Silver might rise to $100 /oz where it will set a major top. This might happen in the timeframe 2026-2027.

Silver requires either exceptional market conditions like rising inflation or an extreme shortage in order to rise to $100 /oz which might not be its endpoint once it clears ATH at $50.

September 22nd, 2024 – Silver charts are updated to reflect recent silver price action. In this article, we stick to big picture analysis, beyond short term oriented fundamental silver news or monetary policy influences.

Silver price set to rise

Our latest silver prediction is based on historical data, market correlations and chart readings. It’s a data driven way to analyze precious metals, in the exact same way we successfully analyze other markets.

Just to be clear, the analyst team at InvestingHaven is unbiased. No silver perma-bulls over here.

An important quote from the article mentioned above:

To be honest, our viewpoint is that all conditions are in place for silver to run to its two higher targets: $34 and $50. The question why silver is not trading at those levels is a good question to ask. The ‘silver manipulation’ theme comes up as an answer. Concurrently, the other answer that comes up is ‘opportunity’: if an asset is undervalued, it usually is a matter of time until a rebalancing act occurs.

With that said, we will take a big picture viewpoint in this article. While the points outlined above are relevant in 2024 and 2025, we think in terms of “how high can silver go this decade” in this article.

Remember, a silver price rise to to $100 an Ounce is not an idea that will materialize in 2025. It marks a secular cycle top, most likely, later this decade.

Silver price to $100: summary

We firmly believe that silver will rally to $50 in the not too distant future. All data points outlined in this article and other articles published in this silver section confirm this, in a very objective way.

The recent surge in CPI is not reflected in the silver price. A delayed upward move in silver in USD terms needs to bring the historical CPI/Silver correlation in synch.

However, a silver price rise to $100 requires extreme conditions. We mention 3 such conditions in this article:

- an extreme silver shortage;

- a series of rate cuts by policy makers;

- hyperinflation

A combination of all some of these 3 conditions may be a catalyst to move silver past $50.

The current silver shortage may become extreme, in which case silver will not only move to $50 but may exceed it.

The issue with a silver price surge past $50 is that it will be so powerful, because of its triple top breakout over 45 years. The energy that will be unleashed, once silver moves past $50, is tremendous. In that scenario, silver has to go to the $100-120 area, simply because of chart and market dynamics following such an epic secular breakout.

Historical silver price trend

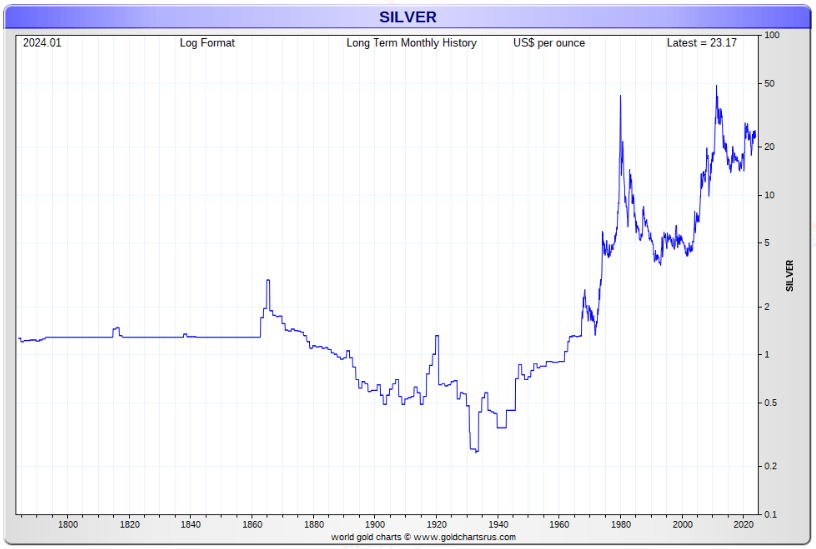

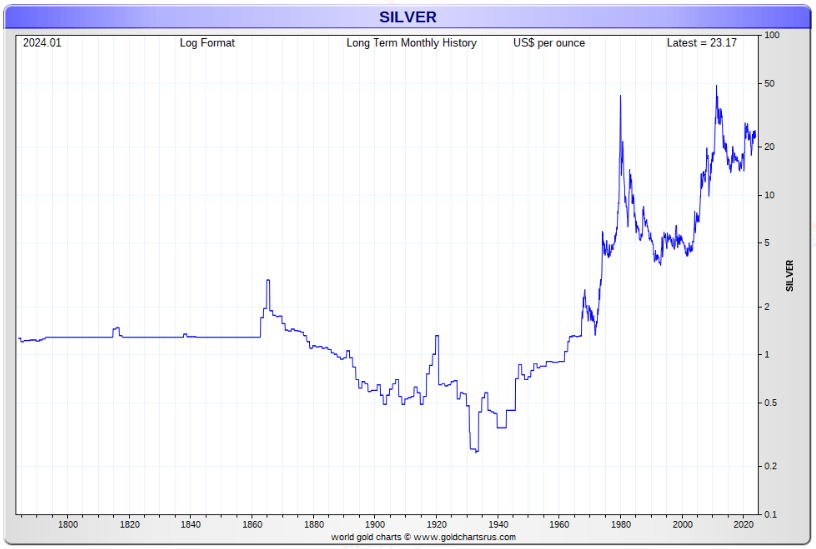

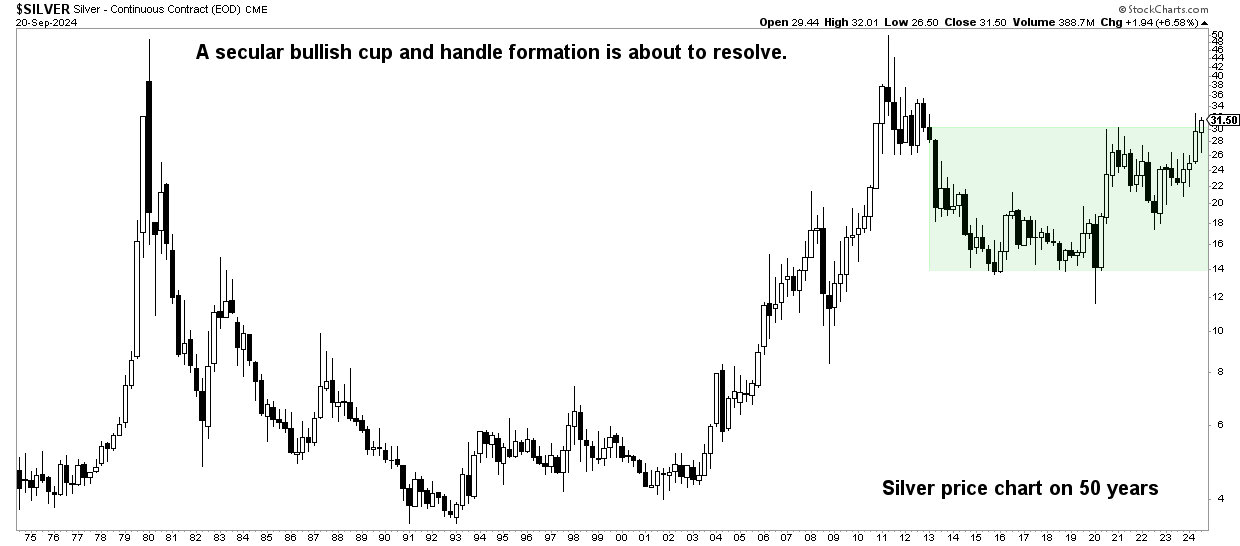

The longest silver price chart learns that silver has a relevant price history since the 70ies.

That’s why the longest relevant timeframe for silver’s price chart is 50 years.

RELATED – Insights from our 50-year silver price chart analysis.

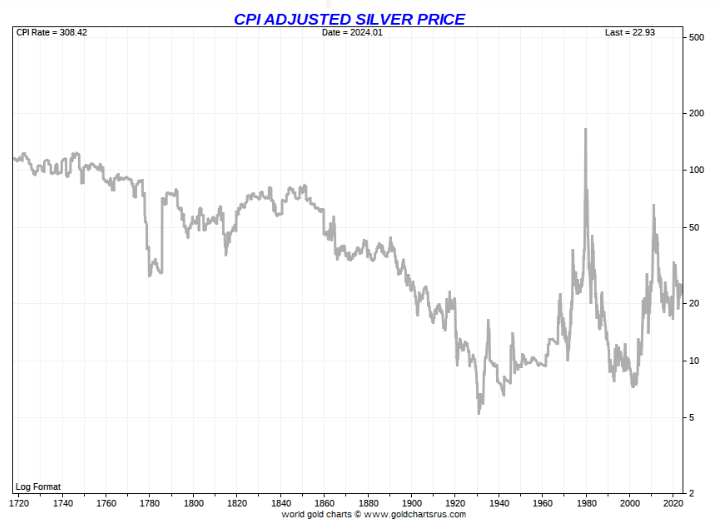

That said, if we zoom out a few centuries, and look at the silver price chart, we understand that the 50-year cup-and-handle formation is the dominant pattern in recent history.

This historical silver price chart does not necessarily tell us whether silver will go to$100 an Ounce. It certainly does not invalidate the silver to $100 thesis, on the contrary. The point is this – silver’s historical chart is not sufficient to confirm a move to $100.

Silver price correlation with CPI

It gets really interesting when we consider the impact of CPI data on the price of silver.

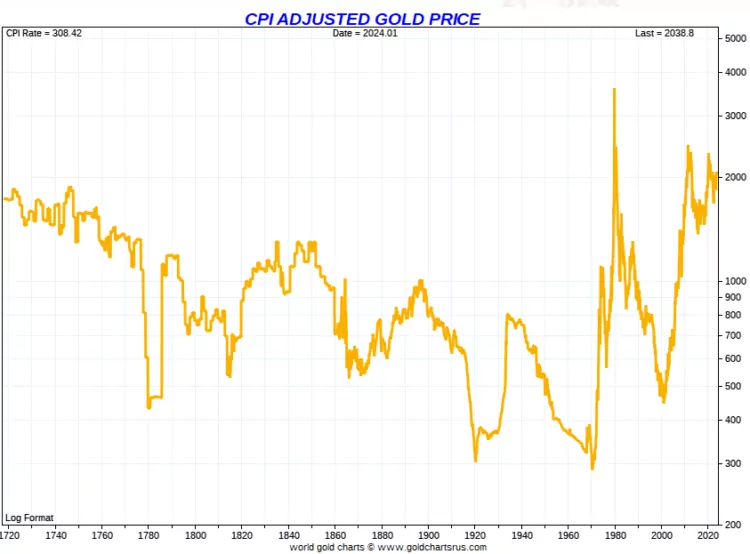

From the learnings defined in the article 100-year gold chart:

When taking inflation into account, and adjusting the gold price for the CPI index, it gets clear how gold is a preservation of wealth and purchasing power. The historical CPI adjusted gold price looks very differently compared to the nominal gold price. It looks stable, in a wide range, not trending. That’s what capital preservation and wealth protection should look like.

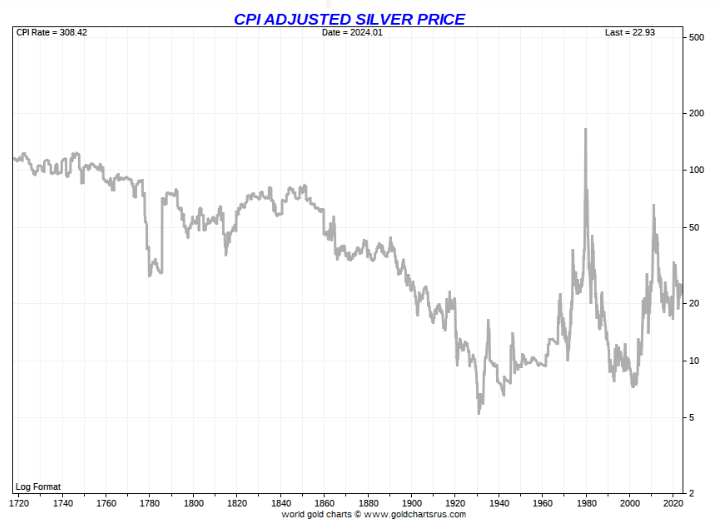

Silver price adjusted for CPI

Below is the silver price adjusted for CPI. In other words, what does the price of silver look like filtering out the CPI impact?

While the above silver price chart (USD denominated, factoring in CPI effects) shows wild swings, the one below moves in a specified range.

Equally interesting is the the absence of a swing to the top of the historical range when CPI exploded in 2022 and 2023. This clearly is because of monetary interventions by policy makers.

The probability of a delayed effect in the price of silver is high – while a delayed rally in silver may bring silver to $50, we doubt it will push silver to $100.

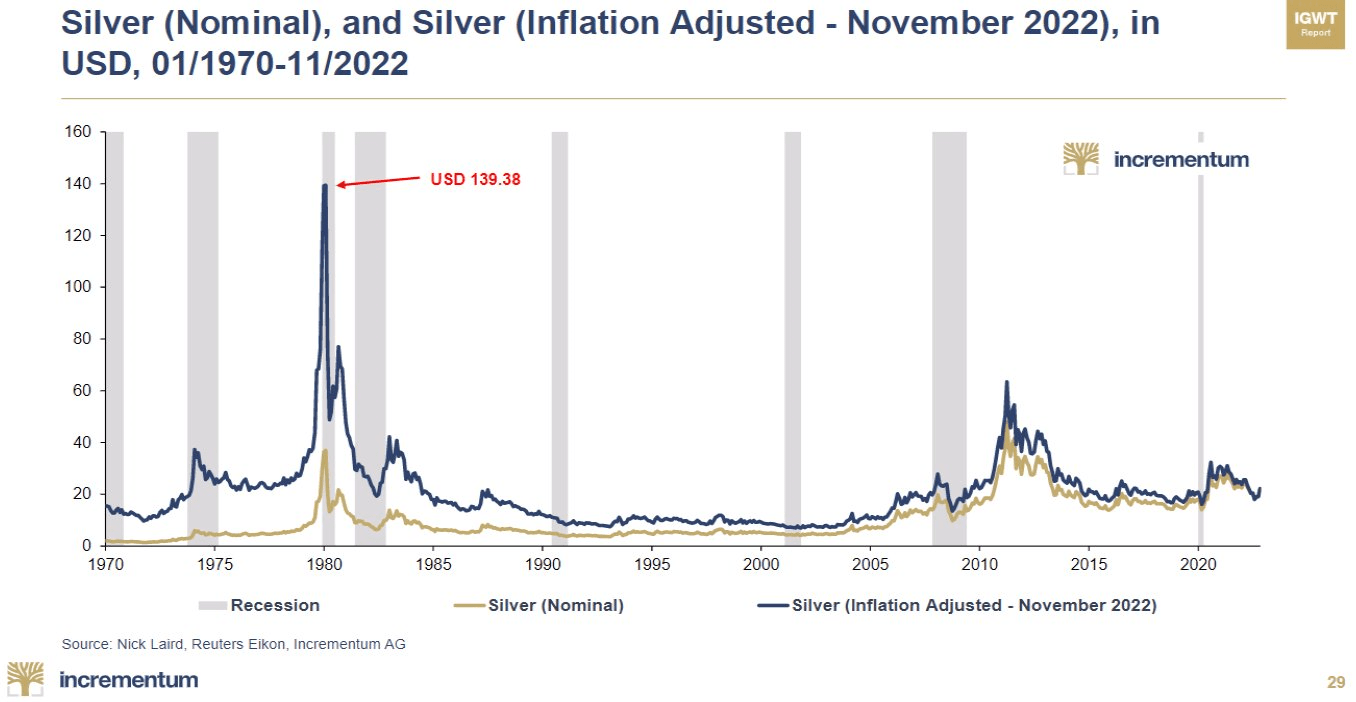

The next chart confirms the historical correlation between CPI and the price of silver, visualized in a different chart format. It also debunks the myth that silver requires a recession to rise in terms of price.

The take-away from this chart, in our view – the inflation adjusted silver price when it topped in 1980 was $139.38, this implies that the current silver price reading in USD terms is significantly undervalued. In other words, the nominal price of silver is lagging CPI which is due to monetary interventions by central banks in recent years. Consequently, when rates stop rising, silver may finally adjust to the upside.

Silver price – is there a path to $100 an Ounce?

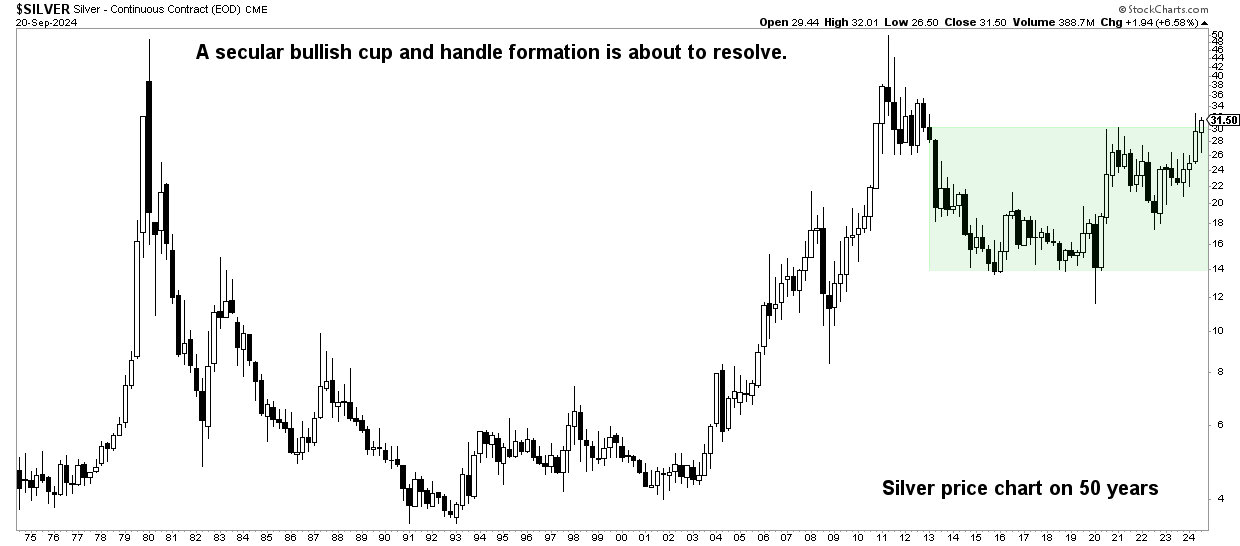

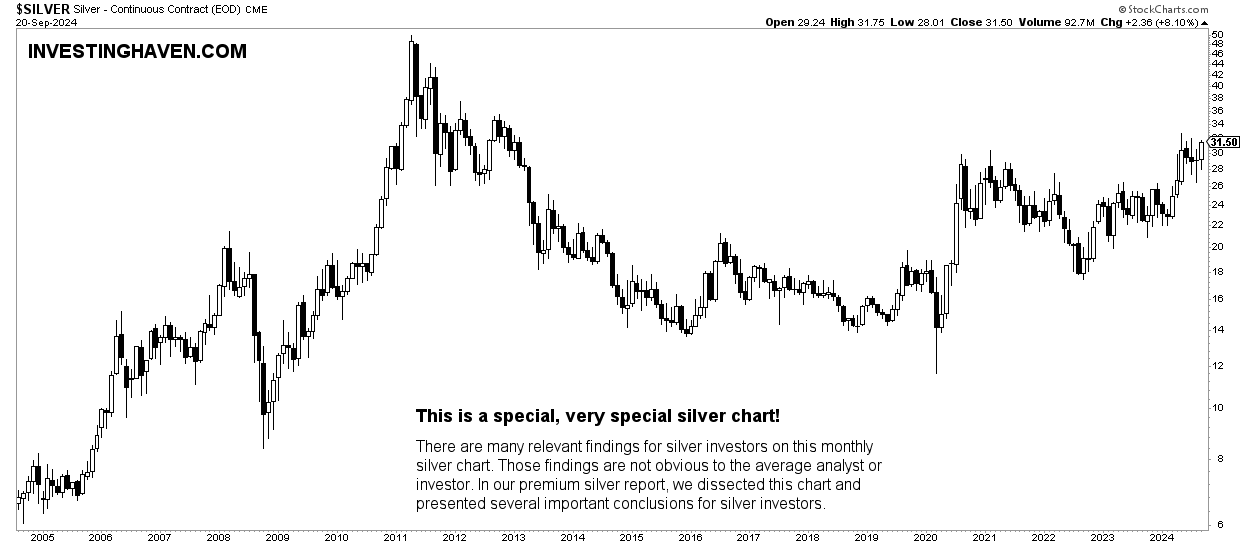

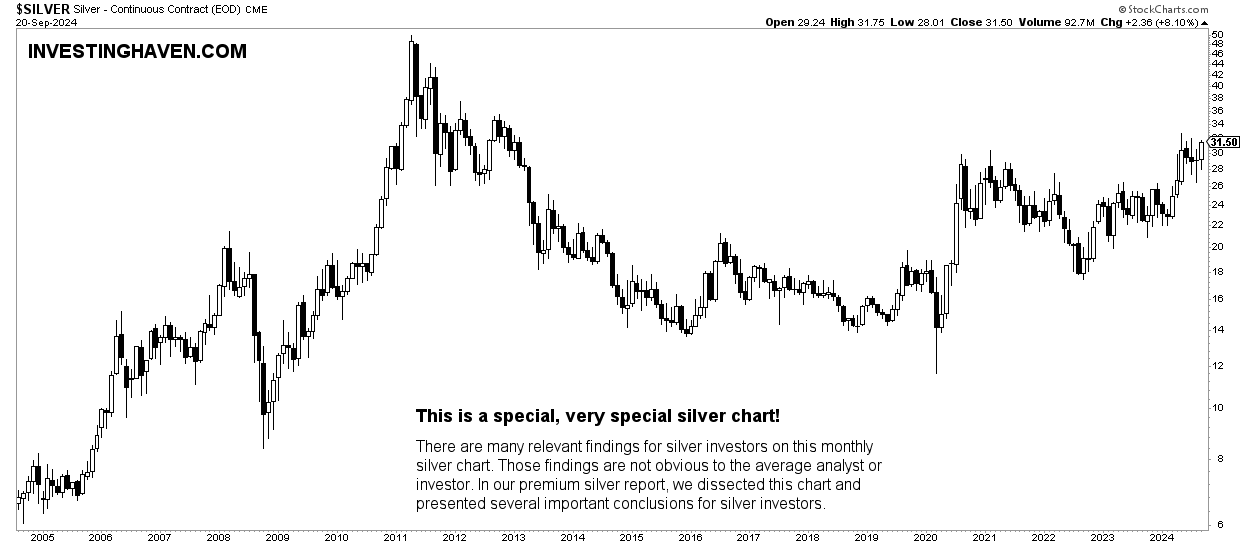

The 50-year silver price chart in nominal terms (USD) truly looks awesome, from a chart structure perspective.

Charts don’t lie – their dominant pattern carry useful information about future price trends – Taki Tsaklanos

What we clearly see on the long term silver price chart is a path to its former ATH (1980 and 2011).

The cup-and-handle pattern is a reliable setup.

Note that the silver price chart remains the strongest bullish pattern on a secular timeframe that we currently see.

In other words, there is a very high probability outcome that silver will rise to $50 (former ATH) in the not too distant future. Silver will likely find resistance at its former all-time highs. This implies that the path for silver to $100 is not a given, certainly not short to medium term.

Silver price secular charts

September 22nd, 2024 – Silver is ready to ‘attack’ its former ATH at $50. Most likely, it won’t be an end point. The ongoing breakout on silver’s secular 50-year price chart is absolutely stunning which is not an overstatement but likely an understatement.

A silver price rise to $100 requires exceptional or extreme market conditions.

Why do we think so?

Let’s do the math – silver from the current $23 USD /oz to $100 /oz is a 5-fold rise. This is very similar to the big historical rallies from the past – 1979/1980, 2005/2007, 2010/2011. Conditions in those periods were exceptional or extreme (source):

- 1979/1980 – extreme inflation.

- 2005/2007 – extreme commodities bull market.

- 2010/2011 – extreme stimulus by the Fed (2009) to end the global financial crisis.

What could bring silver to $100? We believe either another inflationary push and/or extreme silver shortage.

September 22nd, 2024 – Great price action in silver in recent weeks, with a successful test of support. We are cryptic with the annotations on below chart, rightfully so, as we always give our premium silver members an edge. The point is this: silver successfully tested a price point signaled by this chart, in a pretty hidden way, which turns the silver chart very, very bullish!

Silver price to $100: potential catalysts

One of the catalysts for silver to move to $100 is an extreme silver shortage. While, currently, there is a silver shortage, it is not extreme, not yet – it might become extreme.

Below is a video where the silver price dynamics, with the developing silver shortage, are discussed. This silver shortage may develop into an extreme shortage, sooner or later.

Another catalyst might be hyperinflation – while hyperinflation is no fun to go through, it will certainly benefit silver and gold holders. We truly hope we will not experience hyperinflation in our lifetimes.

A third catalyst might be a series of rate cuts by the Fed.

Ultimately, it might be a combination of the catalysts mentioned above.

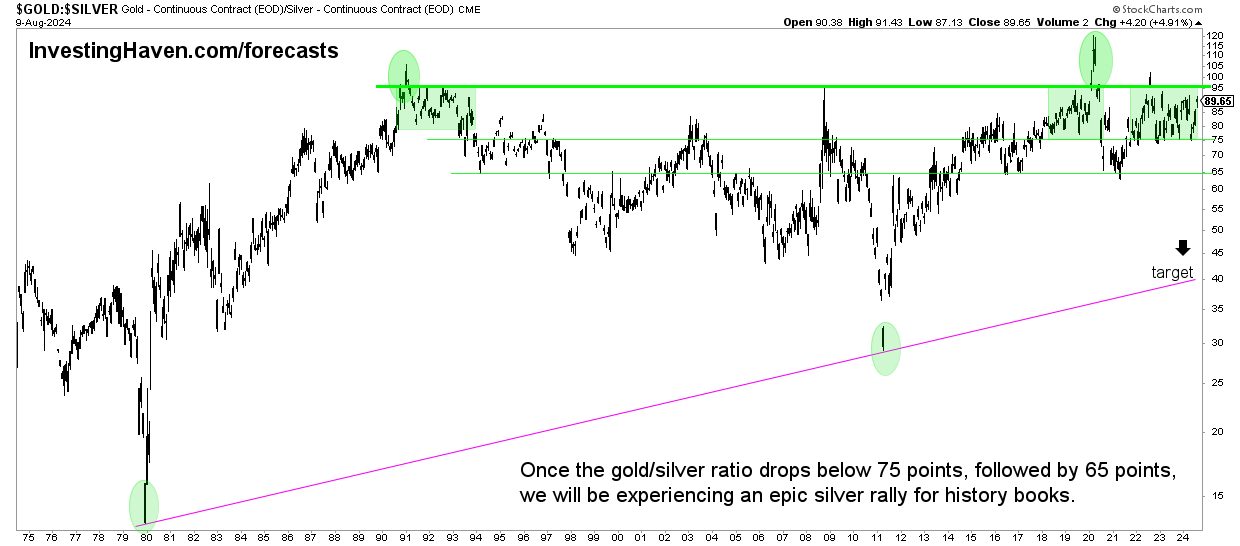

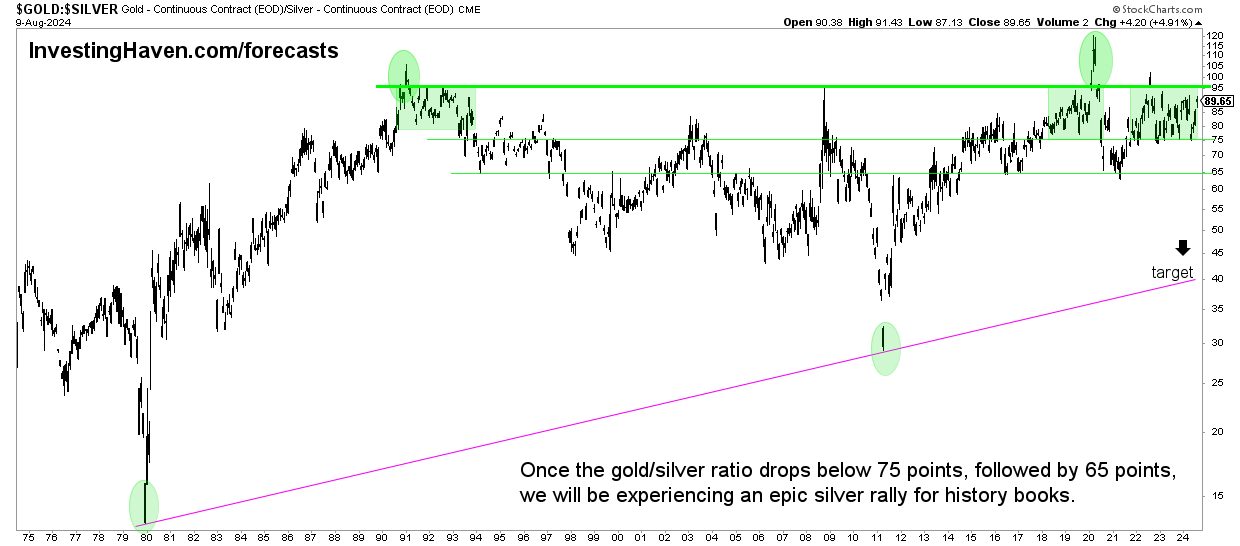

If anything, the secular gold price to silver price ratio suggests that silver will start an epic rally, sooner rather than later.

We don’t know what the catalyst(s) will be, all we know is that the similar readings in the gold to silver ratio (as an indicator) has always forecasted a big silver price swing! The silver price swing to $50 might start any time in the coming months, not later than in the period end of 2024 to early 2025.

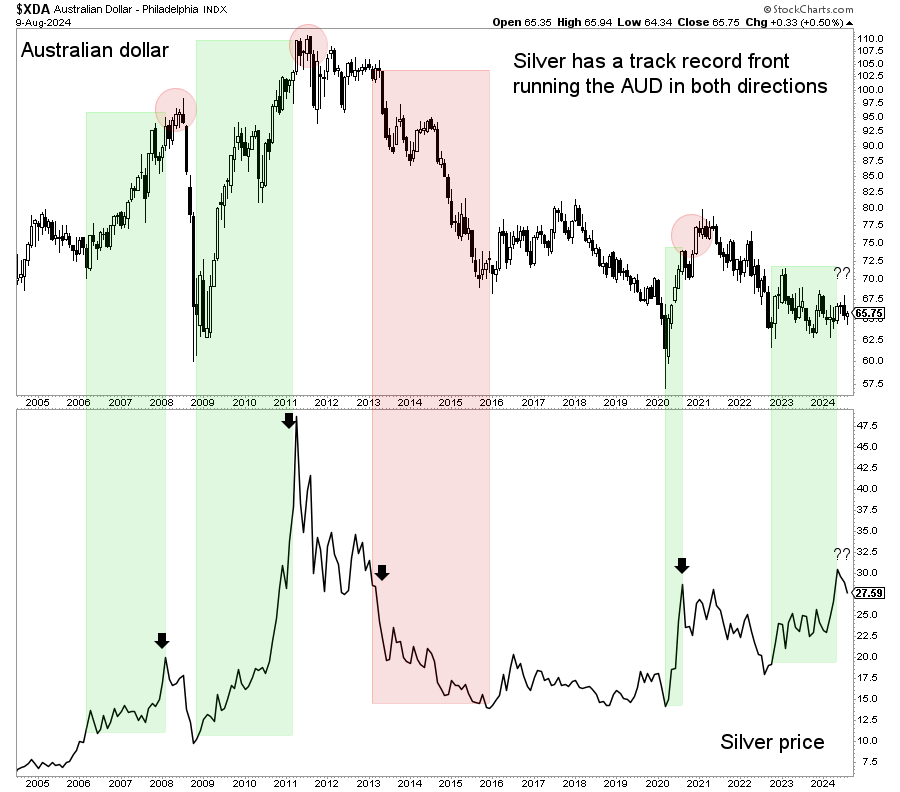

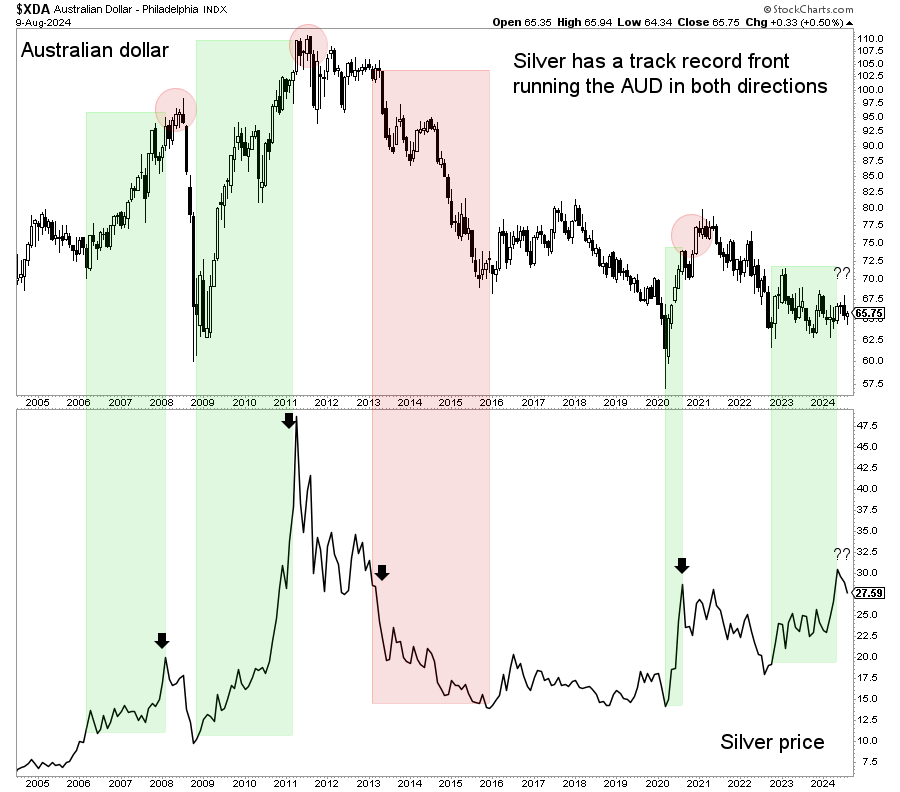

Historical Silver to AUD correlation

Additional evidence of a silver price rally to $50, which ultimately might push silver to $100, is the historical correlation between the AUD and precious metals.

Below is the correlation between silver and the Australian Dollar (AUD).

This analyst is confirming our expectation of a silver rally to $50 to start soon:

Every single time in the last 50 years in which #silver has touched the 50/100

SMA/EMA from above, we have made at least 100% and up to 3600%. Last week’s price correction of 10 % belies the overarching and long-term picture. The precision with which silver works off the 6 most… pic.twitter.com/ps1lA9YcV0— Tim Hack on December 10, 2023

Silver price to $100: timing

With all that said, the question comes up when exactly a silver rally to $100 may occur.

We want to emphasize the importance of breaking down the answer in two parts:

- The silver price rally to $50 is a high certainty outcome. It may happen in 2024 or in 2025, not later, is what all data points outlined in this article suggest.

- The big run of silver to $100 requires extreme conditions, like an extreme silver shortage or a series of rate cuts or hyperinflation or a combination. Those conditions are not visible, not yet, with the only exception being silver shortage. It is only possible to say that a silver rally to $100 is unlikely to happen in 2024 or 2025 unless the silver shortage gets completely out of hand.

Also, we want to remind readers that even the best analysts and forecasts have a really hard time getting silver price rallies right.

This one forecast did not materialize:

With a giddy up and a hi ho Silver away. $SI_F $SLV

For months I have been pointing out this long-term chart to members of the Factor Service. The massive base, completed last July, has a target of $35 to $40. Note break away gap in July & measuring gap today pic.twitter.com/BmOM6cGzfg

— Peter Brandt on February 1, 2021

FAQ about the silver’s potential move to $100

Will silver ever move to $100?

The probability of silver to move to $50 is very high.

However, a silver move to $100 will require exceptional conditions which may be strong inflation or a silver market shortage (supply squeeze).

When can silver move to $100?

Only if extreme conditions appear, like hyperinflation or an extreme silver shortage of rate cuts by the Fed, will silver be able to move to $100. The most imminent trend, of the three, is the developing silver shortage which might get out of hand and push silver above $50.

Is it a good thing if silver moves to $100?

Frankly, we are not sure we want to be living in a world in in which silver explodes to $100 unless it is because of an extreme silver shortage. In case of hyperinflation, a silver move to $100 will be reflecting a big loss in purchasing power which is something everyone will affect in a very negative way. It will be less about silver investing but more about protecting purchasing power.

Can you provide arguments why silver may never hit $100?

There are a few reasons why silver may never hit $100. First, ATH at $50 may provide too much resistance. Second, monetary decisions may suddenly play against silver, which is unlikely. Third, a complete market meltdown may push the world in a depression, which is unlikely to happen anytime soon.

Note – Thank you Adam Walsh for this mention on Linkedin.