This article contains multiple 10 year gold price charts. They put the new gold bull market into perspective.

RELATED – A Gold Price Prediction for 2024 2025 – 2030.

This article provides the 10-year chart of gold with our chart annotations to help readers understand the message of the chart: it is a bullish message.

One of the best practices when reading charts is the top-down approach: start with a higher time frame.

- Let’s first look at the 50-year gold chart.

- We then find the structure of the gold price over a period of ten years.

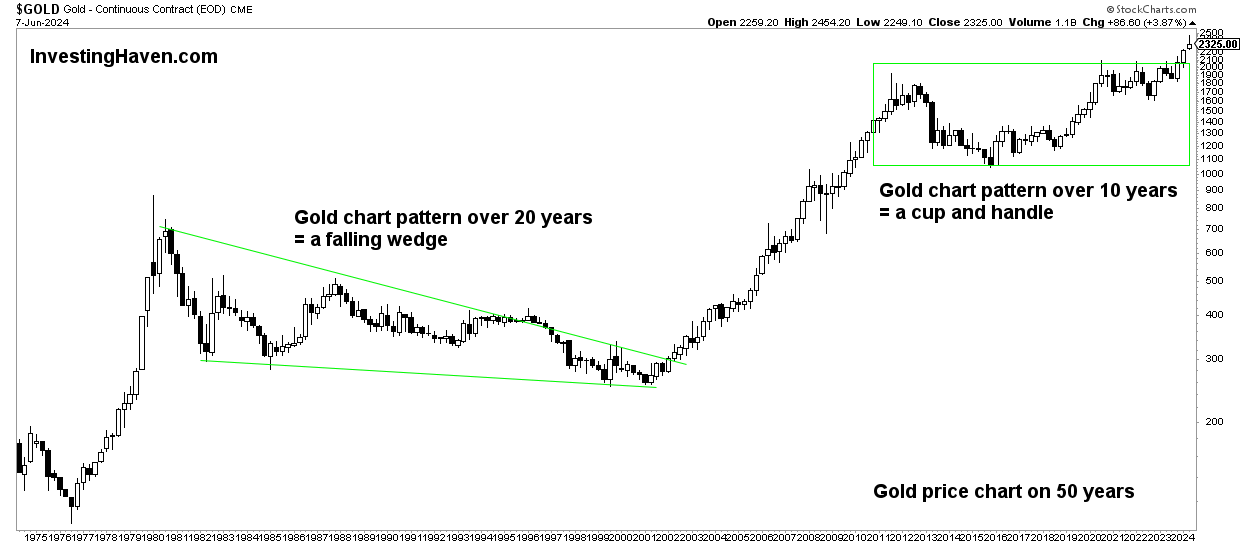

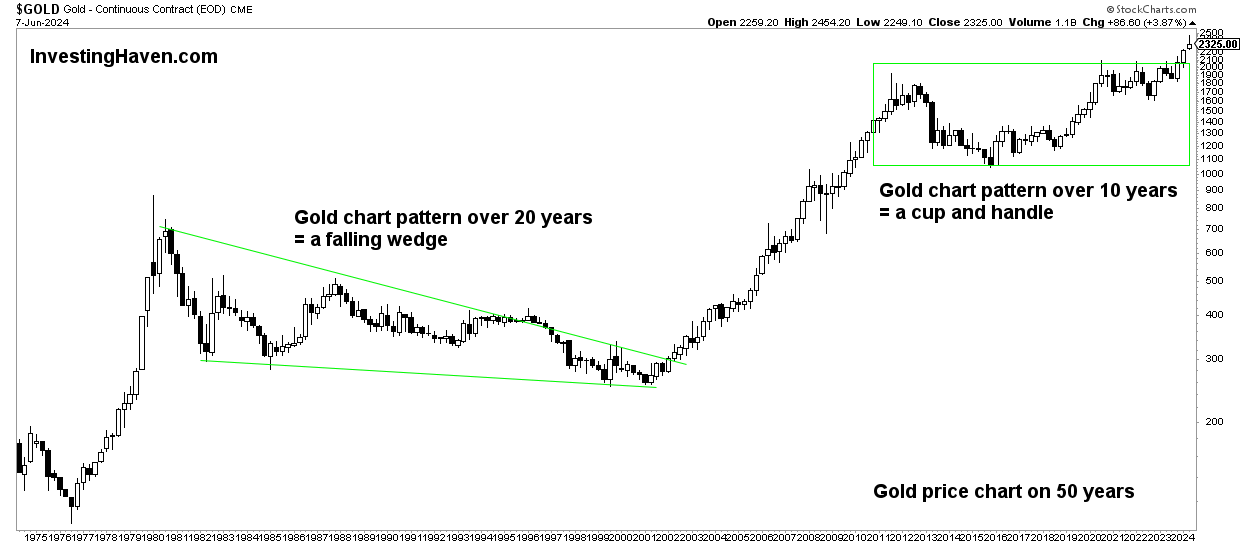

Gold The big time frame is the 50 year gold chart shown below.

That’s where large (dominant) chart patterns become visible. What do we see?

- A falling wedge that took twenty years (1980-2001).

- A secular upward trend (2001-2011).

- A consolidation in the form of a cup-and-handle formation that took 10 years (2013-2023).

The latter is the important insight to take into account when analyzing the gold price in 10 years.

It took the gold market exactly 10 years to complete a bullish chart formationa basic pattern:

- This period has felt very uncertain for most gold investors.

- The broader investing public has questioned the golden thesis.

- However, the long-term gold chart was very clear.

That’s why chart patterns and accurate chart readings are so important: cutting through the noise. A large part of the noise is caused by gold news which usually contains information that is not relevant to the investor. It is at least as important to emphasize that golden cards without patterns and structure are meaningless.

Furthermore, only long-term charts can provide valuable insights. In a world focused on short-term gold price changeswith hashtags and cash tags, it’s a challenge to see the big picture clearly.

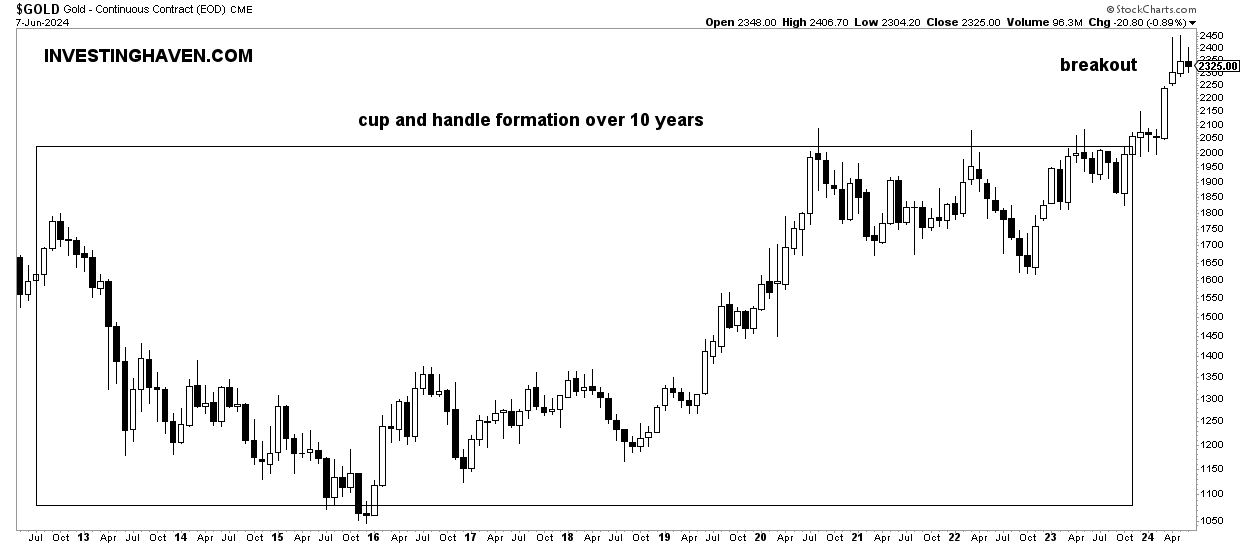

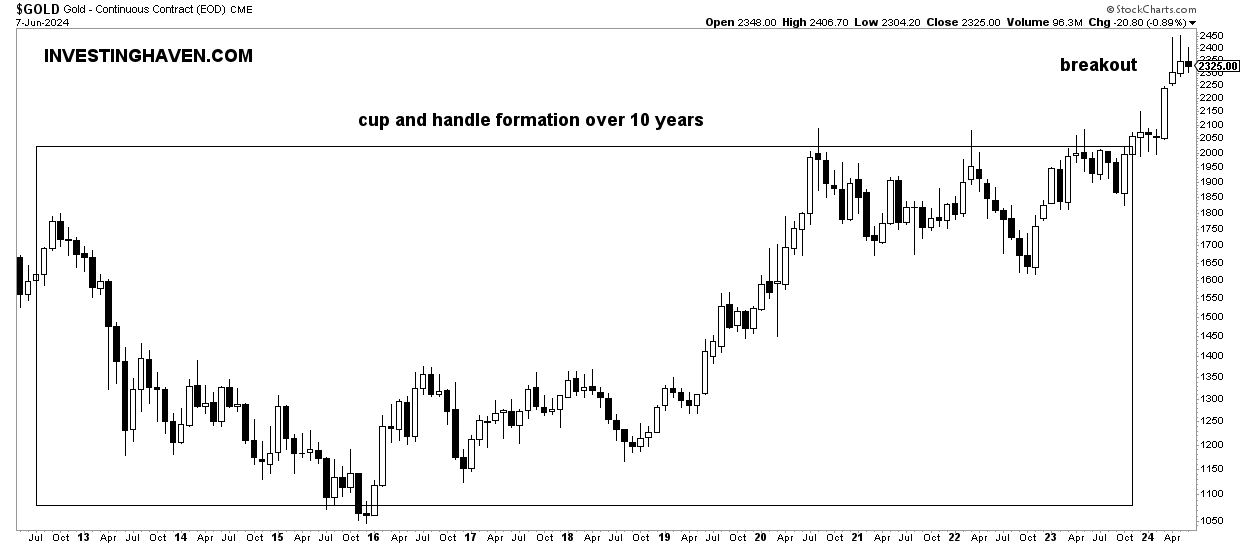

The reason we started analyzing the historical gold chart (above) is to find the dominant pattern on the 10-year gold chart.

Strictly speaking, the 10-year chart goes back to 2014. That’s the problem.

The dominant pattern, the cup and handle formation, a bullish pattern, started in December 2012. A regular 10-year gold chart would not be able to display the ultra-bullish chart pattern.

That said, it is clear from our chart annotations that gold took 10 years to complete a long-term chart pattern. It is a bullish pattern.

A few notes from the 10-year price chart of gold:

- The decline in mid-2015 was deep. This resulted in a powerful bullish reversal.

- It took gold eight years to return to its original 2012 level.

- The three years of consolidation since 2020 provided a solid support structure – it certainly felt uncertain.

The above points contribute to the powerful nature of the subsequent outbreak.

Consequently, the outbreak that occurred in 2024 is a bullish secular breakout.

While gold may pull back and retest its breakout level around $2,100, it will likely qualify as a bullish backtest.

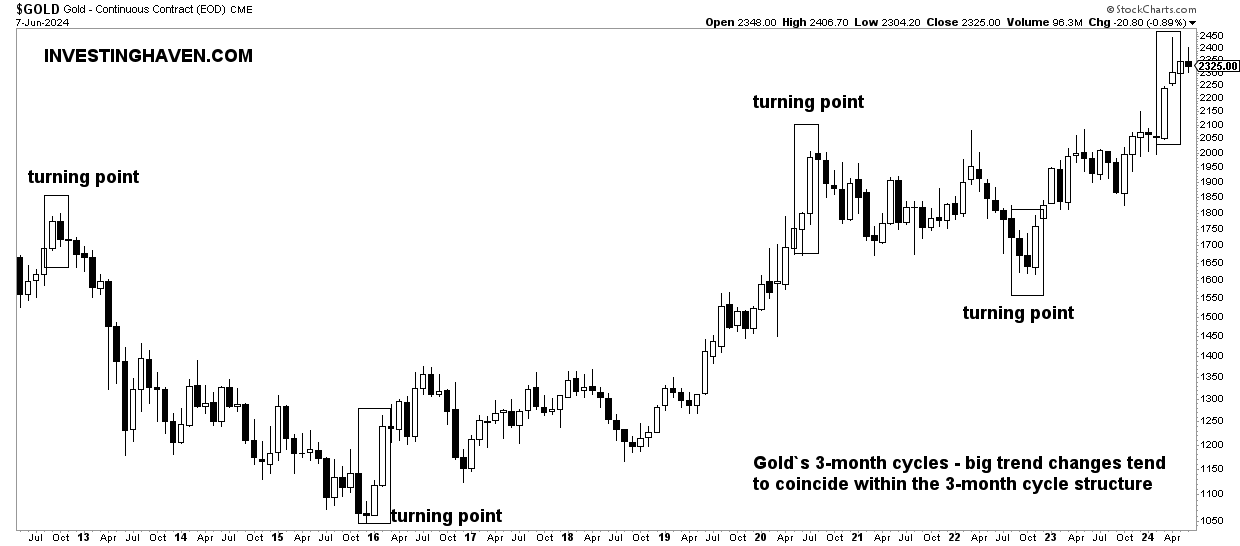

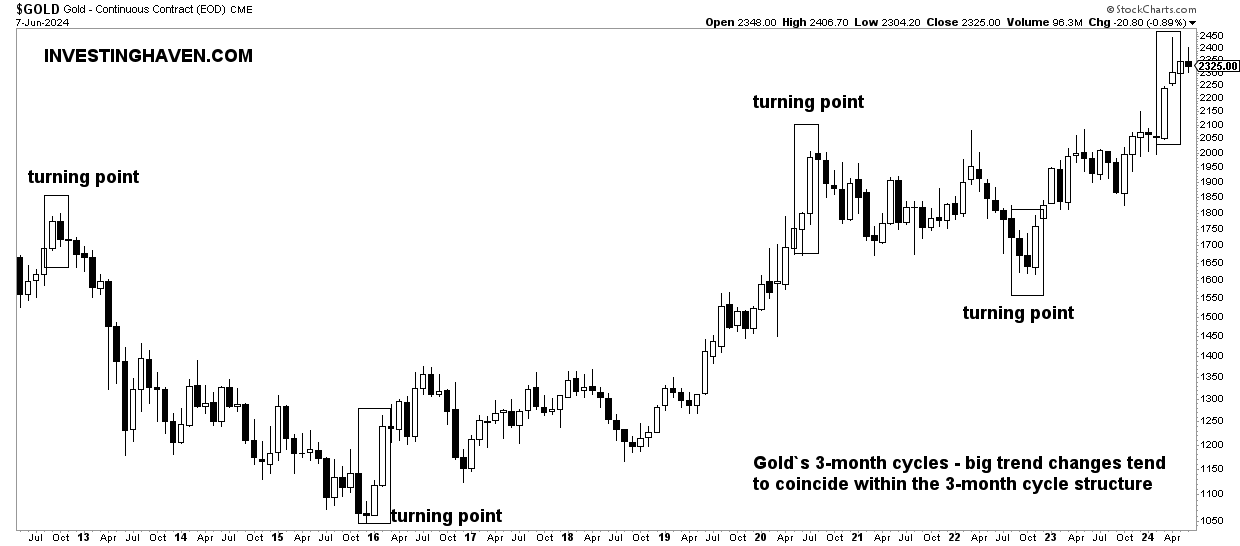

An often overlooked dynamic is short-term cycles.

They can be of great help to investors;

As shown on this 10-year gold chart, we have annotated the quarterly cycles with boxes.

Why is this important? The quarterly cycles help us understand turning points and trend changes, providing crucial information for investors.

Again, these quarterly cycles are not available on regular gold charts, nor visible to regular readers.

That’s why we include these quarterly cycles as the cornerstone of our weekly gold and silver charts that we offer in our premium gold and silver market reports.

While the 10-year gold chart may look very exciting at first glance, the reality is that it contains a wealth of insights.

The point is this: diagrams without annotations tend to be noisy.

Especially a volatile market like gold requires decent chart annotations.

That said, the key takeaways from gold’s 10-year chart:

- A long-term bullish pattern ended in 2023 (probably early 2024).

- This bullish pattern is called a ‘cup and handle’.

- The 2024 outbreak is ‘the real deal’.

- While gold may retest its breakout level sometime in 2024, it is clear that it will move higher again in 2025 and beyond.

Graphs don’t lie.

The 10-year gold price chart doesn’t lie.

Gold has a bullish long-term strategy.