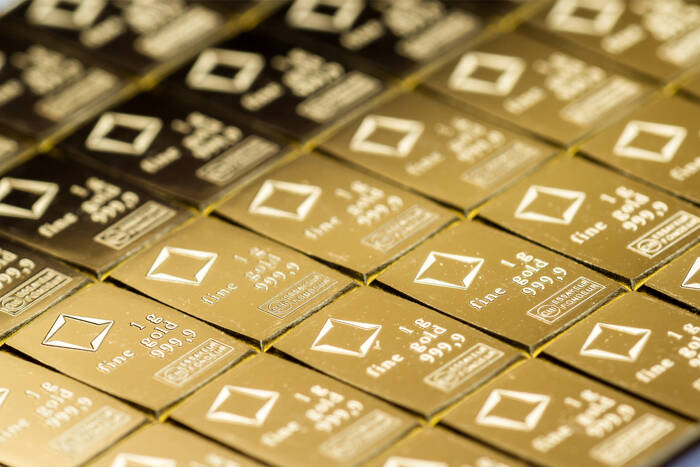

Demand for this safe haven remains as market participants brace for potential disruptions to global trade.

Expectations of Fed rate cuts are supporting gold’s momentum

Market speculation that the Federal Reserve could cut interest rates twice this year has further fueled gold’s bullish momentum. Analysts suggest that easing inflationary pressures in the US have increased the likelihood of monetary policy adjustments, making gold an attractive hedge against potential economic uncertainty.

“Gold remains well positioned as investors anticipate interest rate cuts to support economic growth,” said a senior market strategist at a leading investment firm.

Despite a modest recovery in US Treasury yields, which helped the US dollar (USD) bounce back from a two-week low, gold’s upside has remained largely intact. The 10-year U.S. Treasury yield rose slightly to 4.12%, providing some headwinds to further gold gains.

Silver is under pressure from a stronger dollar

Silver (XAG/USD), on the other hand, struggled to hold its position, trading around $30.91 after hitting an intraday low of $30.73. The modest recovery of the US dollar, combined with shifting expectations around the Fed’s interest rate decisions, has put downward pressure on silver prices.

Analysts point to silver’s exposure to industrial demand, making it more sensitive to economic slowdowns compared to gold.