The breakout of the secular silver market was confirmed a while ago, the secular uptrend of silver is underway.

Related – When Exactly Will the Price of Silver Start a Rally to $50?

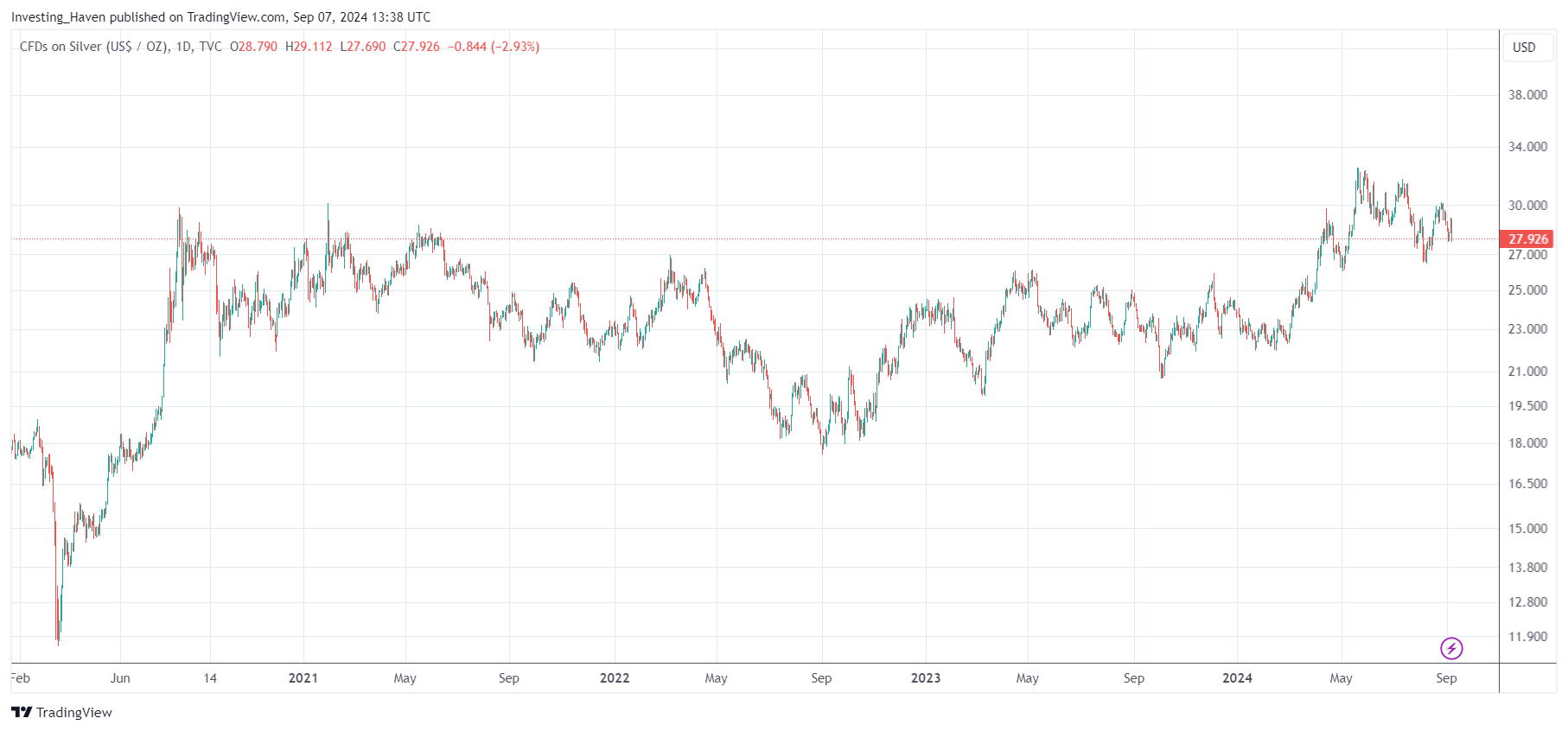

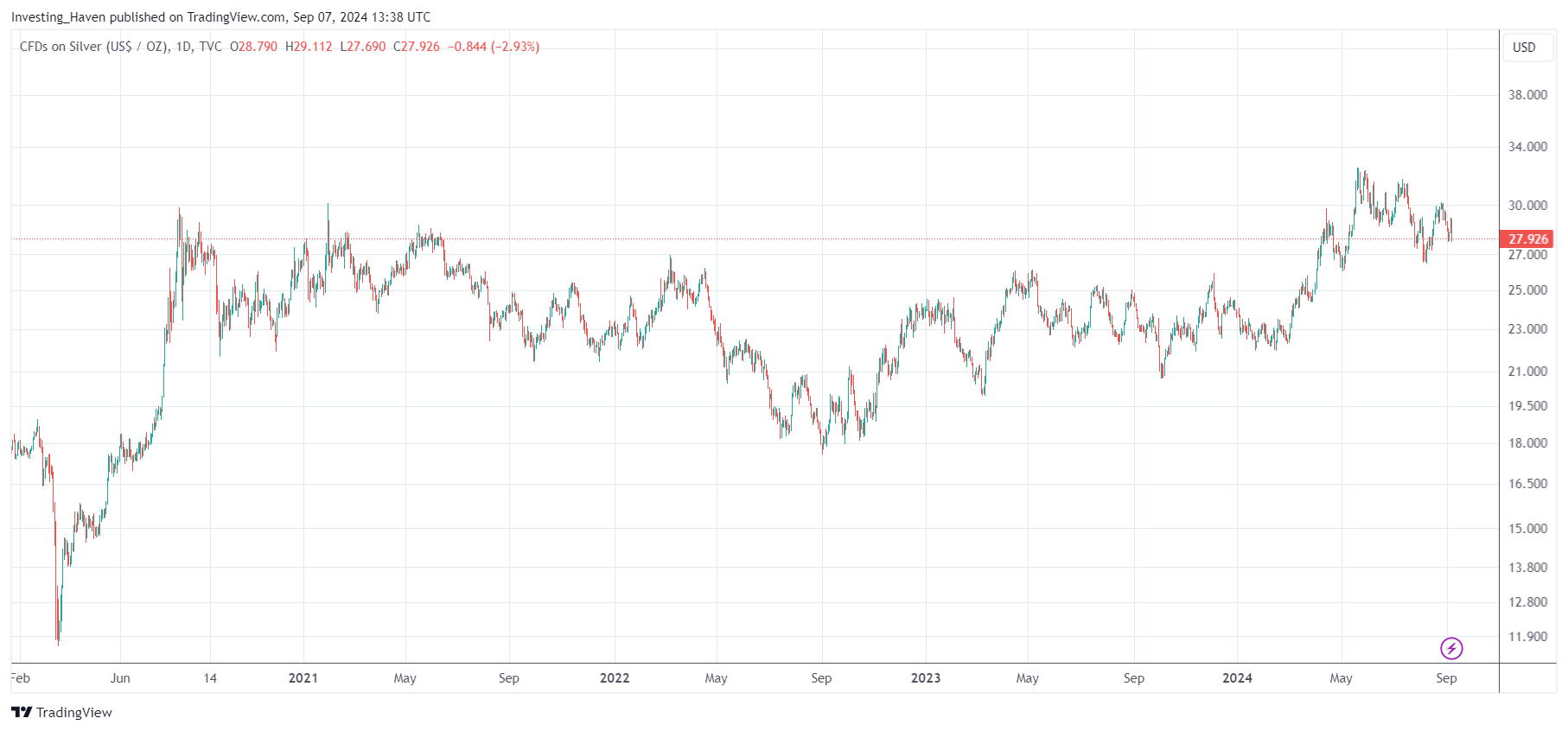

It has been a long time coming for silver, marked by a very long consolidation lasting over three years (2021 – 2023). The outbreak occurred even within the secular time frames.

Silver completes a basic bullish pattern

In general, one of the most powerful chart structures is the bullish basic pattern.

Essentially, a bullish basic pattern is a long consolidation that respects key support levels. The consolidation is proceeding in an orderly manner and takes place after a large increase. Keep in mind that the longer the consolidation lasts, the greater the upside potential.

The basic pattern of silver has all these characteristics:

- A large increase in the period June/July 2020.

- A long consolidation since August 2020.

- Key support levels around USD 20/oz were respected.

- The only ‘violation’ of the key support occurred in late summer 2022. As can be seen from the chart, this ‘violation’ turned into a series of three bullish micro-patterns, just below 20 USD/oz.

In short, the daily silver price chart looks very bullish.

September 4, 2024 – As markets enter the October through April seasonally strong period for silver, it appears that silver is preparing for another leg higher. The breakout stalled at the highest breakout level of USD 28.80/oz, immediately after confirmation of the breakout point of USD 26.60/oz. However, this persistent pattern looks like a short- to medium-term consolidation in the context of a long-term bullish reversal. Silver looks beautiful!

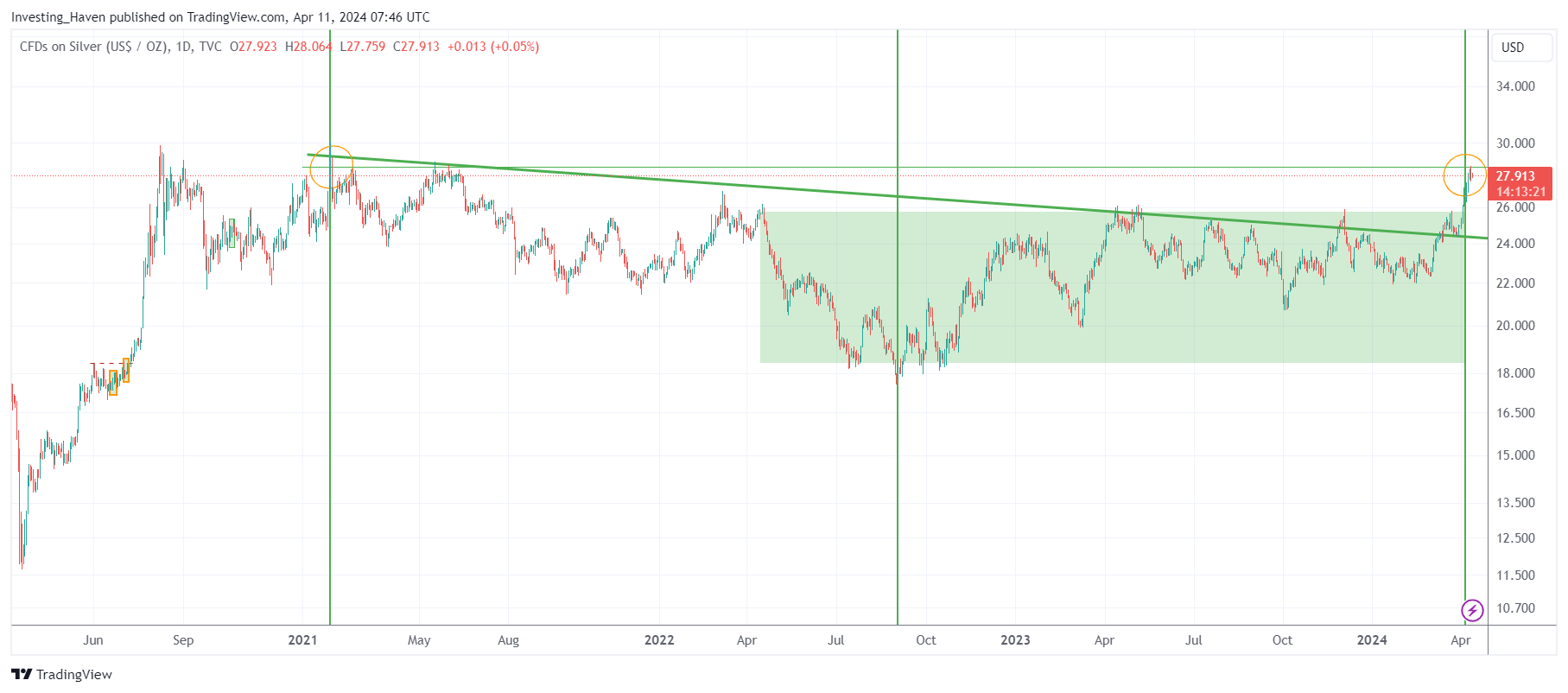

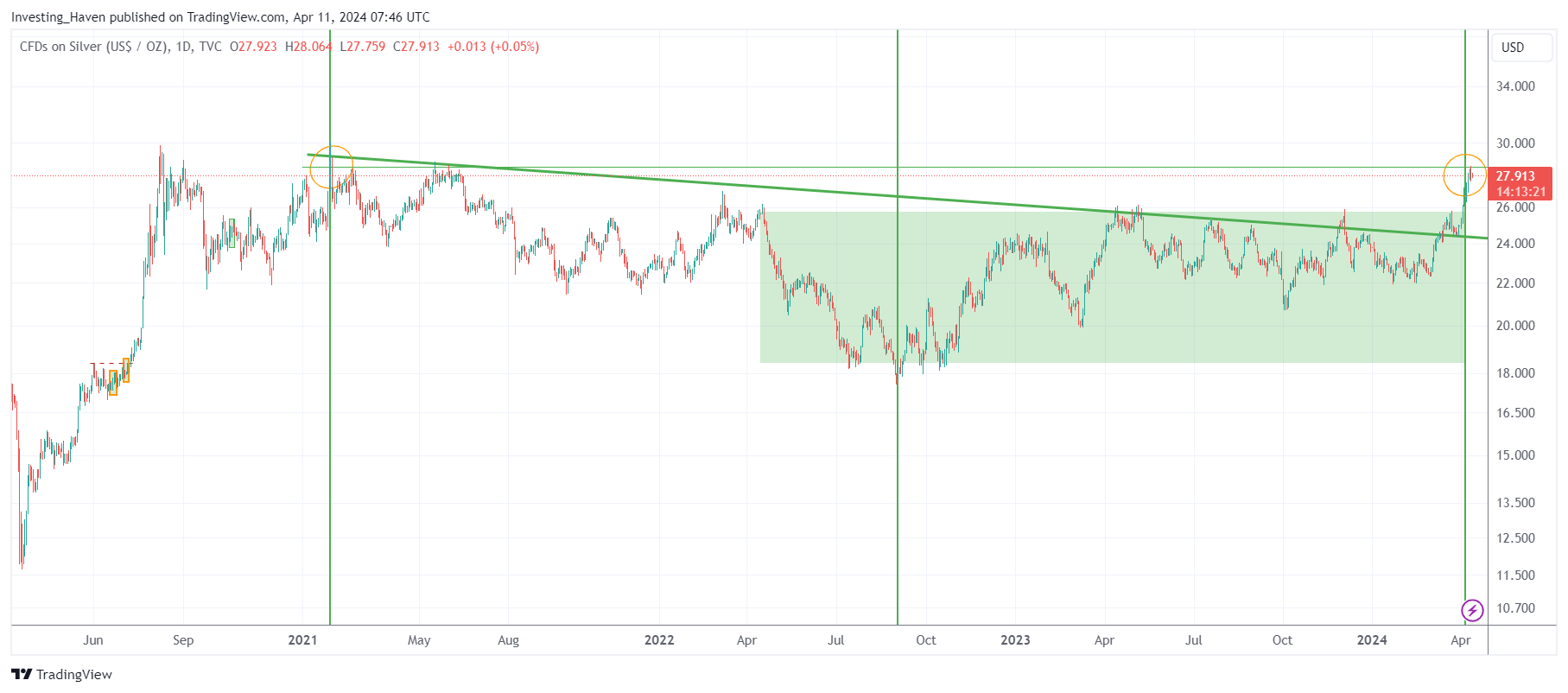

Silver market breakout: April 2, 2024, a day for the history books

Below is the same daily price chart for silver, with our annotations. Readers should pay attention to the timeline with the green horizontal lines that confirm a perfect symmetrical design of 2x 414 days on the time axis:

- The descending silver trend line since the 2021 top – as can be seen, silver has now been above the descending trendline for several days in a row – this is in a sense a breakout.

- The bullish reversal structure since April 2022 – as you can see the inversion structure, the green shaded area, is now complete.

If we combine both chart events, we can conclude that silver has broken out of its multi-year downward trend. In other words, this is a medium-term breakthrough. This silver breakout is confirmed because there are 8 candles above the breakout level daily.

Following the conclusion from the previous card in the previous section, we can now say that the silver card confirmed an epic outbreak.

September 4, 2024 – The chart below shows the breakout point, early April 2024. Interestingly, the same price point is being tested at the time of updating this article. It is no surprise that the price range of $27.70 – $28.80 is the last hurdle before the secular breakout turns into a continuation of the secular uptrend.

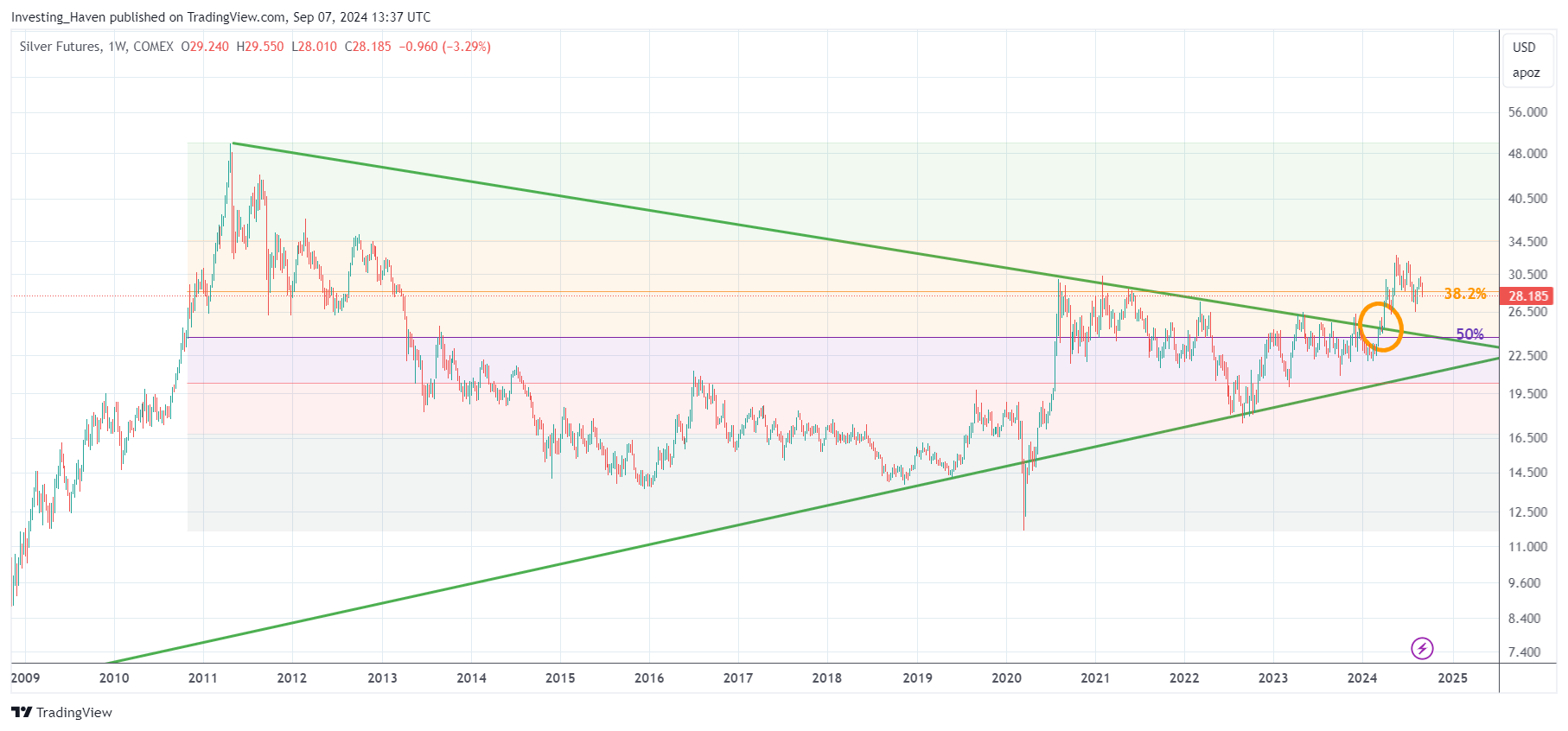

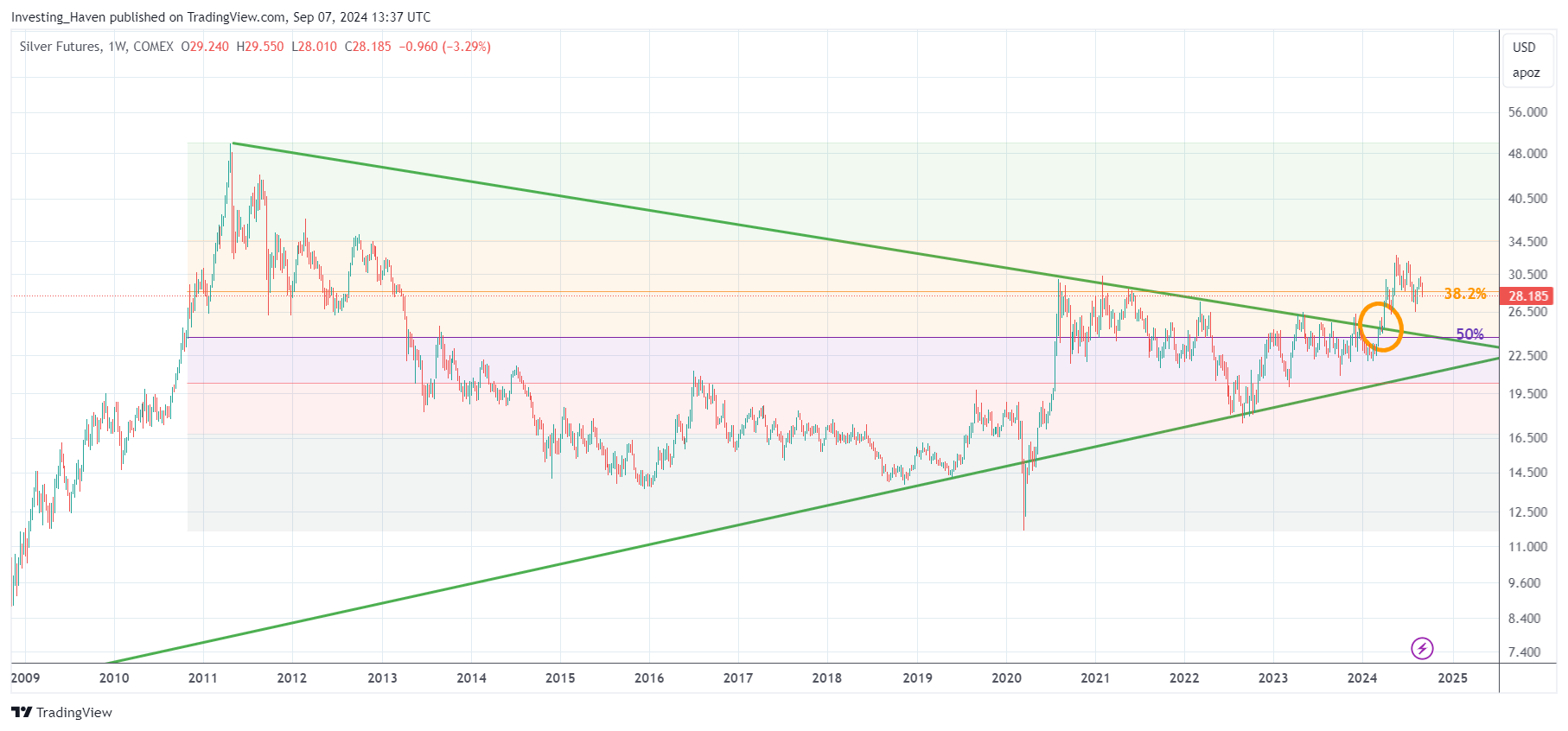

The breakthrough of the silver market in its secular time frame

Now let’s look at silver secular time frame. We use the weekly silver price chart to analyze secular trends, including possible ones secular silver market breakout.

The notes on this diagram are important. The Fibonacci retracement level that really matters is the 50% retracement level which is around 24.50 USD/oz.

As you can see, silver moved above the descending trendline that connects the 2011 peak to the highs since 2020. Additionally, silver is now above the 50% retracement level. What is truly unique is that silver is now above both patterns on the secular chart – this has never happened before.

Furthermore, and this may well be the proverbial elephant in the room, the triangle visible in silver’s secular breakout is nothing short of beautiful and therefore powerful. Remember: the longer a chart pattern, the stronger. This means that the power unleashed by the silver market breakout is enormous.

September 4, 2024 – Why did the silver breakout stop? Because the seasonally weak months of August and September, as explained in our silver seasonality article.

Conclusion – The silver breakout has solidified

With each passing month, silver’s breakout grows stronger:

- The breakout point for all timeframes is the same: 26 USD/oz.

- Silver’s breakout on the daily was confirmed as it moved decisively above USD26.20/oz on a 5 to 8 day closure base..

- Silver’s breakthrough on the weekly chart was confirmed when it moved decisively above 26 USD/oz on a 5 to 8 week closing base.

Silver’s card lineup has everything to qualify for a confirmed breakout.

September 4, 2024 – We are confident that silver will continue its breakout. We expect the silver price to be well above $30 per Ounce in the first half of 2025.

Anecdotal Evidence: More Upside Potential for Silver

Fun fact: you expected it Wall Street Silver to be in overdrive with the ongoing silver outbreak, but nothing could be further from the truth. If this meant that silver’s breakout is not being recognized and respected, it would be the ultimate confirmation that silver has much more upside potential, from an anecdotal perspective. That’s because Wall Street Silver’s success coincided with a big top in the silver market in 2021.

If you like our silver analysis, we invite you to follow our premium gold and silver alerts >>