The long-term silver chart, priced in Euros, has some promising features, including the soft pullback after the recent ATH test.

As has been said in recent months, silver investors should consult the silver chart in their home currency.

Silver priced in global currencies

That’s because silver priced in USD, the standard used for analysis, exhibits significant differences from silver priced in other global currencies.

READ – Silver Hits Record Highs in Most Global Currencies… Silver in USD is Next!

We recently highlighted in the article above how different silver charts priced in Canadian dollars or Indian rupees (to name a few) are compared to silver in USD.

A few days ago we showed that silver is reaching new all-time highs when priced in AUD.

In this short blog post we look at silver priced in EUR.

Silver priced in EUR

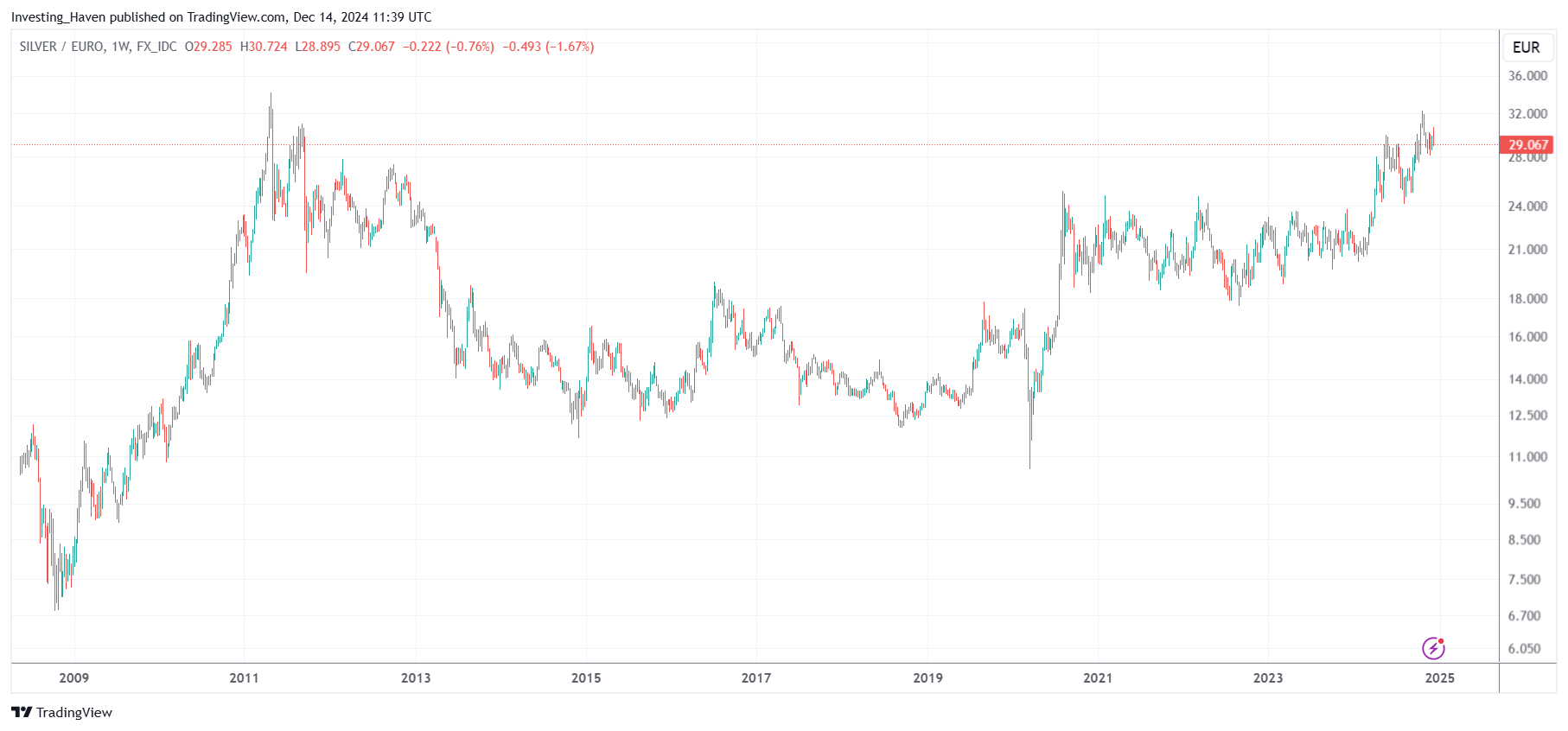

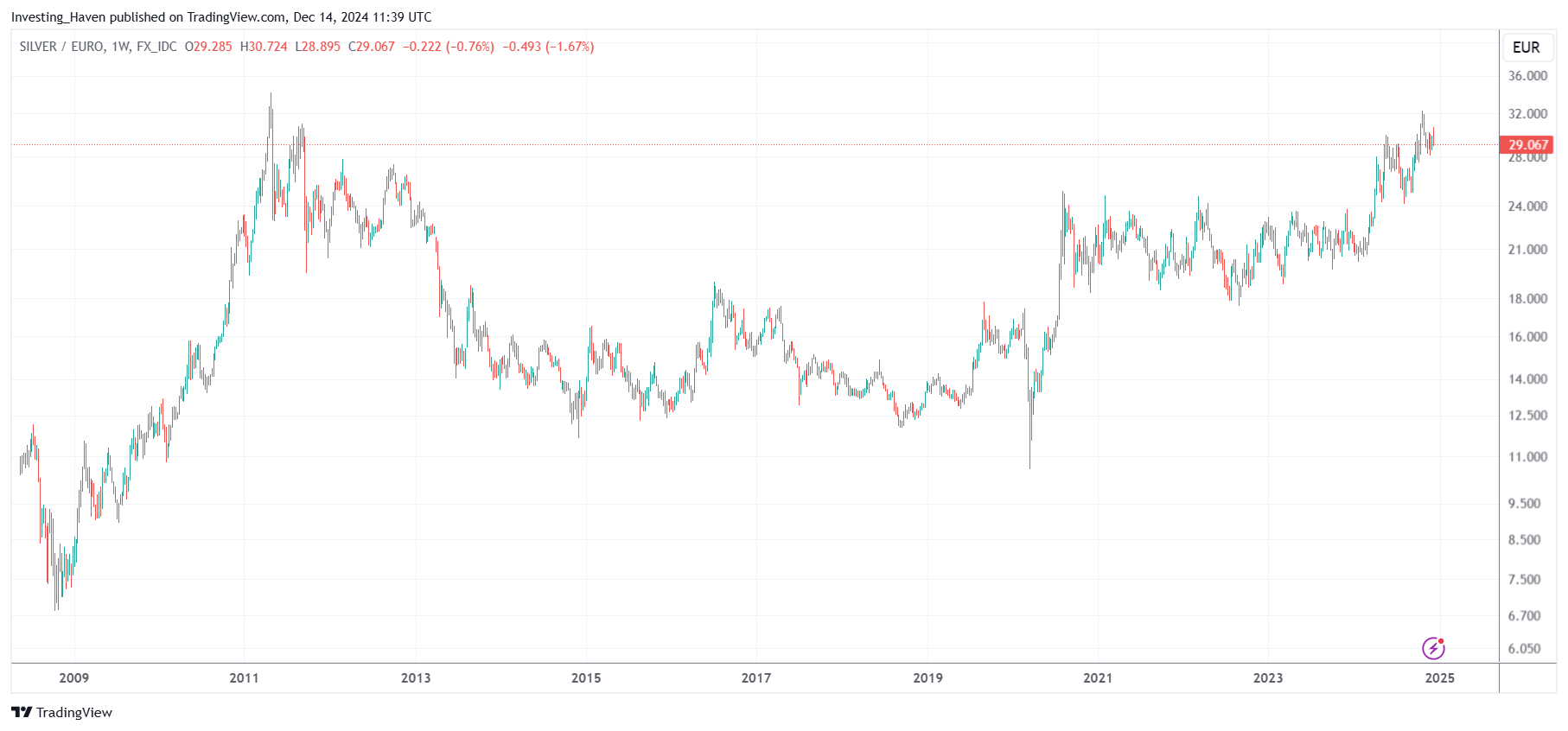

Below you will find the silver price chart of the past 15 years.

It looks different from the long term silver price chart you are used to seeing. That’s because ‘the whole world’ uses it silver priced in USD. The chart below shows the price of silver in EUR.

Interestingly, silver in EUR tested ATH in October. However, no one talked about this because the price of silver in USD was over 30% below the ATH.

Silver in EUR – chart observations

A few observations that stand out when carefully checking the silver price chart expressed in EUR:

- The pullback after hitting ATH was soft. This is great, so far at least, because it implies that there hasn’t been any heavy selling.

- Compared to the pullback in 2011, after a price of 33-34 EUR/oz, the current setup is so different.

- The run-up to ATH in 2024 has been long and slow. This is great because the 2010/2011 run-up was aggressive, fast, with no support structure near ATH.

IT SEEMS THIS TIME IS DIFFERENT. And it lines up with our long-term bullish silver forecast.

RELATED – When Will Silver in USD Reach ATH?

The silver price chart, priced in EUR, has some interesting and encouraging features: there is a lot of support in case the price decides to continue on the course, the price has barely risen in 2024 (in relative terms compared to the steep rise in 2011 ), the chart pattern is a powerful bullish reversal.

Therefore, we believe that silver priced in EUR has more upside potential than downside potential, if we zoom out and assess its long-term potential.

However, keep in mind that a withdrawal is perfectly possible, and not necessarily a bad thing, as long as $26 will hold. Ultimately the bullish result seems inevitable, but the road to such an outcome will be difficult… ultimately silver is the solution restless metal.