Historical relationship between gold, political and economic landscape

Fluctuations in the price of gold are nothing unusual for markets and investors. Although gold prices often see shifts during election periods in the US, geopolitical events and economic indicators – especially inflation and unemployment rates – along with changes (or expectations of a change) in interest rates also affect the yellow metal’s price and appeal of it as a safe gold price. refuge.

During Jimmy Carter’s presidency from 1977 to 1981, the price of gold rose by as much as 326%. In contrast, while Ronald Reagan was in power from 1981 to 1989, the price of the precious metal fell by 26%. Some analysts argue that the price spike during Carter’s term was a continuation of an upward trajectory that began in 1971 when President Richard Nixon ended the Gold Standard (that is, the direct international convertibility of the U.S. dollar into gold) in response to rising inflation. as well as the geopolitical uncertainty resulting from the Cold War.

As the American economy recovered and negotiations with the Soviet Union began during the Reagan administration, the price of gold fell by almost 50% between the start of his first and second terms.

When Barack Obama left the White House in 2017, gold and silver prices rose by 40% and 50%, respectively, compared to when he took office eight years earlier. On concerns about the US debt ceiling and fears that the government could default on its debt obligations in 2011, gold rose to $1,895 – 122% higher than on Obama’s first day in office.

During the presidency of Donald Trump, and given the economic fallout from the Covid-19 pandemic, the price of the precious metal reached an all-time high of more than $2,000 in August 2020, an increase of 72% compared to its first day in business.

Gold Bulls Continue to Outperform Despite Overbought Signals

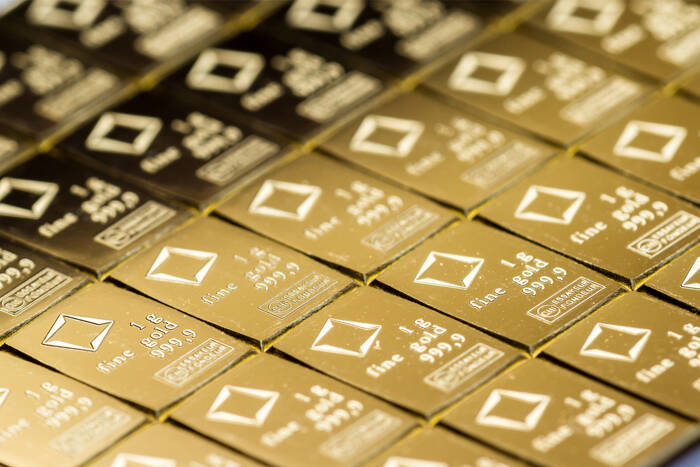

Gold has soared higher this year, up 34% so far and recently hitting an all-time high of US$2,758. The precious metal is on track to post its biggest single-year gain in fourteen years.

While gold’s rise is notable, longer-term action points suggest trouble lies ahead. The Relative Strength Index (RSI) on the monthly chart is approaching a resistance area between 87.02 and 83.87; historically, the momentum oscillator has turned south every time it reaches this zone since 2008.

Another technical observation worth considering on a monthly scale is the convergence of projection ratios at the current price. At US$2,723 there is a 100% projection ratio present (harmonic traders will recognize this as an AB=CD resistance pattern), which is closely linked to a Fibonacci projection ratio of 1.272% at US$2,777 (an ‘alternative’ AB=CD- resistance). .