An example: silver priced in Australian dollars (AUD) has been printing a series of new ATHs lately.

RELATED – Silver Prediction 2025.

It’s so easy to get caught up in the precious metals universe. Gold and silver are mainly denominated in US dollars. This often leads to a distorted picture, especially if the price developments of these metals, expressed in other global currencies, show very different behavior.

Silver priced in AUD – New ATH

A few months ago we wrote this piece Silver is hitting record highs in most global currencies, concluding:

The bottom line is this: the global silver trend is rising and reaching new ATH in most currencies, not yet in the USD. It’s the dynamics of the silver bull market that really matter.

We have added:

It is only a matter of time until silver priced in USD will also reach ATH.

It is truly phenomenal to go back to the article and see how silver was already setting ATH in most global currencies. Silver priced in AUD was then ‘inches below ATH’.

This has now changed.

Silver priced in AUD has since reached a range ATH. Particularly in December, when USD-priced silver weakened, the exact opposite happened for the gray metal, which was priced in AUD.

Silver leading indicator is nowhere near extremes

What’s just as important is how the gray metal’s leading indicators are trending (hint: they’re not China is not buying nor buying an FOMC meeting nor rates).

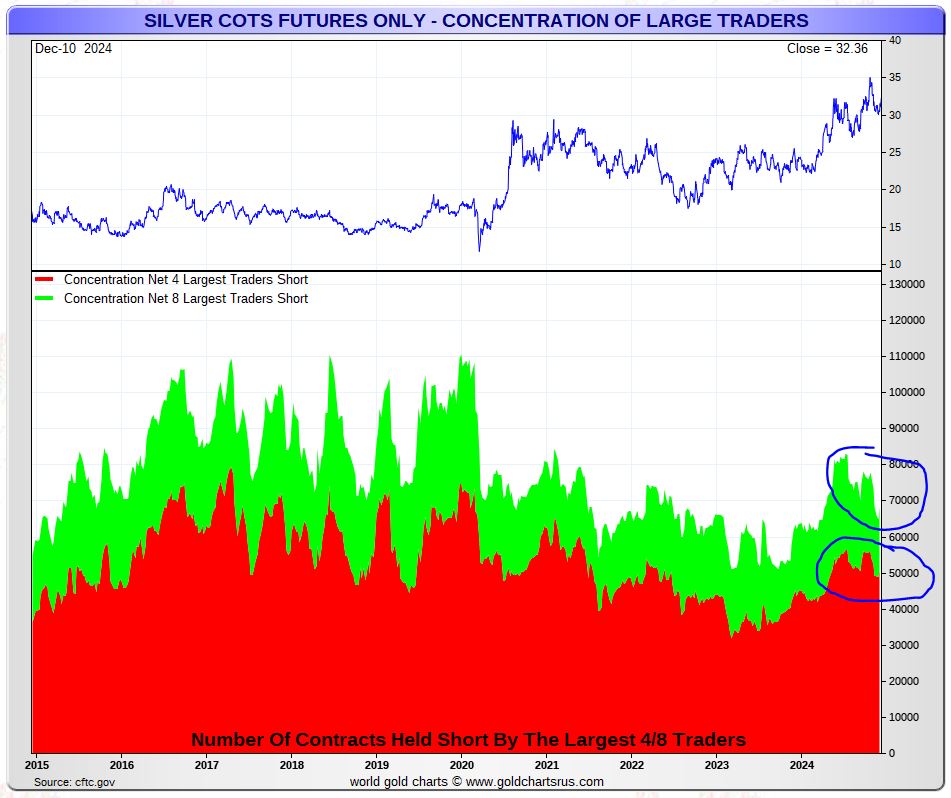

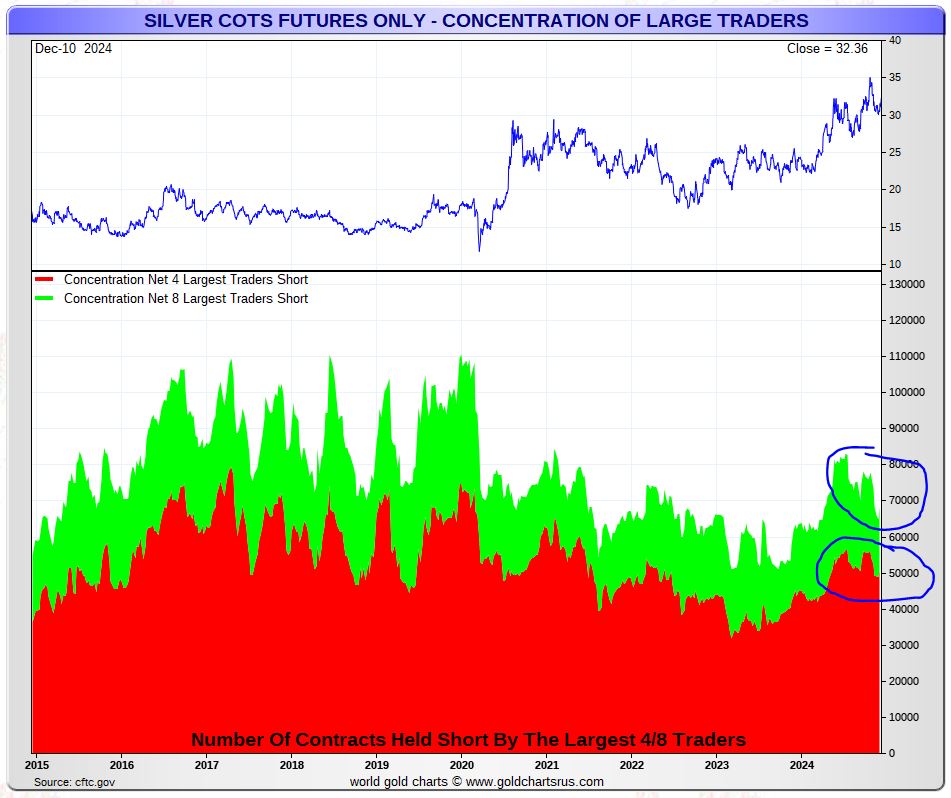

The concentration among the net 4 and 8 largest traders shorting the silver futures market is one of the most important indicators of the price of silver. A very high concentration level, close to historical extremes, indicates limited upside potential. The opposite is also true.

We have been discussing this topic extensively lately and a few days ago updated one of the important leading indicators of the silver indicator in Silver: this one leading indicator confirms a huge upside potential in 2025:

What is very interesting is the sharp decline in the concentration of the top eight traders shorting since October 2024. The circle on the next chart emphasizes our point: the price of silver fell by about 14%, but the concentrated silver positions fell significantly . This is a very healthy development as it brings the concentration of the largest 4 and 8 traders short to very low levels (a bullish development).

Please note that this leading indicator is not a timing indicator. It may have a bullish reading, but it tends to ripple through long time frames. In addition, other leading indicators will determine the price timing of a bullish outcome.

Silver priced in USD?

This leaves readers wondering: when will the USD silver price finally rise?

There is good and bad news:

- Bad News – Silver’s 2024 Rising Trendline Is Being Tested, Medium-Term Uptrend Is Vulnerable If Silver Falls Below $30.5 for more than 5 to 8 consecutive days.

- Good news – there is plenty of support in the longer term $26.7 act as a line in the sand.

Below you will find the graph. Keep in mind that January 21, 2025 will be one of the few decisive dates for silver.

We stick to our long-term outlook, which believes that silver will rise to $50 sooner or later.