I wouldn’t say it’s likely. Banning or restricting the export of materials needed for military applications is one thing, and applying the same measure to the other raw materials based on them (especially gold) is premature.

There is something called the “contagion effect,” which means that investors can panic because one market appears related to another, even though that is not actually the case. For example, during the crisis in Argentina many years ago, many other developing countries began to experience problems despite not having meaningful ties to the Argentine economy. Why? Because global investors wrongly believed that there are problems “in the emerging markets” and not just in Argentina, and thus also took capital from other countries, creating economic problems.

So is a species by Contamination probably occurs here.

I don’t think this will last long because it is quite clear that these are different markets – and it is clearer than has been the case with the emerging markets example.

The alternative explanation could be that martial law was introduced in South Korea, but I don’t think the markets really believed that this was something to really worry about. In the comment to yesterday’s Gold Trading Alert I added:

Some might also say that the martial law enforced in South Korea is the reason behind today’s strength, but that is something that would likely cause a rally in gold (not gold stocks) as gold acts as a safe haven . So there is a good chance that it is actually news from China that is mainly moving mining shares today.

In other words, gold’s lack of action called it a bluff. The market was indeed right, as the martial law episode was short-lived.

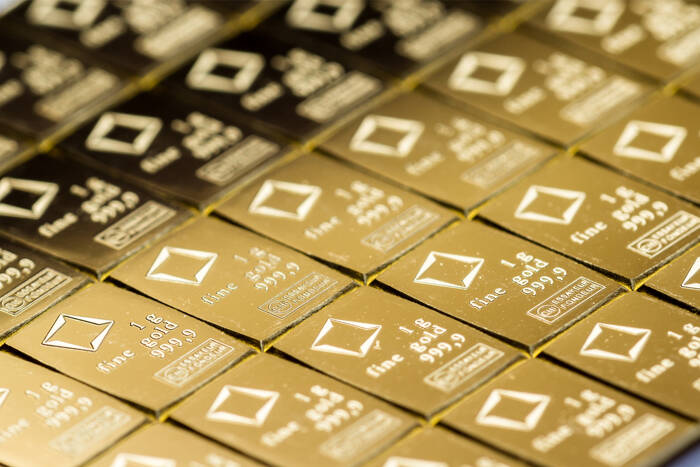

While this probably (we’ll see how it all plays out in the coming days) wasn’t a big deal, let’s keep in mind that such black swan events can happen, and this is why we suggested keeping gold as a reserve keep. part of someone’s insurance capital (yes, it’s been there for years – it’s under the ‘Trading’ and ‘Investment’ sections of the summary section), and what we just saw in South Korea could serve as a reminder to make sure to ensure that this part of the portfolio is taken care of.

If you’ve been neglecting it, now might be the perfect time to pay attention to it. It is recommended to keep some gold in physical possession as that is the safest form, but it may also be a good idea to consider keeping some gold in your IRA for tax benefits.. I’m not a tax advisor, and that’s not investment or tax advice, but I suggest you get a manual for that and make a choice after receiving more information.

Why do I say that this correction is probably nearing its end? As I said before, silver is outperforming gold just like yesterday, but unlike yesterday, miners are no longer strong.

Therefore, I don’t think it would be correct to attribute today’s gains to the continuation of the “contagion effect” – if this were the case, miners would also be strong today. If not, then it’s probably the regular silver-outperformer-near-the-top effect.

Bullish sentiment can be misleading

You may also be wondering: Is the USD index a head-and-shoulders top here?