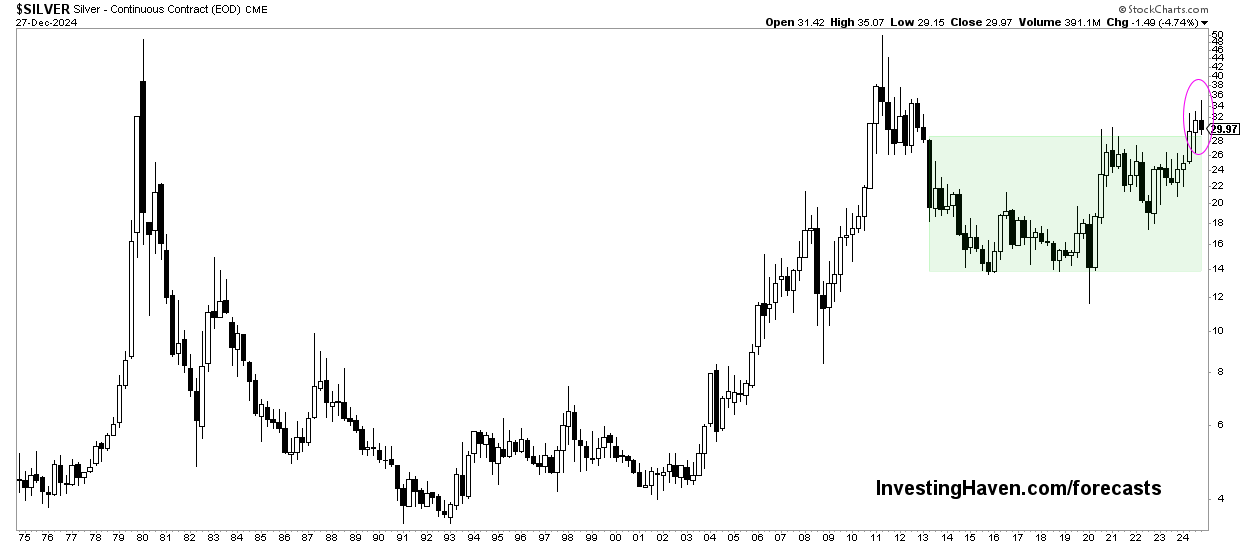

They make a lot of sense, especially when you look at long-term silver charts.

The dream of silver traders is to reach those moments when silver rises sharply. The 50th anniversary silver card Below, with quarterly candlesticks, shows that there have been many instances in history where silver rose for a few consecutive quarters.

Just as important, purely from a trading perspective, are silver’s big declines – when silver moves lower, it tends to do so with a vengeance.

That’s what speculators in the silver futures market are trying to achieve: they keep trying to get a few consecutive winning quarters OR a sharp decline to the downside.

Unfortunately, they usually fail to do this. While there are no studies to report specific results from this category of market participants, there is anecdotal evidence that speculators perform abysmal in the silver futures market.

If you look at the silver quarterly candlestick chart below, it also makes sense that silver has a lot of choppiness on the chart. Just looking at the last 10 years (green shaded area) it seems simply impossible to be successful with a silver trend following trading strategy in the futures market. There is hardly any trend.

Speculators give up silver – what, why, where

With the comments made above in mind, we look at the current trend in relation to the positioning of speculators in the silver futures market.

Below you will find the silver price (top window) and the positioning of speculators (expressed as an index, bottom window). Map courtesy of: Goldchartsrus.com.

As we have seen, there is a massive exodus when it comes to speculators’ long positions in the silver futures market.

While this may sound scary, on the surface it is quite the opposite: super bullish for investors with a long-term horizon (without leverage).

Why?

Because it appears that speculators have completely given up trying to make a large trade (profit, return) on both sides in the silver futures market.

Think about this:

- Silver has been unusually choppy since April 2024.

- Silver has seen steep rises and falls since then.

- There has been no real trend in the price of silver, especially for traders who have highly leveraged positions (meaning their time frame should not be too long).

The great news?

When speculators (‘dumb money’) give up, the ‘smart money’ takes notice.

We believe the ‘smart money’ is on to something big in silver. They collect silver. Even after the recent gentle rise in silver prices, which was admittedly very weak, speculators have exited their long positions.

While it’s not a trend, it’s a sign that something is brewing.

We remain firmly optimistic about silver, in 2025 and beyond. When the pressure is gone (Yield And USD stabilize or decline) we should see strong price action in silver and gold.

READ MORE – When exactly will silver reach $50 an ounce?