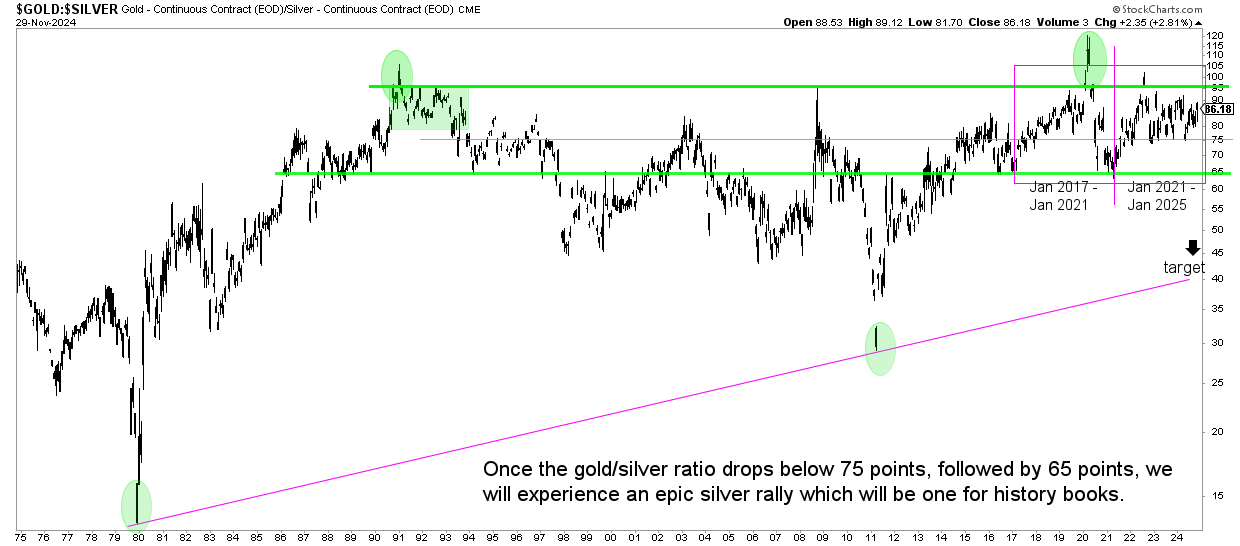

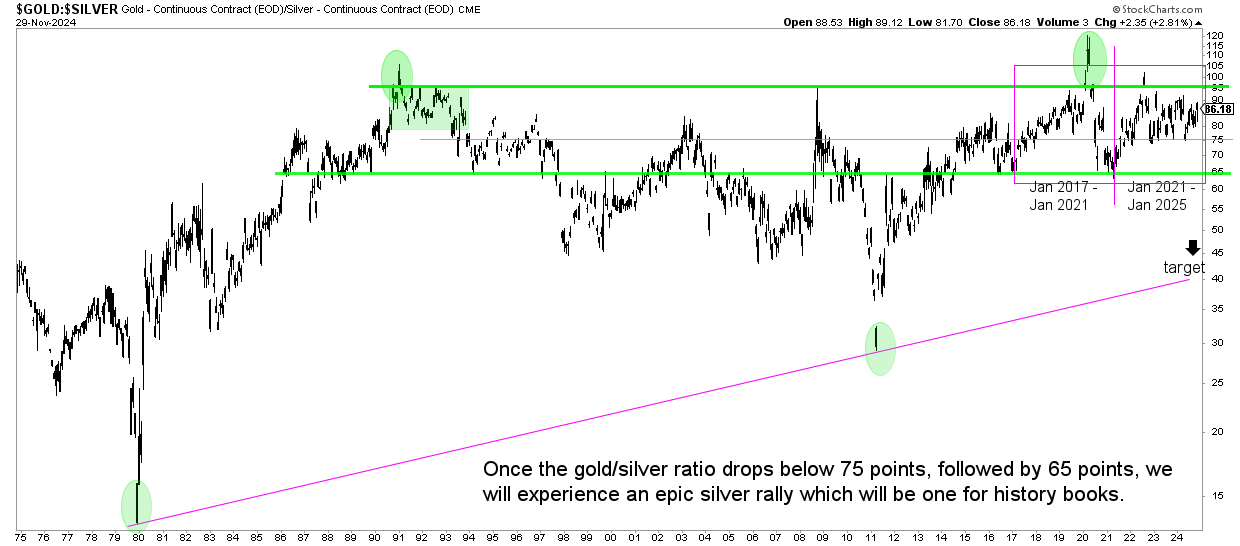

In this article, we analyze the timeline of the gold-silver ratio chart, which suggests that January 2025 could potentially mark the end of silver’s undervaluation.

RELATED – Silver Price Prediction 2025

As has often been said in the past, analysts are too focused on the price axis of the chart(s).

At InvestingHaven.com we also analyze the time axis of the chart(s). This allows us to gain many more insights into the graphs.

If you only analyze the price, it’s like missing 50% of the chart insights available on the timeline axis.

A bearish pattern on the gold-silver ratio chart

The only data point that leads us to conclude that January 2025 is a hugely important month is the gold-silver price ratio.

Once again, all analysts are focused on the price axis. While the price axis reveals relevant and important information, such as the takeaway on the chart, there is an equally important timeline axis that reveals critical insights.

Specifically, the bearish M-pattern on the long-term chart of gold-silver price ratios, shown below in the purple box, has a potential end point in January 2025. If the completion of this M-pattern is confirmed, it will occur. in the period Jan/Feb 2025, implying a sharp decline in the gold-silver ratio.

Remember: a bearish evolution of the gold-silver ratio implies a bullish outcome in favor of silver.

The above scenario would result in a sharp increase in the price of silveradding to the confidence that silver is heading towards $50. In that scenario, a silver price of $100 remains a possible outcome in the long term.

What could happen to silver in January 2025?

First, we are talking about a possible outcome, not a guaranteed outcome.

If there was a time when silver could start to outperform gold, it should and could be January/February 2025.

That’s because the gold-silver ratio has this M-pattern structure, which has a midpoint exactly four years after its inception (January 2017) (January 2021). So for this M-pattern to be perfectly symmetrical, it must be completed by January 2025.

This could result in a drop below 65 points in the gold-silver ratio, which would coincide with a rise in silver prices to at least USD37.70/oz, one of our higher targets (but not the ‘end point’).

But silver is bearish now, right?

Wrong, silver is not bearish.

It may FEEL bearish because it hasn’t been moving higher lately; relative to other markets, such as some technology stocks and other stock market segments, it lags.

This may be a temporary phenomenon… or not.

What matters is price action:

- Above $26/oz, silver is in a long-term bull market.

- Above $28/oz, silver is in a strong bull market.

- Above $30/oz, silver is in a very strong bull market.

- Above $32.70/oz, silver is in a super strong long-term bull market.

The closing price rule of 5 to 8 days applies at all above price points.

It doesn’t happen often, but we will publish an X-post. The outcome below is a viable path for silver:

$Silver is perhaps the most bullish chart of all time. pic.twitter.com/q3MUdiDE0F

— Sqeaky Mouse (@TheSqeakyMouse) November 30, 2024