The demand for safe haven reinforces the uncertainty of the trade war

Gold stays on schedule for a seventh consecutive weekly profit, since the worries about a possible global trade war continue to stimulate the demand for safe haven. The urge of US President Donald Trump for mutual rates has fueled investment uncertainty, in support of the prices of precious metal.

Trump has commissioned his economic team to draw up plans for retribution rates for countries imposing taxes on the import of the US. This step, seen as an inflatoire, could further stimulate the profession of Gold at price pressure and geopolitical instability. Nicholas Frappell, worldwide head of institutional markets at ABC Refinery, noted that constant uncertainty about US trade and foreign policy remains an important engine for gold.

Inflation data and the expectations of the fed rate under control

The latest report from the American producer Price Index (PPI) showed that wholesale prices rise by 3.5%in January by 3.5%, by a monthly increase of 0.4%, which exceeds the market expectations of 0.3% . This followed a hotter -dan expected Consumer Price Index (CPI) report earlier in the week, which contributed to concern about persistent inflation.

Despite these figures, traders expect that the Federal Reserve will lower the interest rates until at least September. A decrease in the unemployed claims has reinforced the expectations of a resilient labor market, which means that the FED has little urgency to adjust the policy in the short term. Investors are now looking ahead to the sales data of the retail trade and the preferred factories of the FED, the Index Personal Consumption Expenditures (PCE), for further clarity on inflation trends.

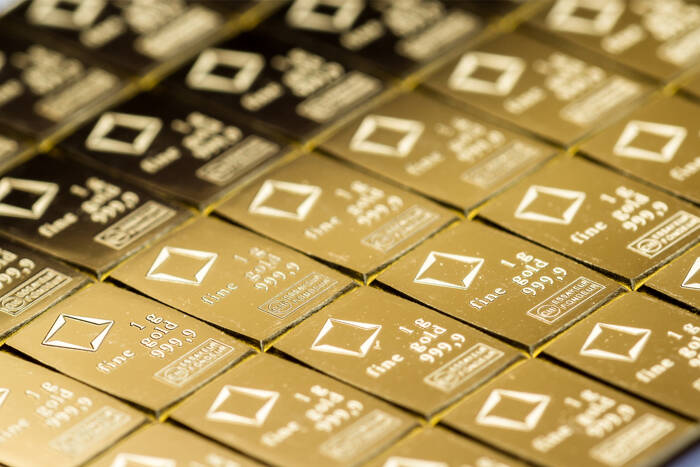

The physical gold demand weakens as prices rise

The demand from the retail trade in important markets such as India and China is softened because record prices scare up buyers. Indian jewelers are forced to offer discounts to attract customers, while the Chinese demand is modest after Lunar’s New Year’s holidays. The lack of strong physical buying could limit the upward momentum in the Gold meeting.