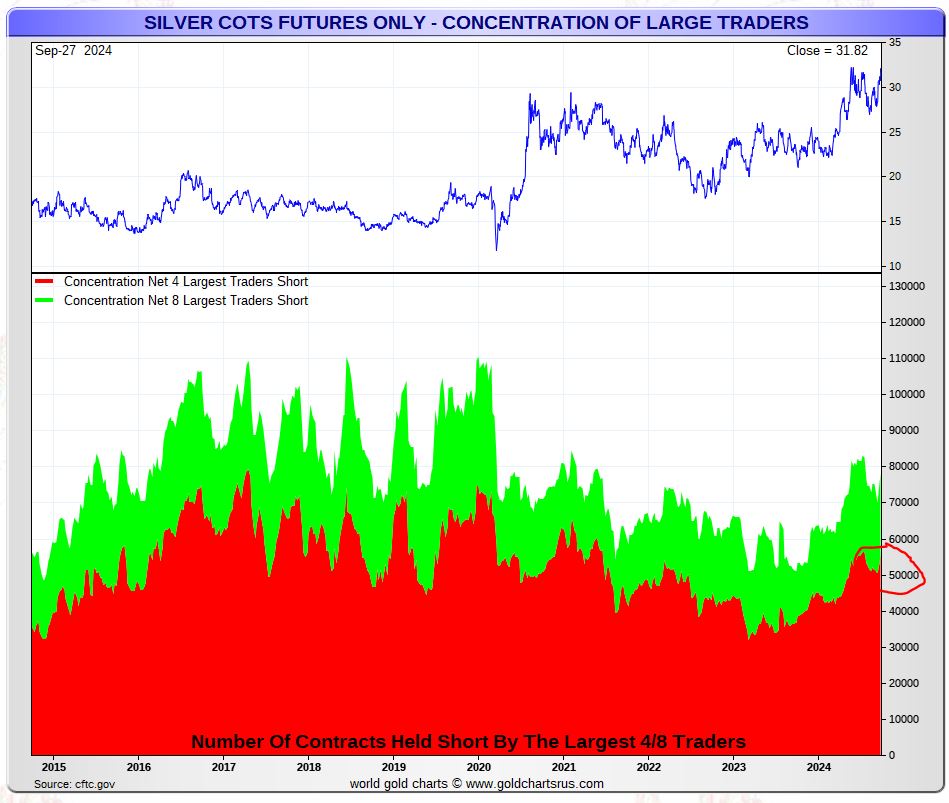

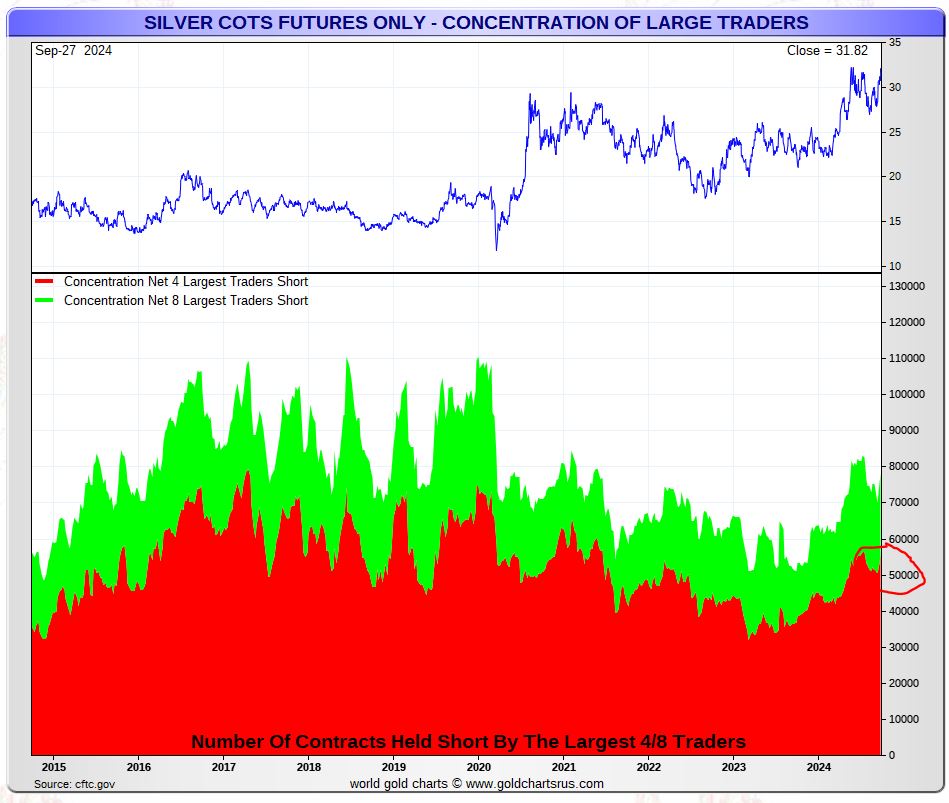

One of the most important indicators for silver is the concentration of the largest traders who are positioned short. This data point is well below the extremes (graph). What does this mean? Simply put, it creates significant upside potential in the price of silver.

RELATED – When Will Silver Reach $50 an Ounce?

While it pays to look at silver price charts, especially the longer term charts like the phenomenal 50-year silver price chart, it is just as important to check the current state of the leading indicators.

Leading indicators for the silver price

Leading indicators form the basis of our silver price analysis methodology.

The point is this: other markets or data points outside of the silver price chart can help us understand the future path that silver is likely to take. Leading indicators include:

- The US dollar, inversely correlated with silver.

- Yields, inversely correlated with silver.

- COMEX silver market short positioning.

The last point can be broken down into two parts: net short positions of commercials and concentrated short positions of the largest traders).

The latter can help us understand the economy’s upside potential price of silver.

Remark – We’ve said it countless times, we’ll say it again: silver news is not useful. The news lags behind. An example: silver news updates such as Ask for Indian silver or price changes per quarter are not helpful at all.

Upside potential for the silver price

As mentioned, within the universe of COMEX silver futures market Related data is one that helps understand the upside potential of the price of silver: the concentration of large traders on the short side of the market.

- The less concentrated the largest traders short, the more upside potential in the price of silver.

- If the concentration of the largest short traders is very high, the upside potential in silver is limited.

Below you will find the most recent graph (courtesy: Gold ChartsRUs) when it comes to the concentration of the largest traders shorting the silver futures market. A few observations:

- In 2017 the concentration was extremely high; the price of silver could not rise.

- Concentration fell in 2018 and started to rise again in 2019 – silver prices followed a similar path.

- In each of these events, the price of silver fell once extremely high concentration levels were reached.

Currently, the concentration is nowhere near extremes. In fact, it’s quite low, given the significant increase in the price of silver between the 2022 lows and the 2024 highs. This suggests that there is significant upside potential for silver, perhaps even huge upside potential, in 2025 and likely into 2026.

Silver price outlook

In all our recent silver-related publications, we have affirmed a very bullish outlook for the silver price. The leading indicator shown above is just one of many data points confirming the bullish outlook for silver.

READ – When will silver reach 100 USD?

Let’s summarize which other data points are bullish:

- Insanely powerful bullish chart pattern on the secular silver chart.

- Leading indicators, especially in the silver COMEX, are (strongly) bullish.

- The USD and interest rates are supportive.

- Gold is in a strong bull market.

- Silver is a huge gold laggard; the lagging effect historically does not last long.

- Silver sentiment is not overly bullish.

- A silver shortage has been developing on the physical silver market for two years.

Source: 5 Reasons Why Silver is the Investment Opportunity of the Decade.

There is ample evidence that silver will dissolve higher.

The mutual dynamics in the markets confirm this, the data points of the leading indicators confirm this and the lack of excessive bullish sentiment confirms this. How much more evidence do we need to expect a bullish outcome, most likely a hugely bullish outcome?