The impact of inflation and interest rates on silver prices in 2025

On the other hand, analysts predict that industrial demand for silver will reach 1.21 billion ounces in 2024, which will be the second highest year on record. Inflation is likely to increase costs in key sectors such as renewable energy and electronics, perpetuating significant supply shortages.

Inflation in the energy sector is also increasing demand for solar panels and electric vehicles, which is in line with global green energy goals. Furthermore, solar energy alone could account for up to 98% of global silver reserves by 2050.

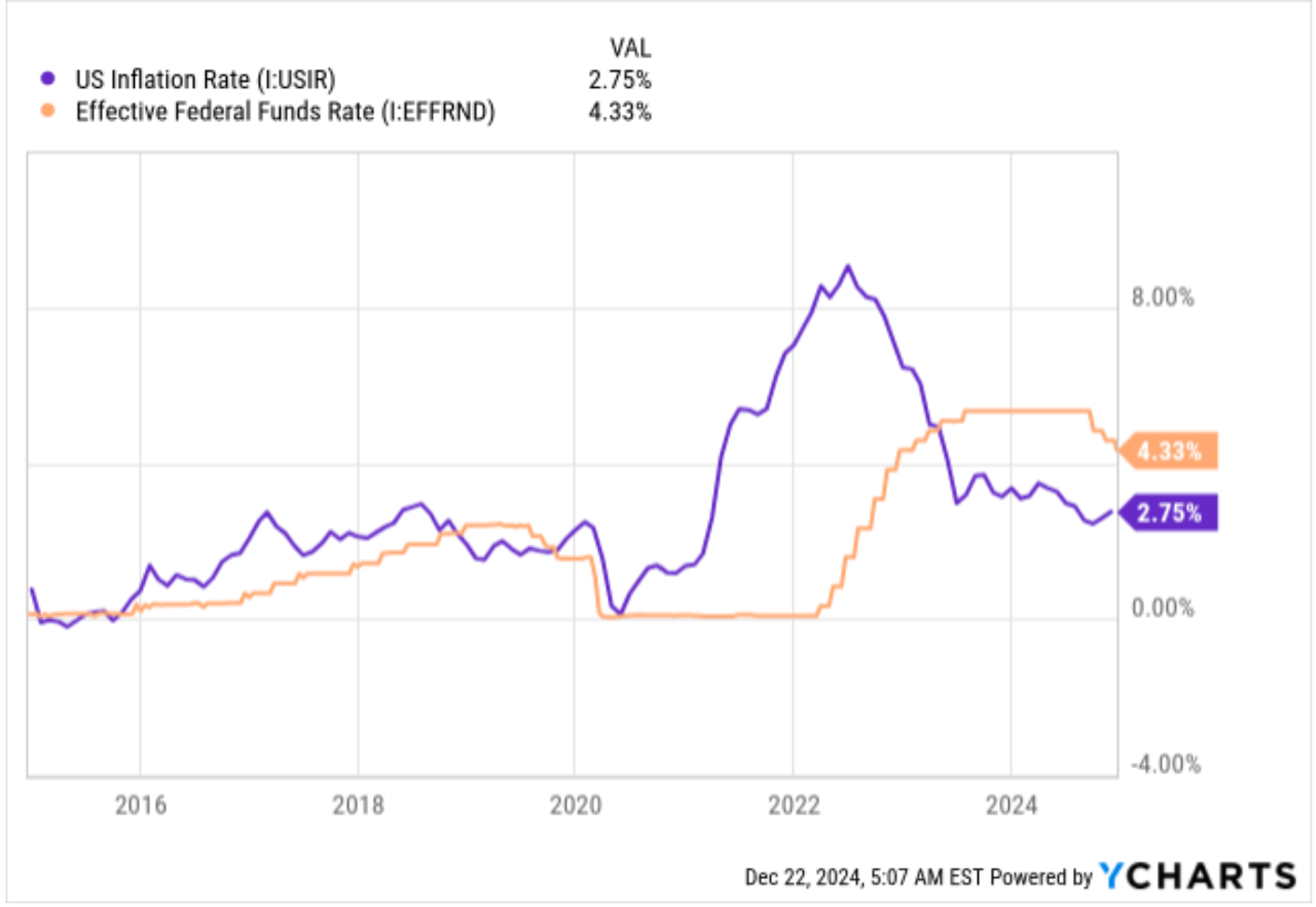

In 2024, silver surpassed $30 per ounce, driven by strong industrial demand and safe-haven buying amid geopolitical crises. The above shows a trend shift in US interest rates in 2024. If interest rates continue to decline in 2025, silver’s upward trajectory is likely to continue. Historical data shows that non-yielding assets like silver gain favor during low interest rates. This trend is in line with projections for 2025 in which central banks take a dovish stance to counter slowing economic growth. High inflation, continued industrial demand and potential interest rate cuts create a favorable environment for further silver price appreciation in 2025.

Industrial demand and emerging trends

Clean energy revolution drives demand for silver

The clean energy transition remains the main driver of industrial demand for silver. Silver’s unparalleled conductivity makes it essential for solar panels, electric vehicles (EVs) and nuclear reactors. For example, in 2024, the US installed 105 million solar panels, which required 67 million ounces of silver. Additionally, electric vehicles (EVs) use approximately 25-50 grams of silver per vehicle. As a result, with tens of millions of electric vehicles expected by 2030, this will significantly escalate demand for silver.

The chart below shows that the solar energy market is expected to grow to $383.78 billion by 2032, underscoring the importance of silver.