We compare silver in USD with silver in other global currencies. Of the 10 currencies, silver sets new ATH in 4 and silver is inches below ATH in 3 currencies.

RELATED – When Exactly Will Silver Reach $50 an Ounce?

We conclude that the global trend of silver is up. Silver is in a global bull market, despite the fact that silver in USD has not reached new all-time highs (ATH).

Takeaway meals – Is This an Epic Opportunity for USD Silver Investors? The most likely answer is YES; it is most likely a matter of time before silver in USD tests its ATH.

Silver in USD – well below ATH, but the chart says…

We have the silver in USD chart in most of our silver-related articles:

This is the secular silver card (silver in USD) without annotations. This chart has a clear setup that any analyst and chartist will recognize as a bullish cup and handle – the chart says it is heading to $50 per Ounce. It’s a matter of time.

For investors not used to analyzing chart patterns, we present the quarterly candlestick chart, which makes the point very clear (below).

Although the following silver map has limited annotations, it should be clear from its structure (particularly the breakout from the consolidation, the green shaded area on the map) that a base formation is now in the final stages of completion.

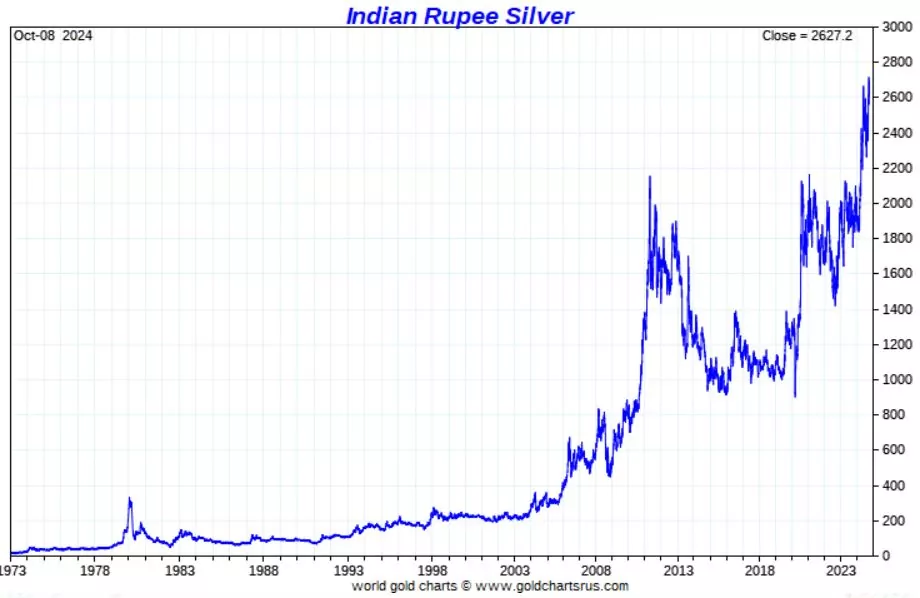

Silver in Indian Rupee: New ATH

Silver, priced in Indian rupees, will reach a range of new ATH in 2024.

It’s no surprise that both the private public and investors have continued to hoard physical silver in recent years, well into 2024.

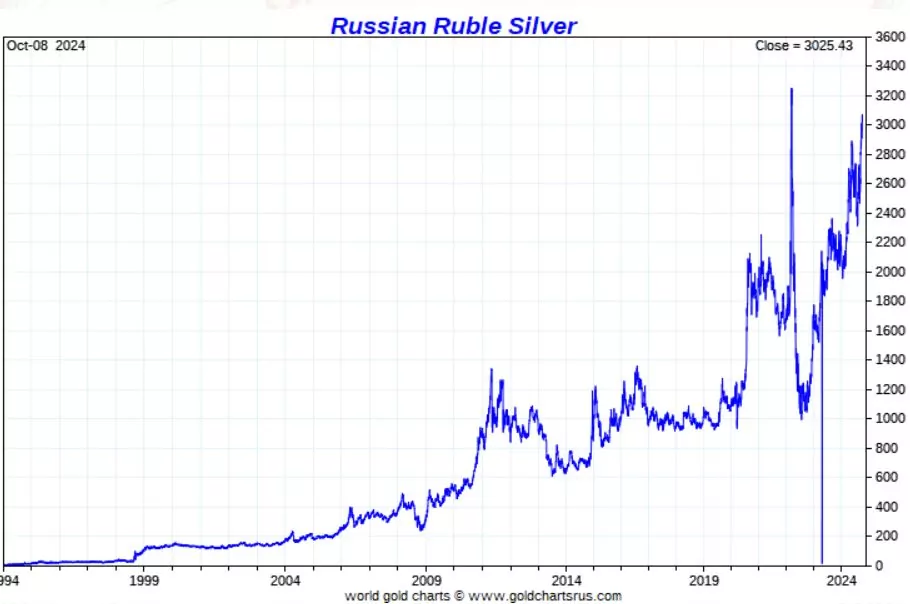

Silver in Russian rubles: new ATH

Silver, priced in Russian rubles, makes a series of higher highs in 2024.

It is likely that ATH was hit in 2022, so technically silver in rubles has not reached ATH yet. However, it is fair to say that the situation in 2022 was an outlier. The peak at the time was very short-lived. For the purposes of this article, we exclude the temporary and short-lived peak of March 2022.

Silver in Australian Dollar: New ATH

Silver, priced in Australian dollars, surpassed the ATH in 2024. It rose above the 1980 and 2011 highs.

Silver owners in Australia should be very happy with their silver holdings, especially since the breakout above ATH has not led to a major decline, quite the opposite.

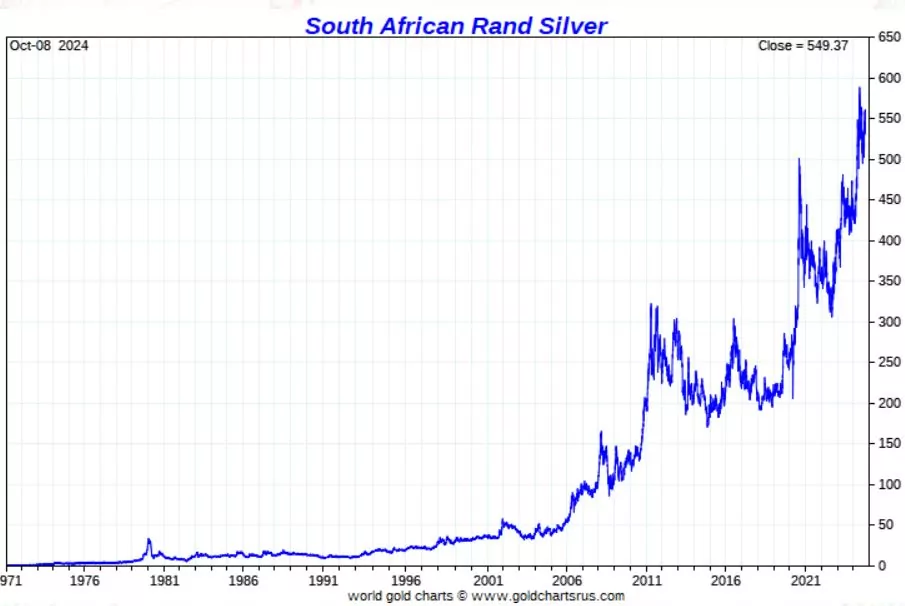

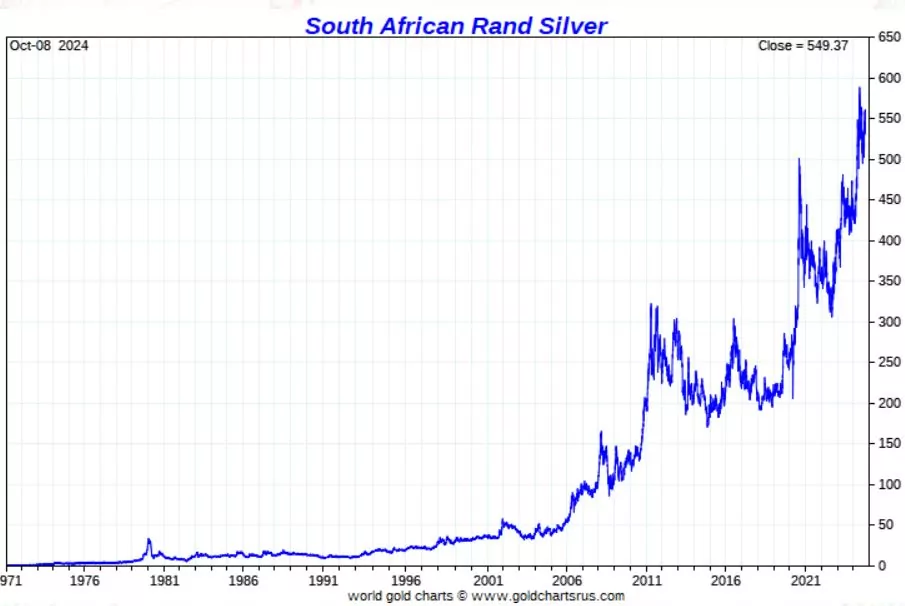

Silver in African Rand: new ATH

Silver priced in African Rand will ensure a continuous run of new ATH through 2024.

Silver in Canadian dollars: inches under ATH

In Canadian dollar terms, silver is exactly below its ATH. It’s probably a single digit lower than ATH.

This chart makes it very clear: silver in CAD will reach ATH very soon, and just like silver in AUD, it will exceed ATH.

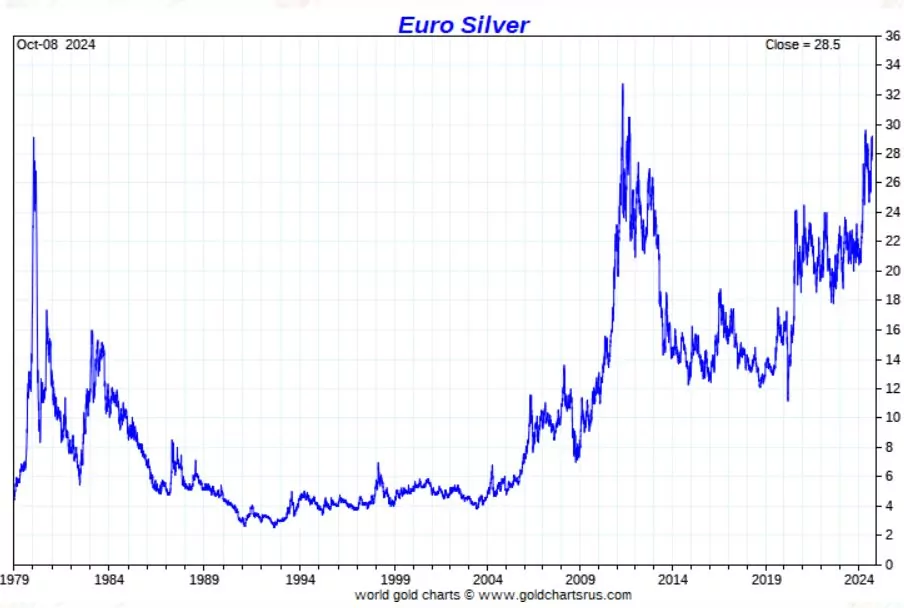

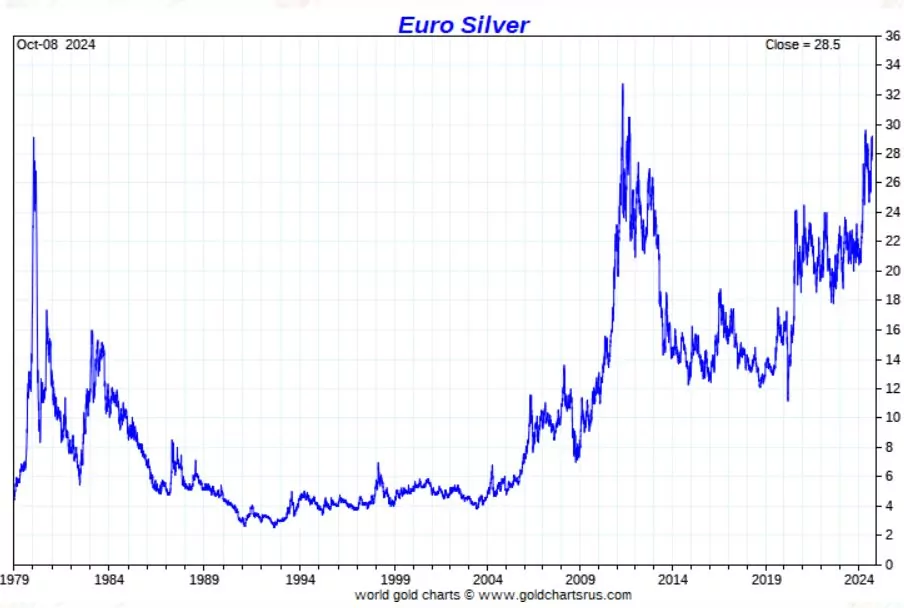

Silver in euros: centimeters below ATH

Silver, priced in Euros, is about to reach its former ATH. Interestingly, silver is now in euros above the peak of January 1980, but just below the peak of 2011 (single digit pct). From this chart it is clear that it is only a matter of time before silver in euros reaches the new ATH.

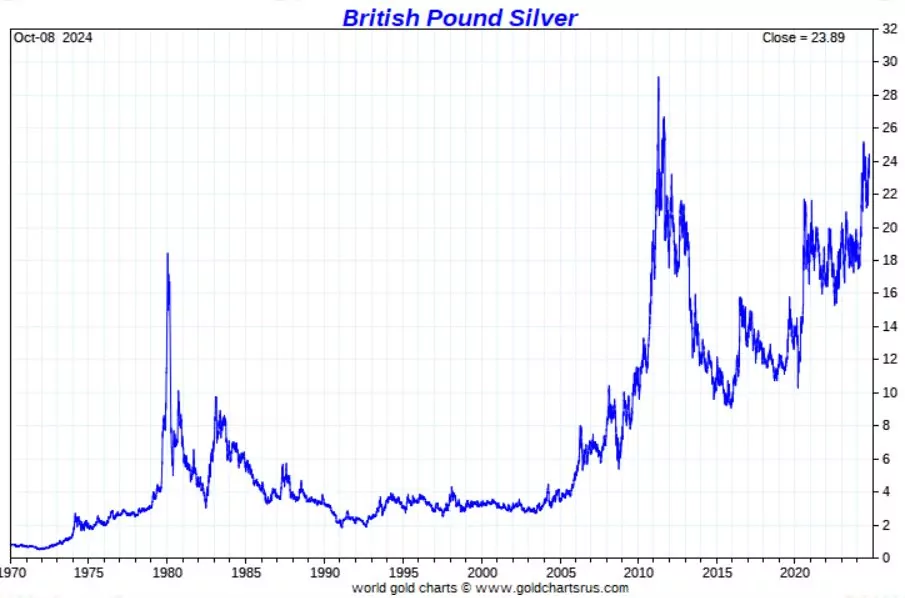

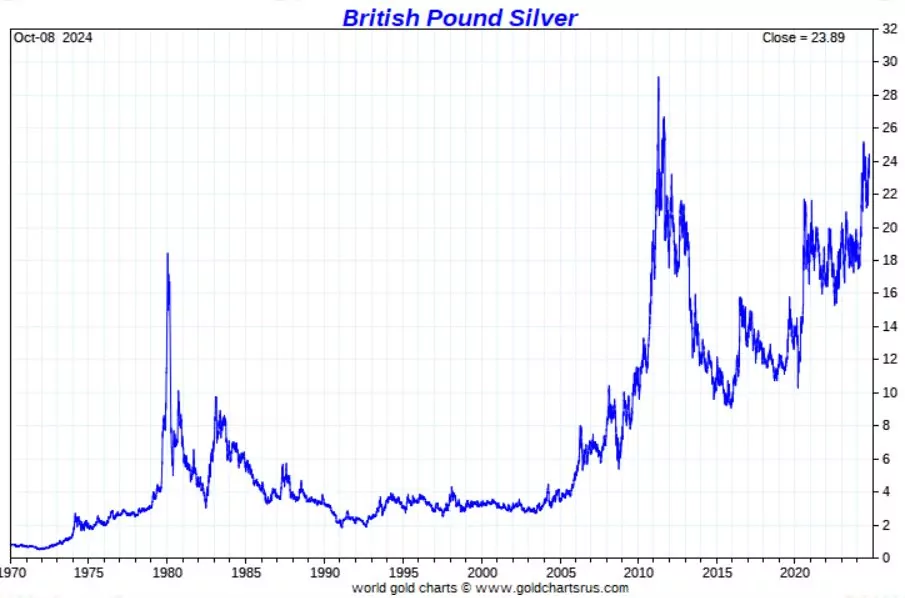

Silver in British Pound: close to ATH

The price of silver in British Pounds is well below the previous ATH. The silver chart setup with a price in GBP is so aggressively bullish that it is only a matter of time (a few months max) before silver will reach and surpass its former ATH price in GBP.

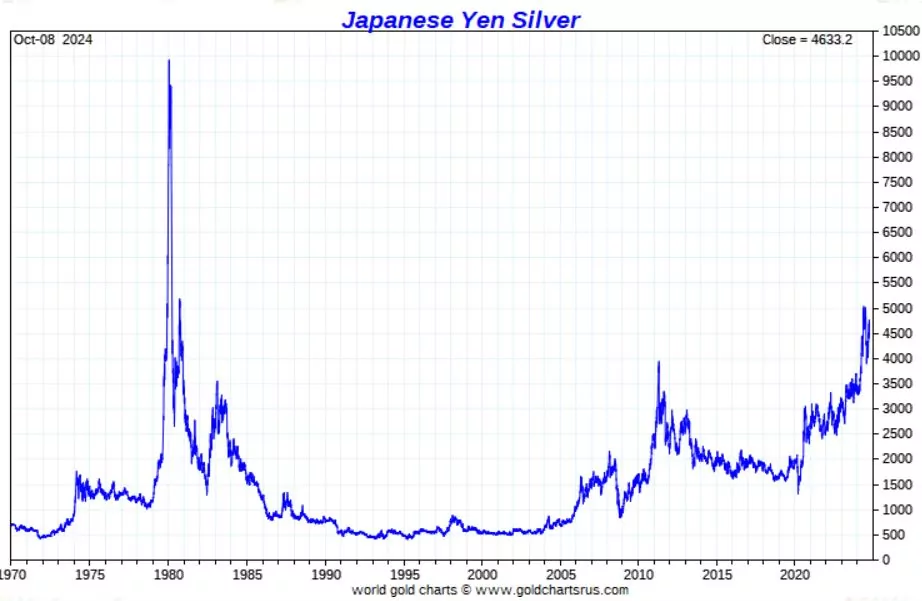

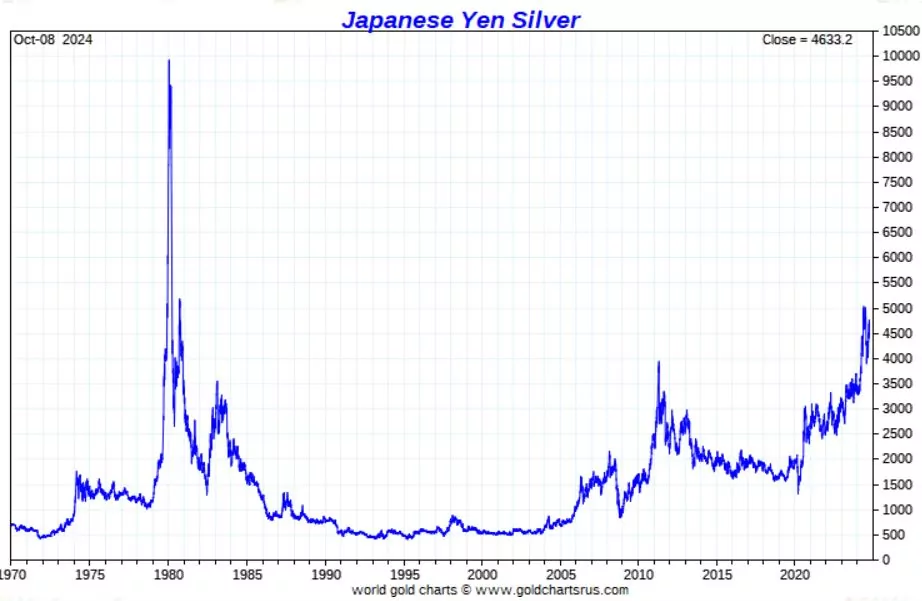

Silver in Japanese Yen

Silver priced in seven world currencies, as shown above, is touching the new ATH and coming very close to the former ATH.

The silver situation in the Japanese yen is slightly different, also specific.

Silver in Yen had a huge spike in January 1980, which was very short lived. If we ignore this outlier (which is not technically accurate, but helps make the point in the context of this article), silver in Yen reaches its highest point in 1981, well above the 2011 high.

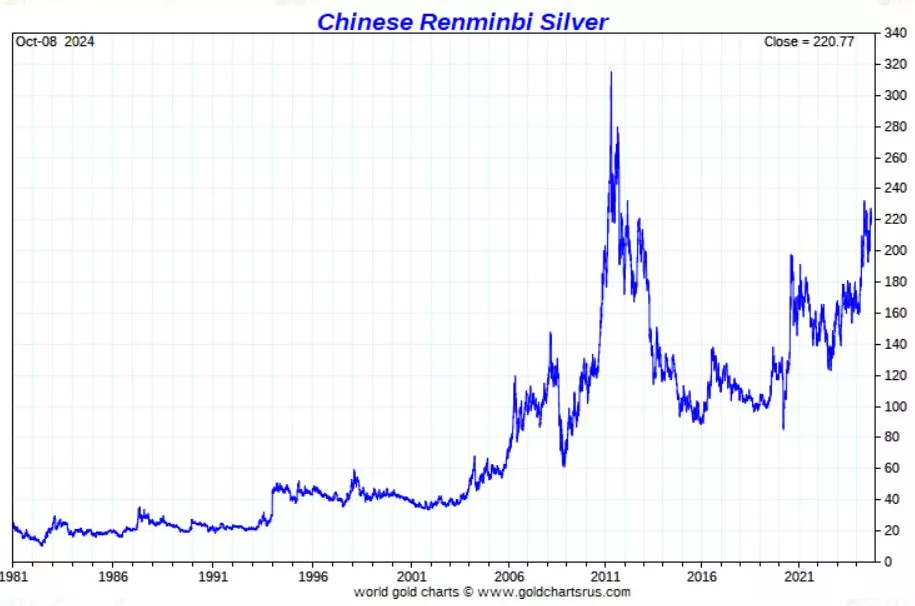

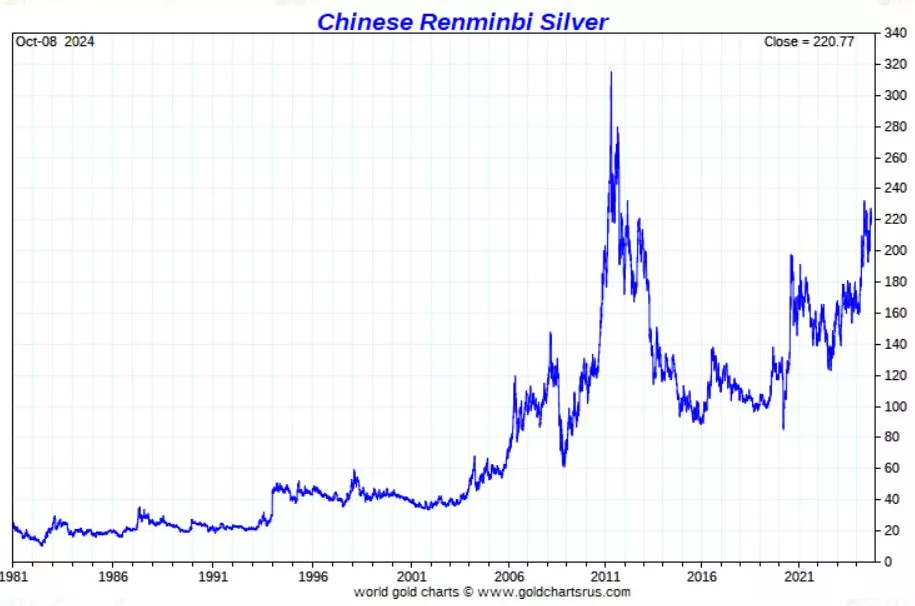

Silver in Chinese Renminbi

Silver in Chinese Renminbi is below its ATH. The chart setup is aggressive and suggests a test of ATH is underway (although it won’t be in the very short turn).

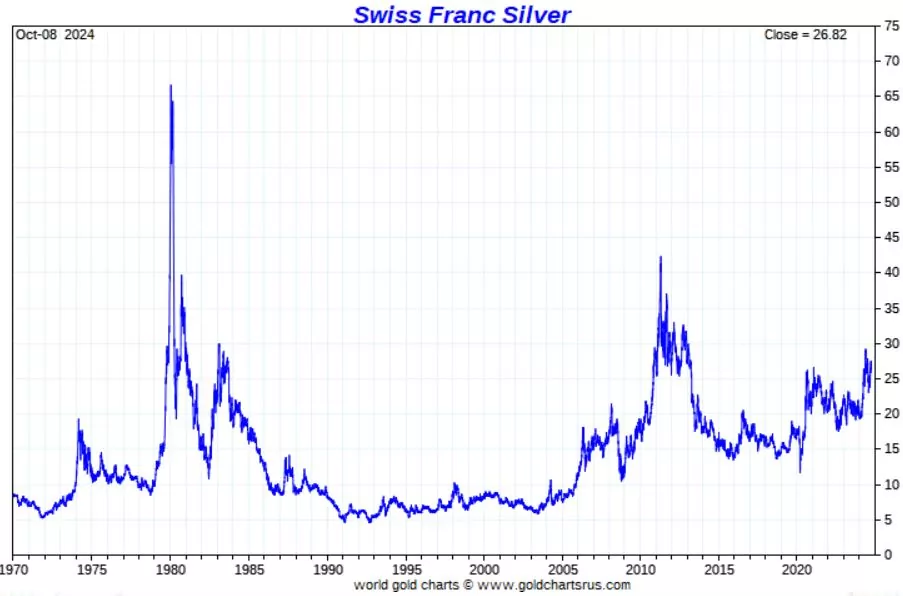

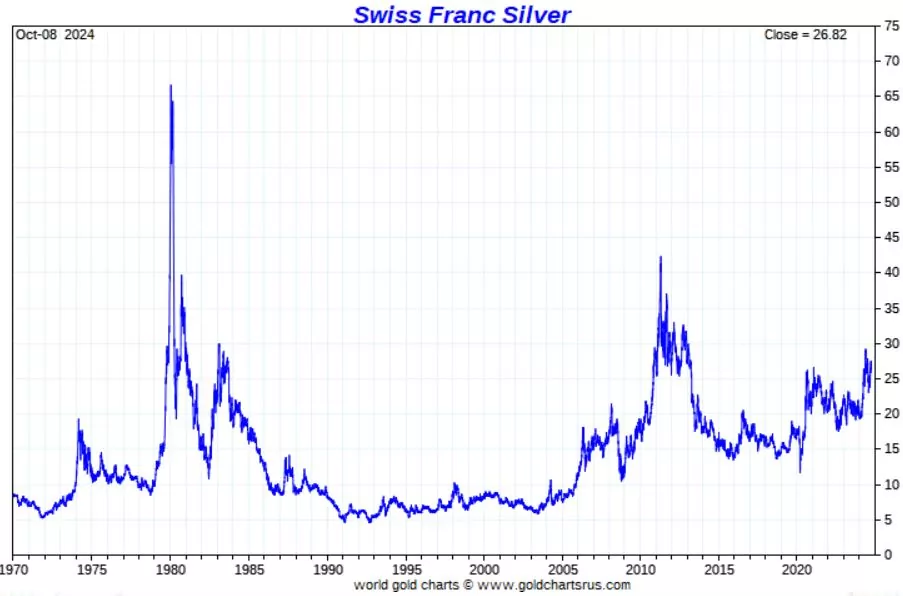

Silver in Swiss francs

The only exception, when looking at silver priced in world currencies other than the US dollar, is silver in Swiss francs. While this setup on the silver chart is extremely bullish, silver is well below its ATH in CHF.

Silver at ATH in most world currencies, so what?

Why is this silver analysis important?

Because it puts the silver bull market into perspective.

We have been predicting a strong silver bull market for a few years now, with silver reaching a new ATH in the second half of this decade. To some extent our prediction has already come true, but not when we look at the silver to USD chart.

The bottom line is this: the global silver trend is rising and reaching new ATH in most currencies, not yet in the USD. It’s the dynamics of the silver bull market that really matter.

It is only a matter of time until silver priced in USD will also reach ATH.

This conclusion is simple: there is no need to overengineer things.