A gold-silver ratio of 88 points is not sustainable during a gold bull market. It is a matter of time until silver will react positively and its value against gold will return to equilibrium.

RELATED – Silver Prediction 2025

The gold-silver price ratio is a crucial indicator for assessing the relative value of these two precious metals. Historically, the ratio has fluctuated, but when it rises above 88 it indicates that silver is significantly undervalued compared to gold.

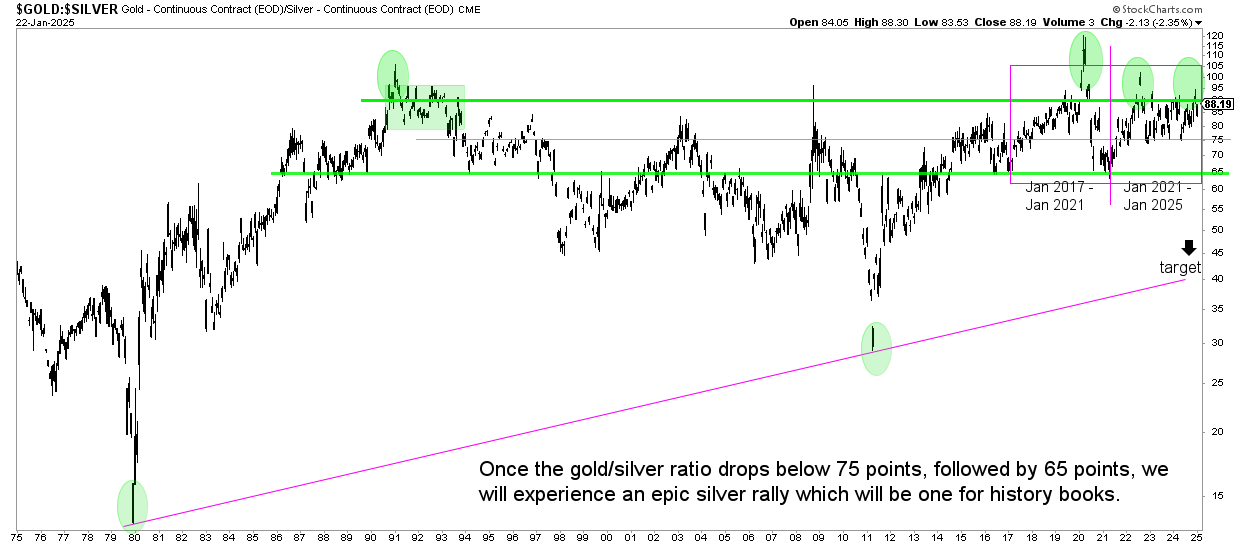

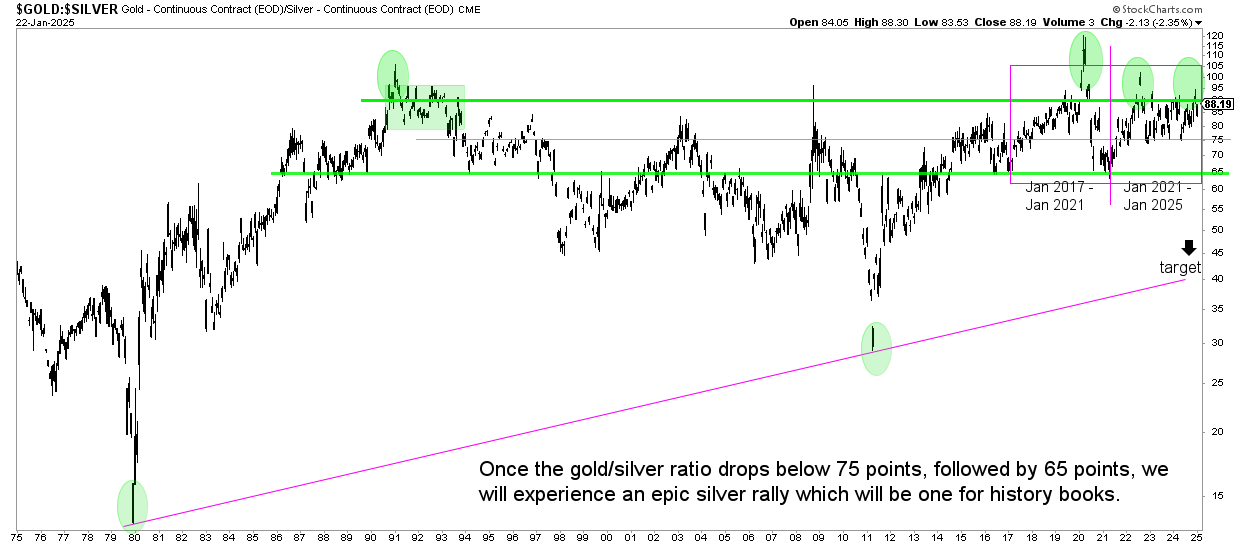

Over the past five decades, silver has only sporadically risen above this 88-point threshold, indicating moments of extreme undervaluation.

Right now, it’s fair to say that silver is the most undervalued metal in the precious metals universe.

Understanding the relationship between gold and silver is key to understanding why the gold-silver ratio matters. Typically, gold is seen as a store of value, and silver, while also a precious metal, has often lagged behind in price appreciation. However, the gold-silver ratio has shown periods of extreme undervaluation, represented by higher values 88do not have a long shelf life.

When the ratio reaches or exceeds this level 88 points, silver is priced at an unusually low value relative to gold.

This discrepancy creates a powerful buying opportunity for those looking to capitalize on silver’s potential.

As history has shown, such imbalances rarely persist. Possibly, silver tends to overtake gold, resulting in a potential price correction or increase that reduces the ratio.

The chart below helps visualize this pattern and shows how silver has sporadically risen above it 88 points compared to gold, but every time it is eventually resolved. When silver is undervalued to this extent, it is only a matter of time before the market corrects itself. This is especially true when we look at the industrial demand for silver, which has been steadily rising due to its essential role in industries such as electronics, solar photovoltaics and electric vehicles.

In conclusion, the gold-silver ratio above 88 is a clear signal that silver is currently in an extremely undervalued state. Investors should keep a close eye on this trend because historically, silver has tended to resolve such imbalances with upward moves.

As industrial demand for silver continues to increase, solving this relationship could be a major catalyst for silver price growth.

Once again, silver is the most undervalued metal in the precious metals universe.