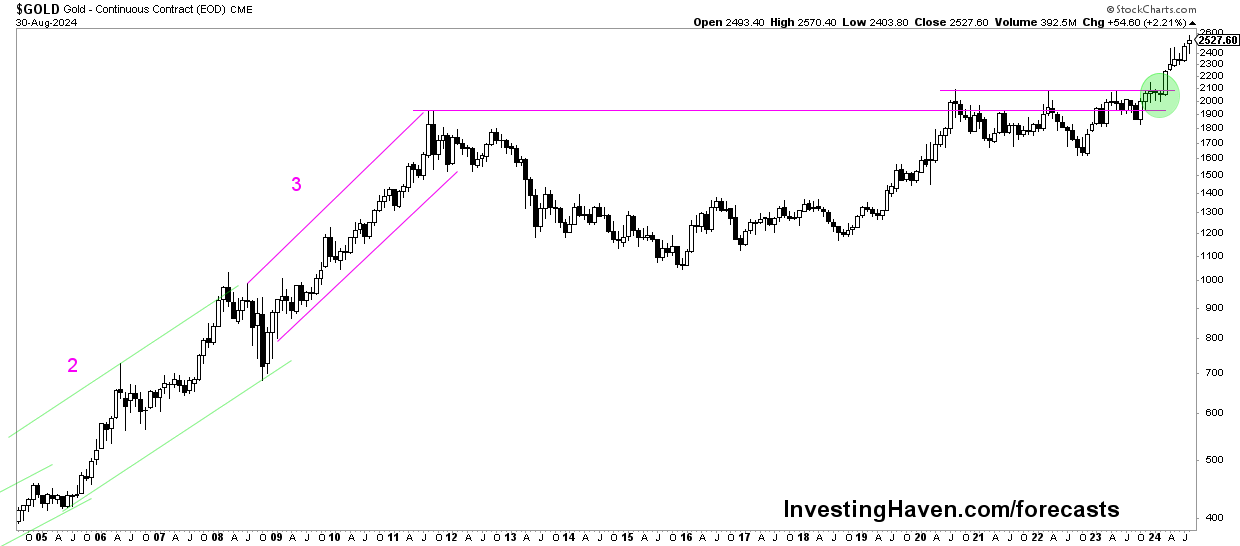

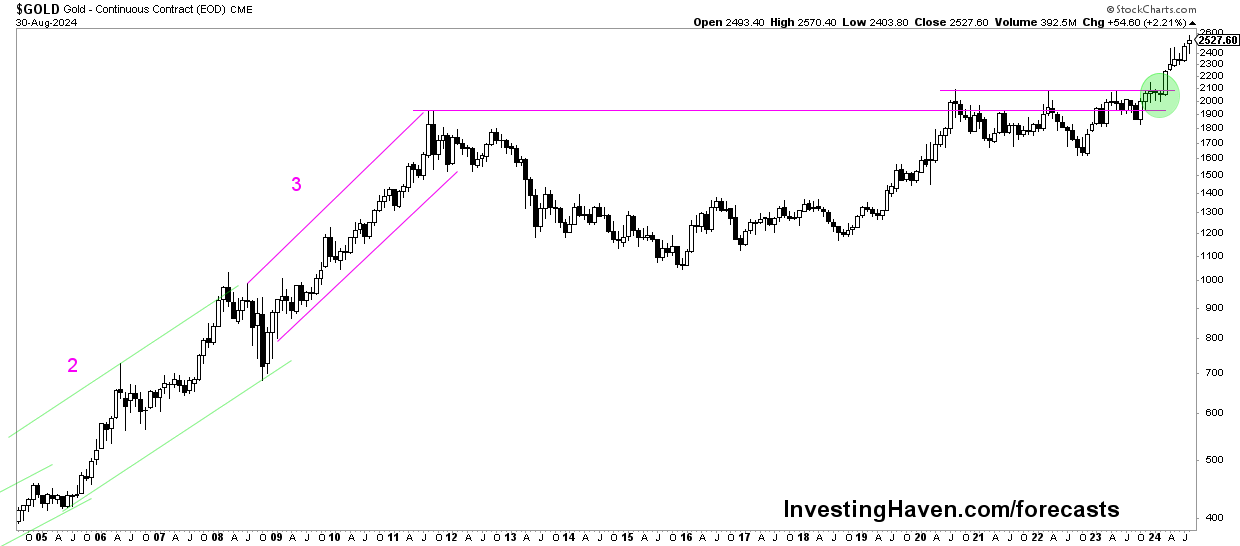

The 20-year gold price chart in this article shows long-term dynamics and patterns.

RELATED – Gold Price Prediction for 2024 2025 2026 – 2030

Gold has long been a cornerstone of investment portfolios, providing protection against inflation.

Analyzing the 20-year gold price chart provides valuable insights into the metal’s performance and its role in the broader financial landscape. This article highlights the key gold trends and pivotal moments of the past twenty years, and compares them to the longer and shorter term gold charts.

Gold price chart over 20 years

The gold map of the past twenty years has a number of clear phases:

- The new gold bull market started on March 4, 2024 (source: Gold is expected to set a new ATH).

- The consolidation in the form of a ‘cup and handle’ chart pattern – this lasted 10 years (2013-2023).

- A long uptrend prior to the 2011 peak.

Below is the 20-year gold price chart with the different phases explained above.

Gold trends of the past 20 years

Based on the 20-year gold chart shown above, we identify a few different periods that coincide with high-level gold trends.

Gold bull market in the early 2000s

The twenty-year period begins in the early 2000s, a time when gold began a significant bull run. From around 2001, the price of gold began to rise steadily, driven by a combination of factors, including declining confidence in traditional investments and rising fears of inflation.

Golden trend: This trend was part of a broader commodity rally and reflected growing investor demand for safe haven assets.

Gold’s peak in 2011

One of the most notable highlights of this period is the 2011 peak. Gold reached all-time highs, surpassing $1,900 per ounce, the previous gold ATH.

Golden trend: This increase was largely influenced by the aftermath of the 2008 financial crisis, which led to increasing concerns about debt levels and economic stability. The Federal Reserve’s monetary policy and global economic uncertainties have further fueled this rally.

Correction after the peak

After the 2011 peak, gold experienced a period of correction and consolidation. Prices fluctuated and generally trended downward or sideways.

Golden trend: This phase was characterized by a stronger US dollar, reduced fears of inflation and changing interest rates. During the correction phase, gold prices were also challenged by market sentiment and geopolitical events, reflecting a period of market adjustment.

The revival of gold in the 1920s

In recent years, gold has seen renewed interest, especially in response to growing concerns about inflation, economic uncertainties and geopolitical tensions.

Golden trendRecent years have demonstrated gold’s resilience as a safe haven, with prices responding positively in times of market turbulence and instability.

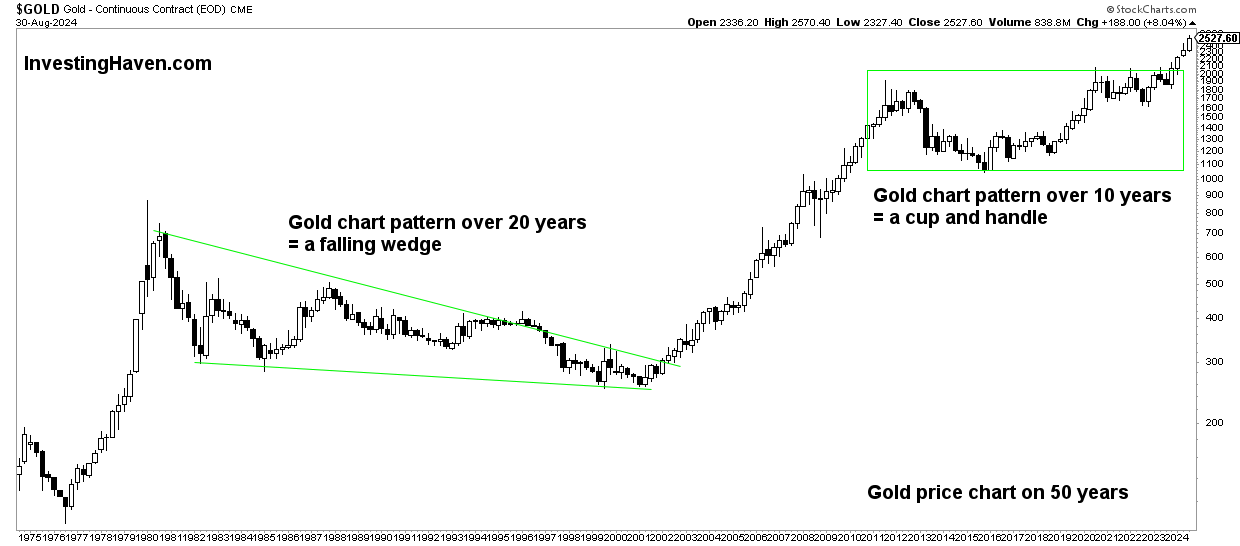

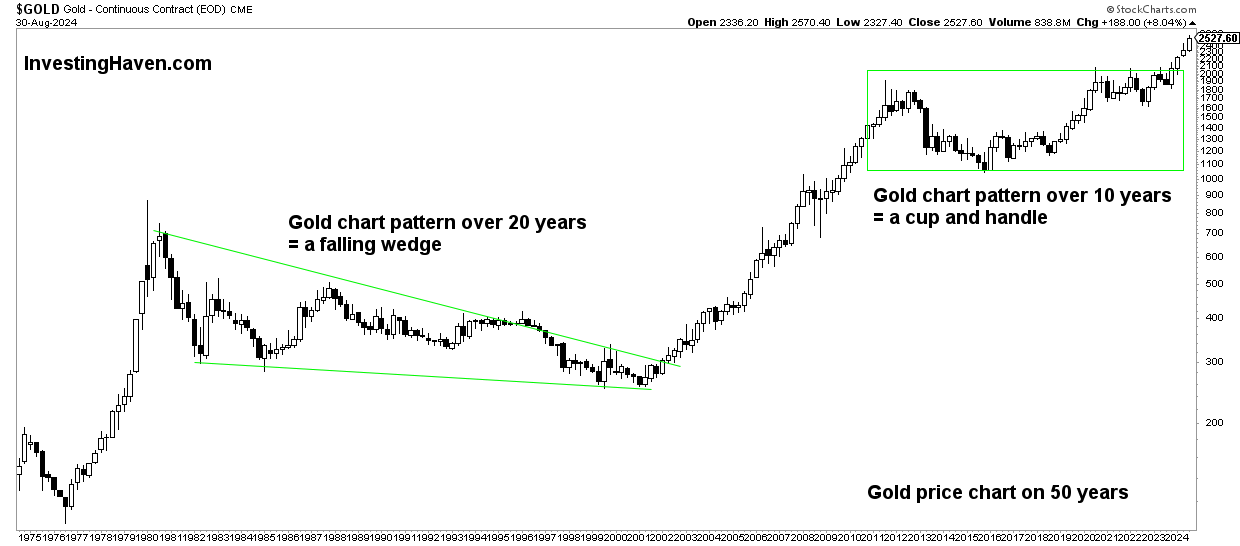

Gold price chart over 20 years: comparison

When we compare the 20-year chart with the 10-year and 50-year perspectives, a number of important observations emerge:

10-year trends: The 10-year trend in the chart below provides a more detailed view of gold’s recovery phases. In chart terms: a consolidation in the form of a bullish reversal.

50 year trends: The 50-year gold chart provides a long-term perspective and shows the evolution of gold over different inflation cycles. It highlights the cyclical nature of the gold price and the long-term bullish trend that has persisted despite corrections.

Conclusion

The 20-year gold price chart provides a comprehensive view of the yellow metal’s performance.

By examining these trends in the context of shorter- and longer-term perspectives, investors can gain a deeper understanding of gold’s long-term dynamics.