Since July 11, 2024, the EUR has been undergoing a secular breakout attempt. If this works, which could take weeks or even months, the gold price will be extremely bullish.

RELATED – Will Gold Ever Reach $3,000 an Ounce?

Now that gold has been flat for about four months, many are starting to question where gold has peaked.

We strongly disagree with a top scenario for gold for many reasons.

The main reason is that the long-term chart of gold is very bullish, especially the longer time frames such as the 50-year gold price chart. Even the 10-year gold chart looks very solid.

Gold is bullish at its highs. This implies that consolidations or sell-offs will occur in the lower time frames noise more than anything. As has been said before: stay away from it gold newsit is confusing and misleading.

Gold price chart – a gentle uptrend

If anything, the daily gold price chart (XAUUSD) is a beauty.

Yes, it has met resistance recently, but that is a short-term view.

The one characteristic that stands out on the gold chart: it is an uptrend. The gentle nature of this uptrend is not important because it is an uptrend.

Gold leading indicator – a secular breakout attempt

One of the leading indicators of gold, as explained in our gold forecast, is the EURO.

The EURO is positively correlated with gold, because gold is inversely correlated with the USD.

RELATED – A Gold Price Prediction for 2024 2025 2026 – 2030.

Below you will find a multi-year price chart of the EURUSDwhere our annotations include (a) the key Fibonacci levels (b) the most obvious descending trendline.

As we can see, on July 11, 2024, the EUR rose above both the descending trendline and the most critical Fibonacci level (the 50% retracement level). This is meaningful, very meaningful.

If the EURUSD continues to move higher, it will support the gold bull market thesis.

While the EURUSD may move lower in the short term, invalidating the breakout attempt that began on July 11, 2024, the breakout may be delayed. So we need to take a long term view on this EURUSD chart even in the event of a decline in this currency pair.

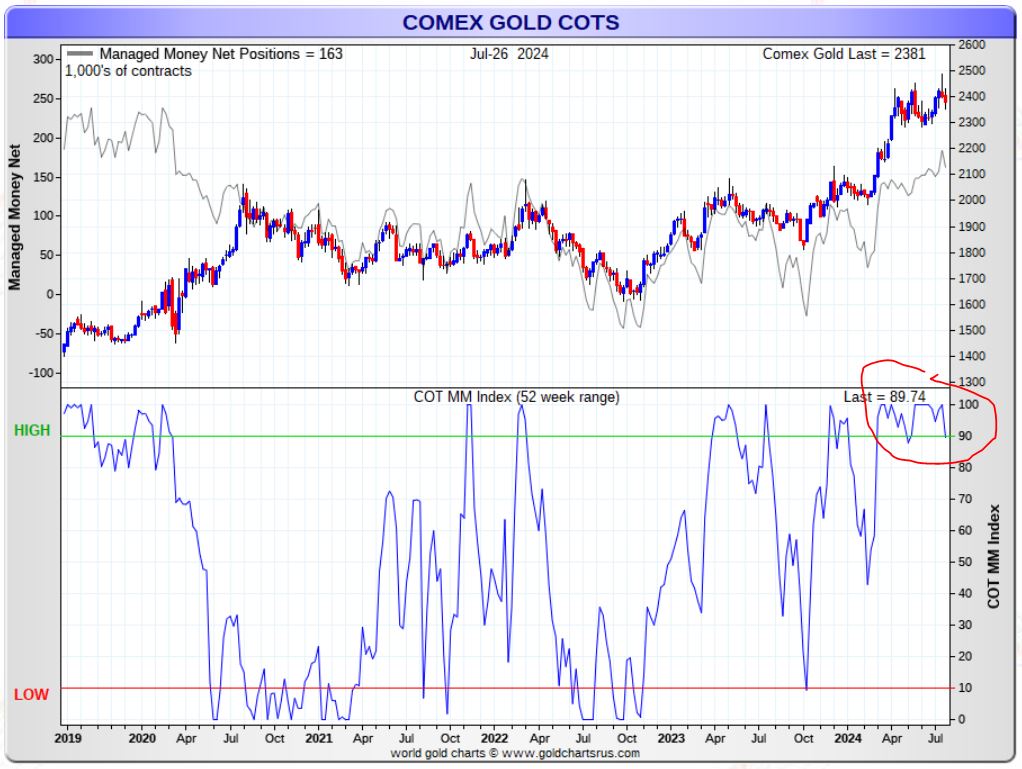

Leading indicator for gold – speculators too optimistic

On the other hand, there are far too many speculators on the long side in the gold market.

Below you will find the managed money index (also called speculators) with unfortunately a high ‘long’ value.

The gold price may need to drop a bit to deter speculators.

Ideally, if the gold price is to continue to show a sustained bullish trend, there will be fewer speculators on the long side.

In order for gold bulls to have confidence in gold’s long-term bull market, we would prefer to see a drop in gold prices, resulting in fewer speculators on the long side, followed by an epic, extended breakout in the EURUSD.

Both could happen between August and October 2024, our research suggests.

Read more in our latest gold and silver research reports >>