Every week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to surface five stocks that deserve attention.

Investors are constantly looking for undervalued, underwatched and emerging stocks. With numerous methods available to retail traders, the challenge often lies in sifting through the abundance of information to discover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week of September 20:

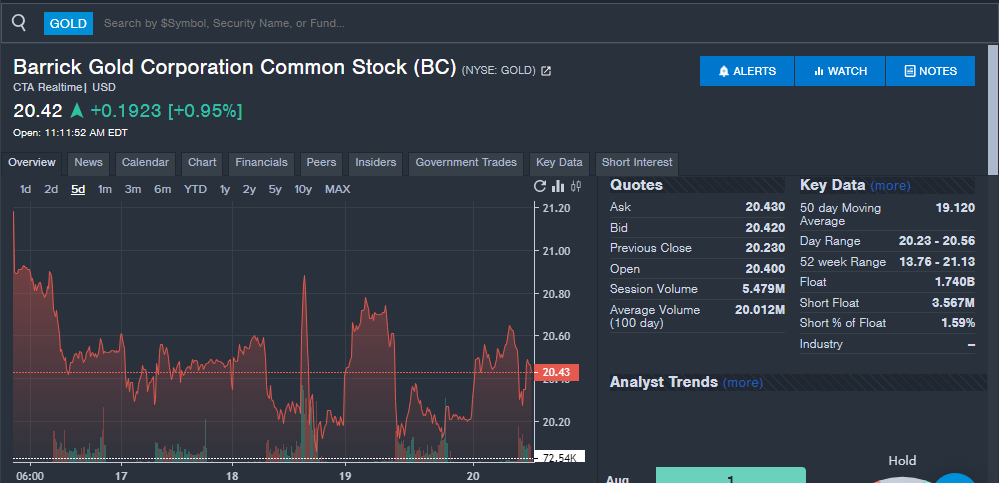

Barrick Gold GOLDThe gold mining company saw increased interest from readers this week following a 50 basis point cut in interest rates by the Federal Reserve, which saw gold prices rise. The interest also comes after Barrick Gold CEO Mark Bristow spoke at the Gold Forum Americas earlier this week, saying the company expects 30% growth in gold equivalent ounces from its existing assets by the end of the decade.

Bristow’s comments focused on the company’s current mines and those under development as the industry experiences a surge in merger and acquisition activity. The CEO also highlighted how the company is expanding its copper portfolio, which could be exciting for investors to watch.

Barrick shares are down 2% over the past five trading days, as seen on the stock market Benzinga Pro Card below. The stock is up 14% this year through 2024.

Galmed pharmaceutical products GLMD: The biopharmaceutical company saw shares rise this week after an announcement about drug development activities. Galmed plans to add drug developments targeting cardiac fibrosis and colorectal and liver cancer. The company will release data from the studies in the fourth quarter.

“The circumstances that Galmed plans to focus on in the coming years are major public health issues that impact millions of people around the world and impose a huge financial burden on healthcare providers,” said Galmed’s CEO. Allen Baharaff said.

Due to the high interest in Galmed, the shares were halted several times during the trading week. Helping with the volatility in the biopharmaceutical company is its low share price, with about 625,000 shares available according to Benzinga Pro. Stocks with low float can often see high volatility on company announcements.

The stock is up 160% in the past five days and is up nearly 100% in 2024.

Also Read: EXCLUSIVE: Top 20 Most Searched Tickers on Benzinga Pro in August 2024 – Where Do Tesla, Nvidia, Apple and AMD Stocks Stand?

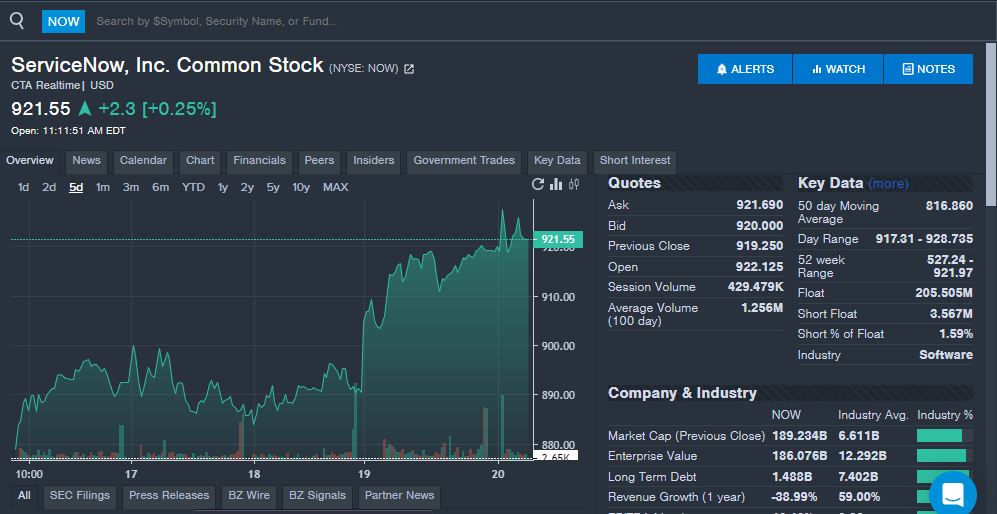

ServiceNow Inc NOW: The software company is seeing a big uptick in reader interest ahead of its third-quarter financial results. Analysts expect the company to report revenue of $2.74 billion, compared to $2.29 billion in the third quarter of last year.

The company has exceeded analyst revenue expectations for six straight quarters. Analysts expect the company to report earnings per share of $3.46, compared to $2.92 in last year’s third quarter. ServiceNow has exceeded analyst earnings estimates for more than 20 consecutive quarters.

The company’s earnings report will show investors and analysts whether revenue growth and demand for AI platforms continue to increase. The company saw subscription revenue rise 23% year-over-year in the second quarter and said it helped meet demand from CEOs looking for new growth as ServiceNow “delivers every workflow, in every business, in every industry, reinvents, with GenAI at its core.”

ServiceNow shares are up 4% in the past five days and 34% since the start of the year.

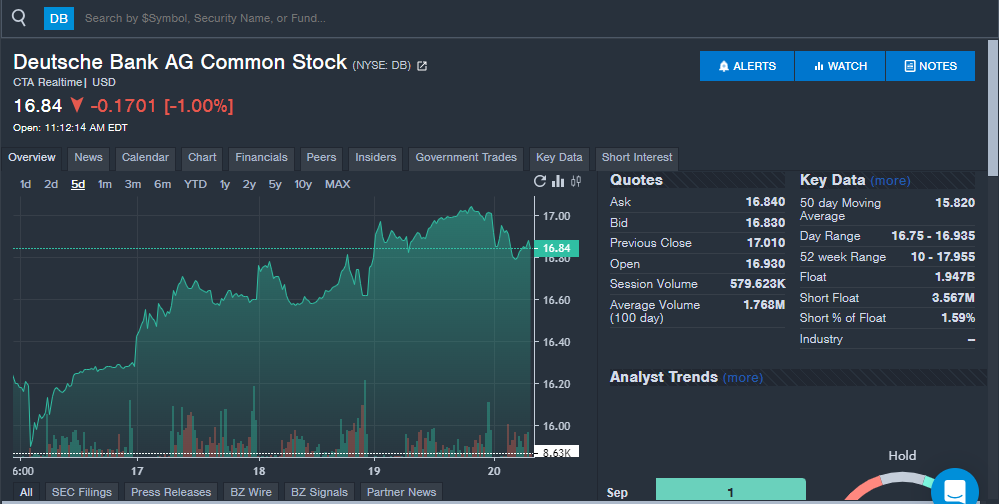

Deutsche Bank D.B: It’s not every week that a bank stock finds its way into the Stock Whisper Index, but here we are. Deutsche Bank saw strong interest from readers, which could be due to bank stocks rallying after the rate cut was announced.

This move could lead to strengthening lenders’ balance sheets in the future and increasing demand for lending activities. Deutsche Bank reports third-quarter financial results in October and can comment on demand and what the future looks like for the company and the industry.

Shares are up 5% in the past five days and 24% this year.

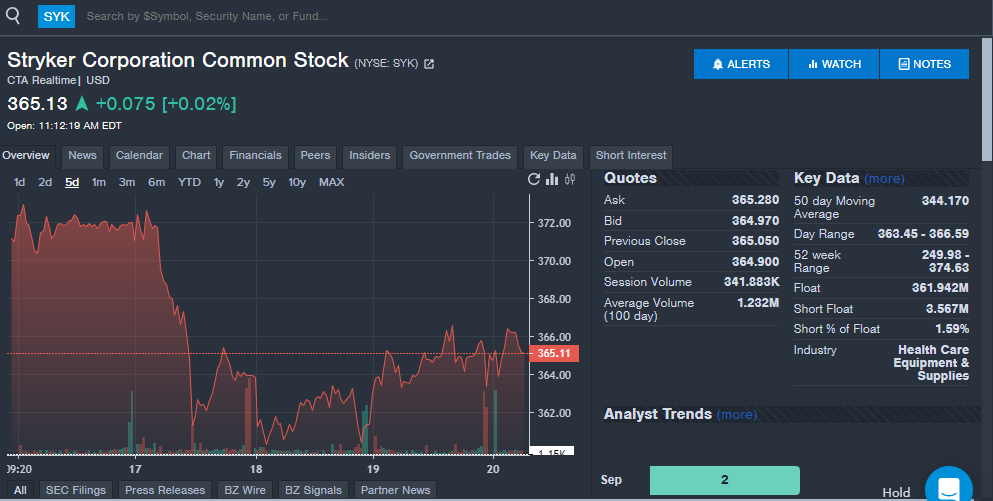

Stryker Corporation SYK: The medical device company saw strong reader interest throughout the week, following acquisition announcements, new products and analyst comments.

The company recently unveiled new foot and ankle solutions that can help restore limb length. Stryker completed the acquisition of privately held care.ai, a company that helps with AI-enabled virtual care workflows and smart room technology. The company says the acquisition will help accelerate its digital vision and expand its healthcare IT business.

On Friday, Stryker completed its acquisition of NICO Corporation, a surgical method company for tumor and intracerebral hemorrhage. Stryker also announced an acquisition of pain management company Vertos Medical in August. Together, the acquisitions and new products could get investors excited about the company’s future and its potential diversification efforts.

Piper Sandler recently maintained an Overweight rating and a $380 price target on the stock. Wolfe Research initiated coverage with an Outperform rating and a $405 price target.

Stay tuned for next week’s report and follow Benzinga Pro for the latest news and most important market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read next:

Photo: Benzinga

© 2024 Benzinga.nl. Benzinga does not provide investment advice. All rights reserved.