Although 2022 was one of the best years ever for silver imports into India, this happened due to falling silver prices. In 2024, the silver price will rise, which is a very important difference.

RELATED – When Exactly Will Silver Reach $50 an Ounce?

While we focus on the import of silver from India in this article, let’s start with some context on the silver market as an investment opportunity.

Silver market and investment opportunities

To put the import of silver from India into perspective, we need to provide an overview of the silver market and its message. Context is important, even when analyzing financial markets and assets like silver.

Silver: Long-term chart now officially the most powerful bullish reversal in history (October 6, 2024)

This is what we wrote: “The silver price chart is now the most powerful bullish reversal we have ever seen.”

Silver imports from India are surging at a time when the long-term silver price chart is showing an unusually bullish reversal chart structure. Coincidence or correlation?

Silver: This Leading Indicator Confirms Huge Upside Potential in 2025 (September 30, 2024)

Here’s a key data point that caught our attention:

Currently, the concentration of the largest silver traders shorting is nowhere near extremes. In fact, it’s quite low, given the significant increase in the price of silver between the 2022 lows and the 2024 highs. This suggests that there is significant upside potential for silver, perhaps even huge upside potential, in 2025 and likely into 2026.

While this data point may not be visible to silver investors and buyers in India, it is likely no coincidence that both occur during a similar time period.

Silver: This Hidden ‘Risk On’ Indicator Breaks Out, the Silver Market Will Soon Be on Fire (October 16, 2024)

We wrote this on October 16:

The ratio of silver miners to junior silver miners, the ultimate RISK indicator for the silver market, breaks out! It is a RISK ON indicator when it rises.

We continued:

The silver market will soon be on fire, the data shows.

Literally one day later, silver began an epic breakout, reaching THE key level of USD 32.70/oz, likely THE breakout that will lead silver to the new ATH.

Readers can learn more about the opportunities in the silver market in this recent article: 5 Reasons Why Silver is the Investment Opportunity of the Decade.

Silver import from India

India’s appetite for silver is nearing its limit, as evidenced by the latest import data.

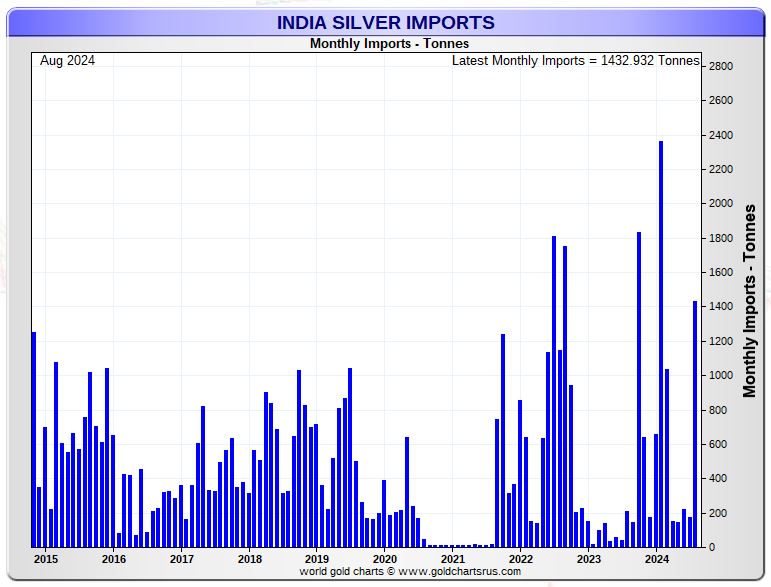

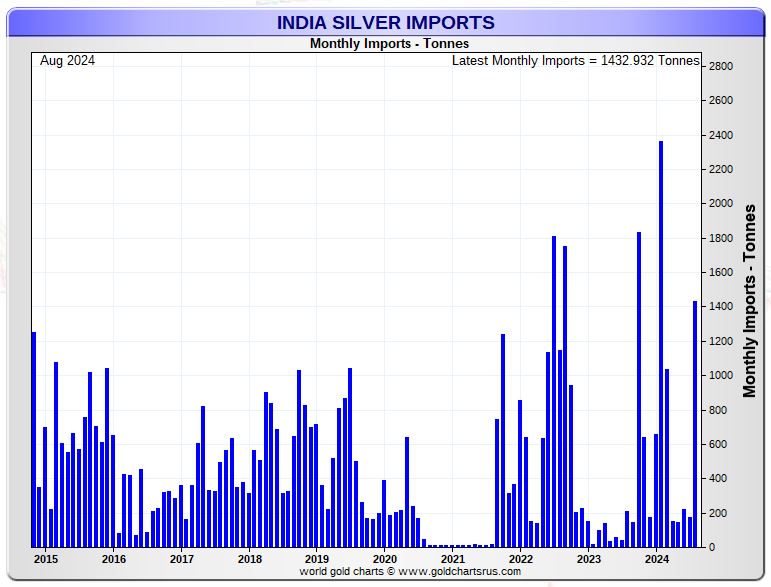

The chart below (courtesy of GoldChartsRUs) shows a staggering increase in silver imports from August 2024: 1432.93 tonnes.

This indicates strong demand for silver in one of the largest silver consuming countries in the world.

A few observations when looking at the 10-year India silver import chart:

- August marks the second ‘peak’ of 2024, with four months left on this chart. 2024 could be one (if not the) best year when it comes to silver imports from India.

- There has been a structural increase in demand since 2022. Essentially, 2022 and 2024 stand out from the previous 10 years visible on this chart, as well as from the last 25 years (not available on this chart).

- The really important difference between 2022 and 2024 is that the silver price fell in 2022, while the silver price rose in 2024.

So, Silver imports from India are close to reaching ATH as silver rises. THAT’s the important take-away. And it is meaningful, very meaningful.

Note – The January 2024 peak was the best month ever for silver imports from India (based on 25 years of data).

Rising demand for silver – a false statement from AI

However, we ask ChatGPT for an explanation. This is what came back:

- Hedge against inflationWith inflation remaining a major concern, many investors in India are turning to silver as a safe haven. Silver’s historic role as a store of value during times of financial uncertainty makes it an attractive option for wealth preservation.

- Industrial questionIndia’s booming industrial sector is another major factor driving silver imports. The metal’s wide range of applications in electronics, solar energy and other industrial applications has pushed demand to a new level.

- Cultural and seasonal factors: Silver has long had cultural significance in India, especially during the festive season. Demand often peaks during festivals and weddings, adding to the already strong interest in the metal.

Unfortunately, none of the points raised by AI are relevant: inflation is falling in 2024 (it rose in 2022), industrial demand in sectors like solar and electronics is strong elsewhere but not in India, the festive season in India is starting in September and runs through November (the chart above shows data through August).

Rising imports of silver from India – our expert explanation

Needless to say, AI completely missed the point we were making.

Again, Silver imports from India are close to reaching ATH as silver rises. That’s the main point, and there’s only one explanation for it:

India truly understands that the value of silver is rising and will continue to rise.

Remember, India is smart when it comes to precious metals.

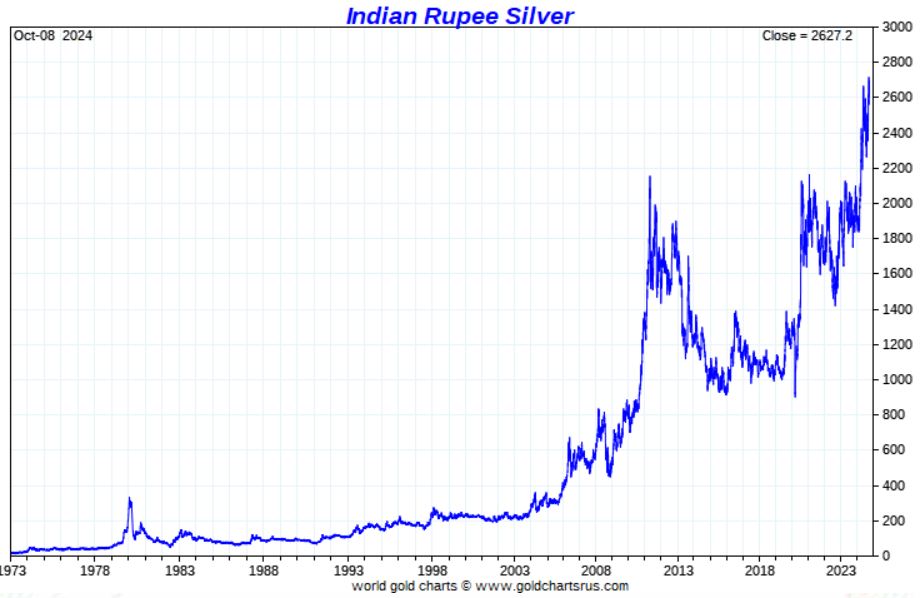

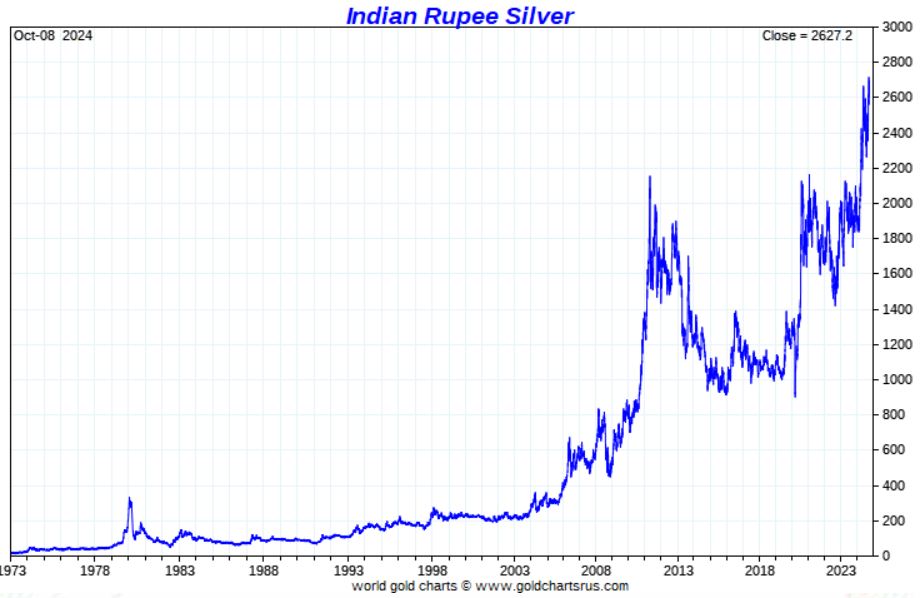

A few weeks ago we wrote this: Silver is hitting record highs in most global currencies… Silver in USD is next! The point we made is that silver is hitting new ATH in many global currencies. The silver price expressed in USD is only part of the story; In fact, silver in USD is lagging the most against other global currencies.

An example: silver priced in Indian rupees will reach multiple record highs in 2024.

Call it FOMO, call it smart, call it foresight.

The point is this: India is further along in terms of silver bull market maturity.

This, in our opinion, explains the staggering demand for silver in India, reflected in silver imports from India.

Sooner or later the West will wake up, but for the majority of Western investors it will be too late. Silver is about to accelerate its rise, leaving the majority of investors behind…