The silver price is more than 42% below its ATH, while gold printed a new ATH on Friday, August 16, 2024. This divergence is epic; it won’t last forever. Silver will sooner or later overtake gold; there is no bull market for gold without the participation of silver.

The gold-silver ratio rose to 87 points. One of the most extreme values is the gold-silver ratio of 95 points. This means that silver is vastly undervalued compared to gold by any standard.

RELATED – Will Silver Ever Reach $50 at a Time? Here you will find the answer and the must-see graphs.

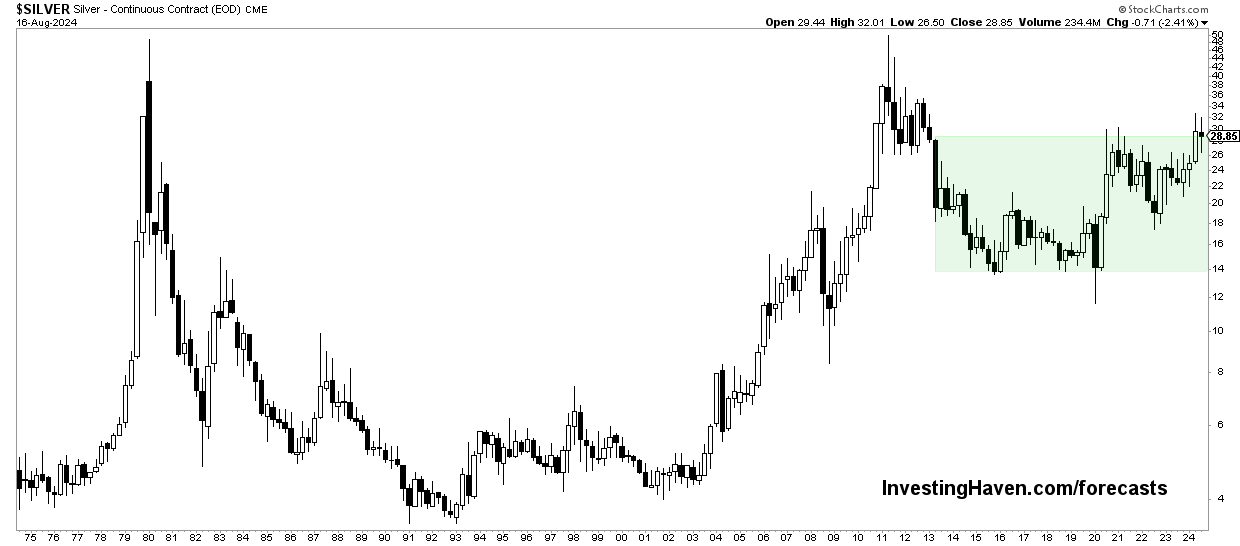

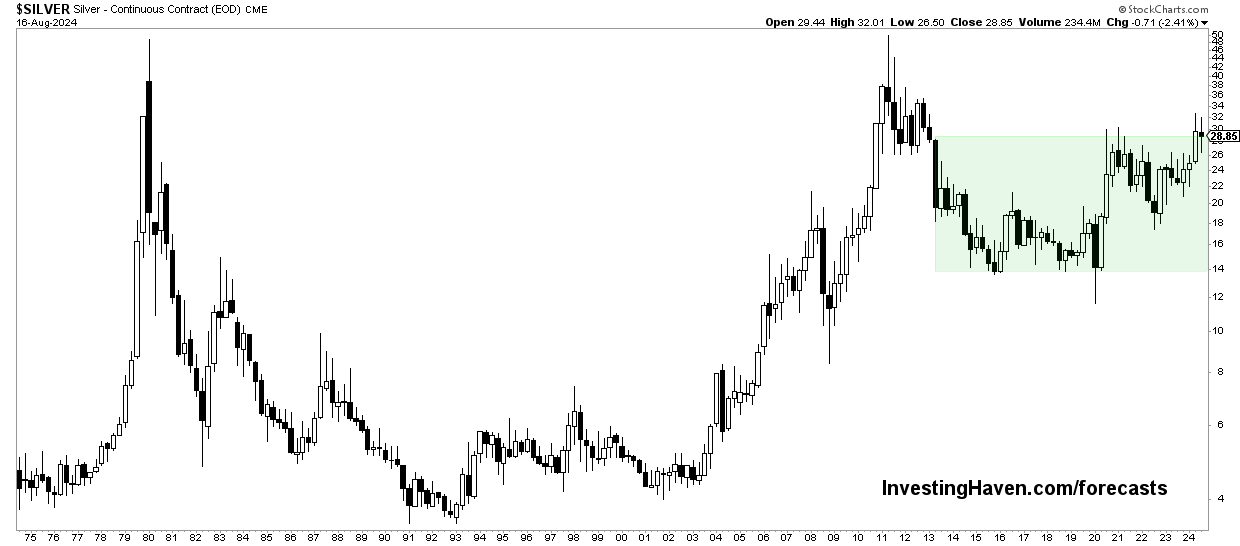

Silver Card – The most powerful cup and handle in history

We said it and we’ll say it again: the long-term silver chart is one of the most powerful cup-and-handle chart structures ever in the history of financial markets.

Not often will investors see such a bullish reversal structure.

The silver card is an absolute beauty; in fact, it’s a monster!

Silver is currently trading 42% below its ATH. It may seem like hitting ATH sooner or later is inevitable. We could argue that this kind of chart setup could lead to silver reaching $100 per Ounce sooner or later.

Silver price versus silver squeeze

It’s interesting (read: funny) how some still call it a “silver pinch.”

We have long been focused on our 2024 silver forecast of higher silver prices. This prediction has a leading indicator as a catalyst, but more importantly it is the silver chart structure that is so amazingly powerful.

In a sense, the “silver squeeze” is simply a “chart event.”

The same people talking about a ‘silver squeeze’ are showing the same bullish silver chart pattern.

Time to send it $SLV $SILVER #SILVER #SILVERSQUEEZE pic.twitter.com/Kgmf0KQlYE

– Rock bottom entries August 16, 2024

Silver Price Analysis – Fibonacci Levels

One way to simplify reading silver price charts and improve silver price analysis is to add Fibonacci levels.

Admittedly, if you look at the silver price through the lens of Fibonacci, it becomes an even more interesting chart.

As we can see, silver has been flirting with its higher Fibonacci levels for four months now. This says it all: silver remains at or above its higher (most bullish) Fibonacci levels.

Silver Price Analysis – One Crucial Insight on the Chart

There is one, and only one, truly critical insight into the price of silver that every silver investor should know about.

We documented it research-wise, specifically in the “Silver Candlestick Analysis” section in the research note shared on August 10, 2024: [SPECIAL EDITION] The most comprehensive silver analysis you will ever read.

We consider this to be THE most important insight that can be derived from silver price analysis.

It is immediately available to our current premium members, and also immediately available to any new member looking for premium silver guidance.