Tokenized gold offers a modern way to invest in gold using blockchain technology. It combines the stability of gold with the flexibility of digital assets, giving investors safe, transparent and easily tradable exposure to gold.

RELATED – Gold Prediction 2025 and Bitcoin Prediction 2025.

Gold has long been considered a safe haven, valued for its stability and ability to preserve wealth. As fintech capabilities mature, #tokenization – transforming physical assets into digital tokens on a blockchain – is gaining ground. This article explores how tokenized gold can revolutionize investment strategies and attract traditional investors.

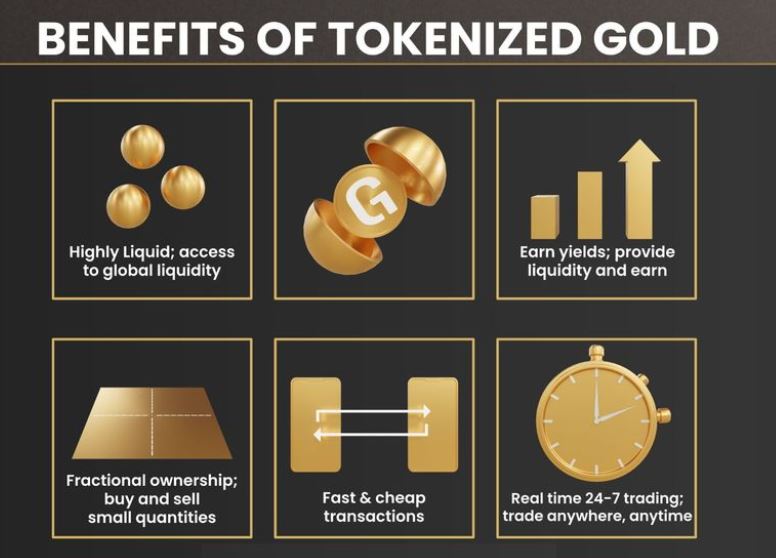

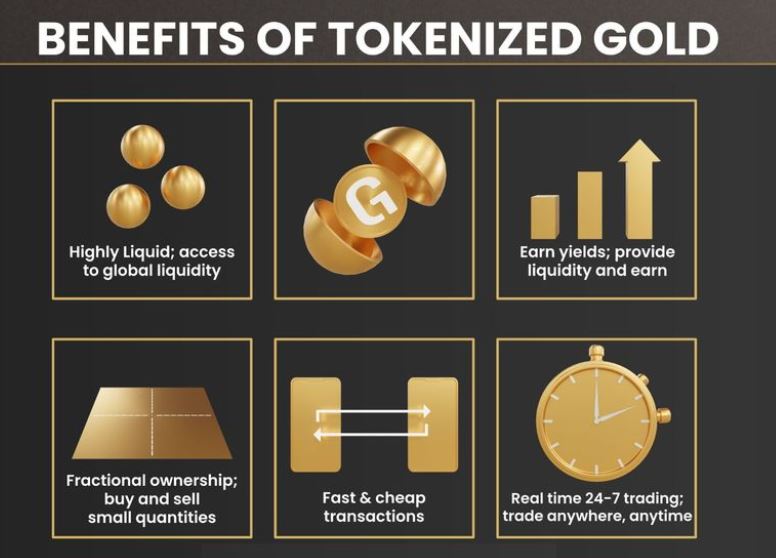

Tokenized gold and its benefits

What is tokenized gold?

Tokenized gold refers to the digital representation of physical gold on a blockchain. This process allows investors to trade and manage gold assets more easily. These are the main features:

- Digital tokens: Each token represents ownership of physical gold.

- Blockchain Benefits: Improved security and transparency through immutable records.

Benefits of tokenized gold

1. Liquidity

Tokenized gold can be traded 24/7 on various platforms, offering improved liquidity compared to traditional gold investments. This constant availability allows investors to respond quickly to market changes, providing a level of flexibility that physical gold does not offer.

2. Transparency

Blockchain technology provides verifiable ownership and transaction data, promoting trust among investors. The provenance of each token is easily traceable, allowing clear verification of ownership. This transparency is essential in an industry where the authenticity of physical assets can sometimes be questioned.

“With tokenized gold, investors can easily confirm the provenance of their assets.”

3. Cost efficiency

By reducing the number of intermediaries and streamlining processes, tokenized gold can reduce transaction and storage costs. Traditional gold investments often incur significant costs for storage and security, while tokenized assets can minimize these costs, making gold investments more affordable.

4. Accessibility

Tokenization enables fractional ownership, making gold investments more accessible to a wider range of investors. This feature allows individuals to invest in gold without needing large sums of money, democratizing access to this valuable asset.

Politeness: aurus.io

Blockchain’s role in tokenization

Blockchain technology is crucial for the implementation of tokenized gold. Its ability to provide secure and transparent data makes it an ideal solution for asset ownership management.

The decentralized nature of blockchain ensures that no single entity controls the records, improving security and reducing the risk of fraud.

Furthermore, blockchain technology enables faster transactions. Unlike traditional gold trading, which can involve lengthy processes and a lot of paperwork, tokenized gold transactions can be completed in real-time, providing a more efficient trading experience.

Market trends

The current gold market is experiencing rising demand, driven by factors such as:

- Worries about inflation: As inflation rises, investors often turn to gold as protection against currency devaluation.

- Increased purchases by central banksMany central banks are accumulating gold to diversify their reserves, further boosting demand.

These factors create a favorable environment for tokenized gold and reflect a shift in investor preferences towards more innovative and flexible investment options.

Challenges

While tokenized gold offers many benefits, there are also challenges to consider:

- Regulatory landscape: The regulatory environment surrounding tokenized assets is still evolving, and unclear regulations can pose risks to investors. Clear guidelines are needed to ensure market stability and protect investors.

- Market acceptance: Successful market adoption of tokenized gold requires robust infrastructure and investor education. Many traditional investors may be hesitant to embrace digital assets without a clear understanding of their benefits and risks.

One thing is clear: if at all Blackrock is committed to tokenizationyou know that it is a new and sustainable trend:

Real world examples of tokenized gold

Several successful platforms are paving the way for tokenized gold on the market, such as:

- PAX Gold (PAXG): This platform allows investors to hold gold-backed tokens that represent real gold, stored in secure vaults. PAXG increases trust and offers investors the opportunity to exchange their tokens for physical gold if desired.

- Perth Mint gold token: Like PAXG, PMGT offers a model where each token is backed by physical gold held by the Perth Mint, ensuring transparency and security for investors.

While these examples have not yet gone mainstream, they illustrate the evolution of tokenized gold and its increasing adoption (slowly but surely at this point).

The future of tokenized gold

Looking ahead, the future of tokenized gold seems promising. As technological advancements continue and the financial landscape changes, tokenized gold may become increasingly relevant.

- Integration with traditional finance: The potential for integrating tokenized gold with traditional financial products could further broaden its appeal. As more financial institutions adopt blockchain technology, tokenized gold could become a standard offering.

- Increased investor interestContinued interest in digital assets and the rise of fintech solutions are likely to drive demand for tokenized gold, making it a viable option for modern investors.

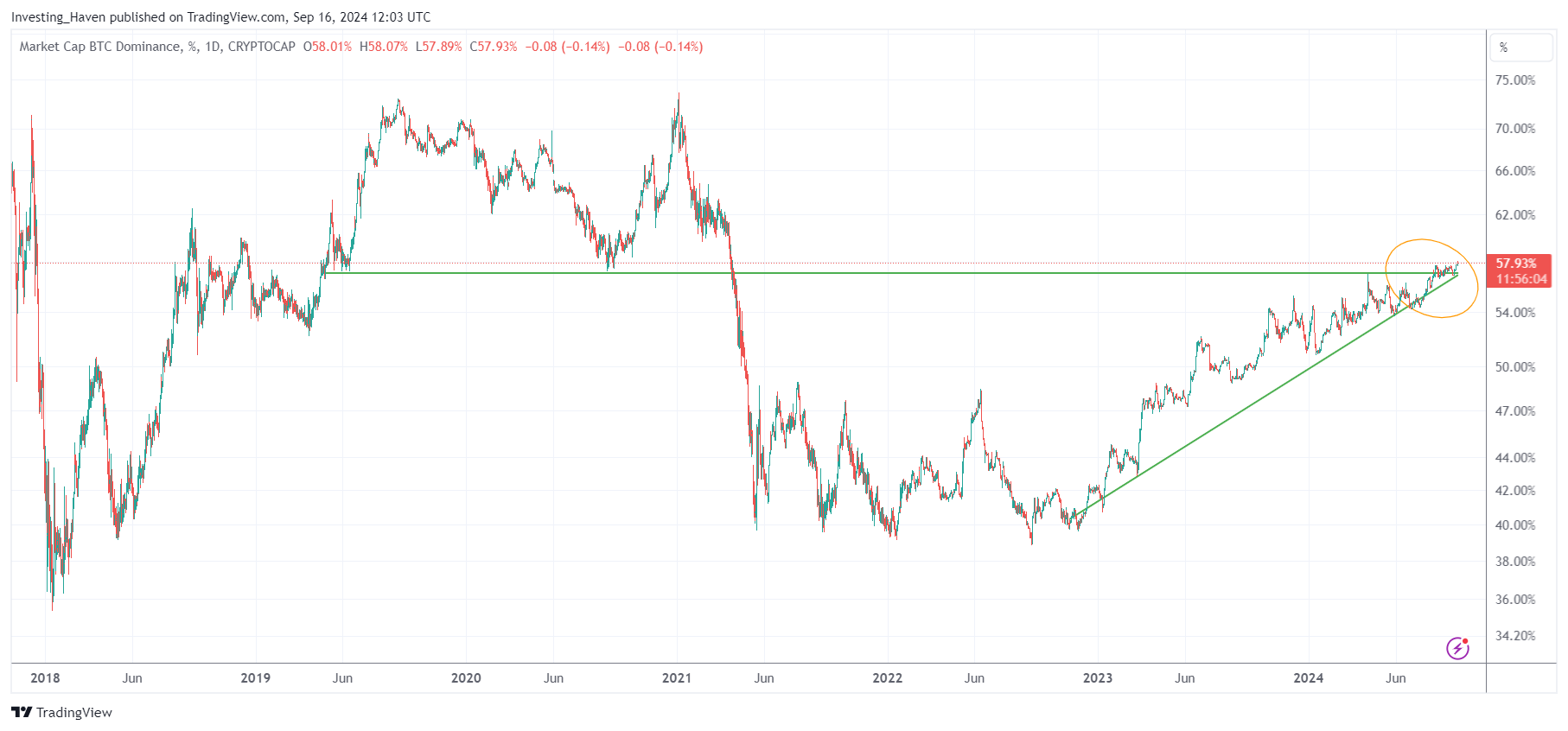

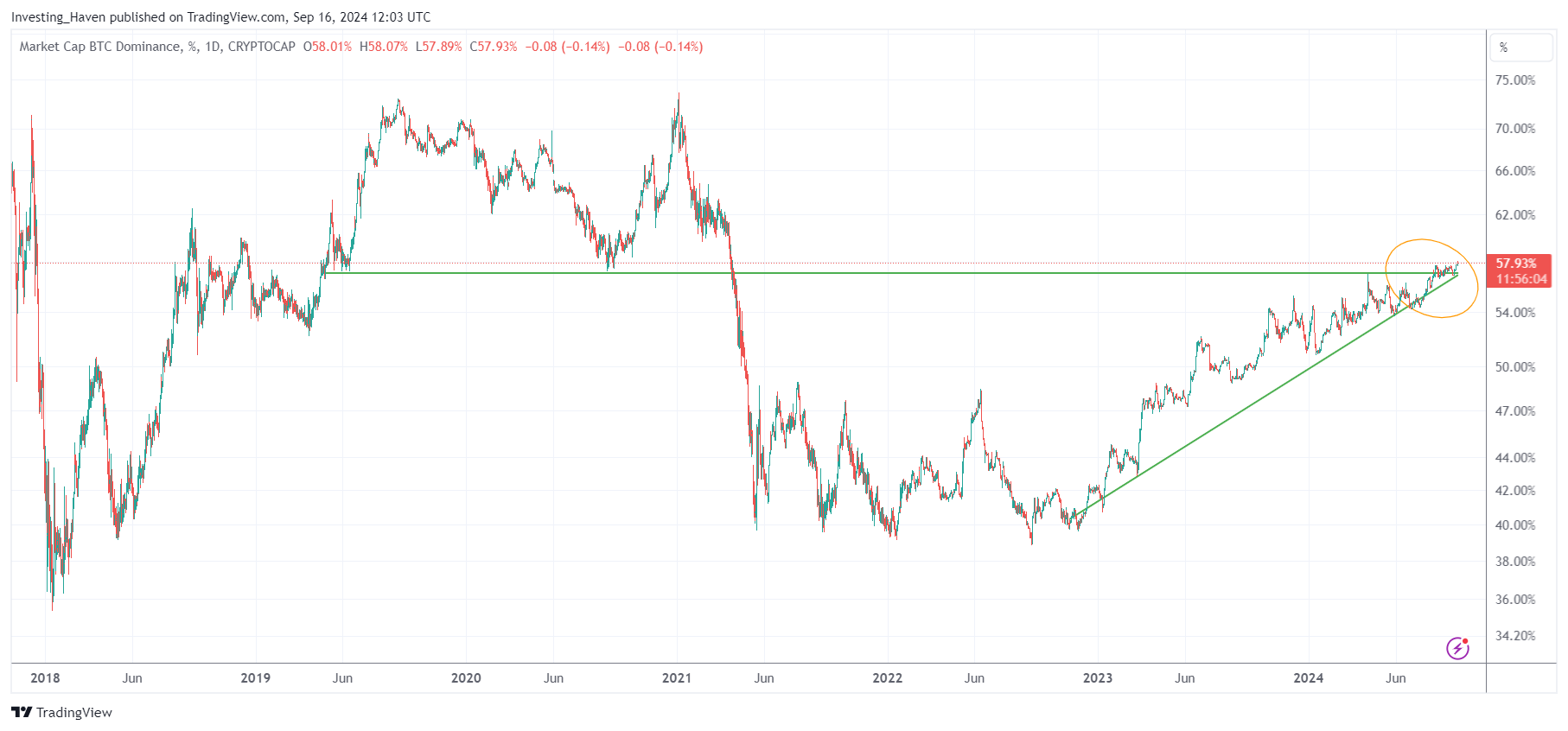

Bitcoin dominance and the emerging crypto story

An important trend to keep an eye on is the increasing dominance of Bitcoin. Recently, Bitcoin’s dominance has increased, indicating that the market focus is shifting towards blue-chip tokens.

This increase in dominance often means that altcoins can experience slower momentum, with attention turning to established cryptocurrencies such as Bitcoin.

Interestingly, tokenization tokens are relatively strong compared to their peers. It is THE top topic in our premium crypto research, and many recent alerts have been devoted to this trend.

This indicates that while the broader crypto market could consolidate, tokenized assets – including gold – could emerge crypto stories in the near future.

Takeaways

The integration of blockchain technology into gold investments represents a remarkable evolution in the financial sector that is worth keeping a close eye on as it could potentially become the next big story.

Tokenized gold offers a secure and accessible method of handling precious metals, appealing to traditional investors who prefer security in an increasingly digitalized world.

As these innovations continue to develop, they could play a crucial role in investing.

Understanding these new technologies can help investors stay informed.

Ongoing developments in tokenization suggest that gold investing could undergo a transformation in the not-too-distant future.

As the next wave of innovation accelerates, tokenized assets could take center stage. We will monitor this trend in our premium crypto research service.