There are many reasons to believe that silver could be the investment opportunity of the decade. From leading indicators to the secular dynamics on the silver chart, silver is expected to outperform most markets this decade.

RELATED – Will Silver Ever Reach $50 an Ounce? Here’s the surprising answer.

In this article, we pick our top 5 reasons that make us believe silver will become one of the best investment opportunities this decade.

We answer the question of whether silver is a good investment opportunity this decade. We do this in a data-driven manner that characterizes all our work.

If our investment thesis comes to fruition, we expect silver to reach $100 before 2030.

#1. Leading indicator extremely bullish

Gold is the leading indicator in the precious metals market.

Since March 4, 2024, gold confirmed a new one secular bull market. Emphasis on the word: secular.

In other words, this is just the beginning of the gold bull market.

Source: Is Gold Expected to Hit New All-Time Highs (ATH)?

Silver lags behind gold. It’s massive lagging gold.

That’s not a bad thing. It’s a normal thing. That’s expected because silver is the laggard.

Just like during the gold bull market of 2002-2011, silver will pick up again with some delay.

Whenever the silver bull run starts, it will crush gold and every other metal, market or commodity.

It’s a matter of time for silver – gold is leading the way. Silver will follow – it’s one of the many reasons why silver could be the investment opportunity of the decade.

#2. Physical supply demand – shortage

Scarcity makes something valuable.

The expected scarcity will cause the value of an asset to skyrocket.

We have often talked about the silver shortage. We tend to take a macro view, which goes beyond the short term demand for physical silver news.

It appears that a silver shortage is developing. The highest probability outcome is that this is a macro trend that will strengthen over time.

Silver Squeeze update

The world consumes 1.3 billion ounces of silver annually and old mines are becoming depleted. World silver production is only 830 million ounces.

The silver industry has added less than 10 million ounces of new (mine) production per year in recent decades,… pic.twitter.com/yIC2P8yoo5

— Willem Middelkoop (@wmiddelkoop) August 10, 2024

#3. Silver price chart dynamics

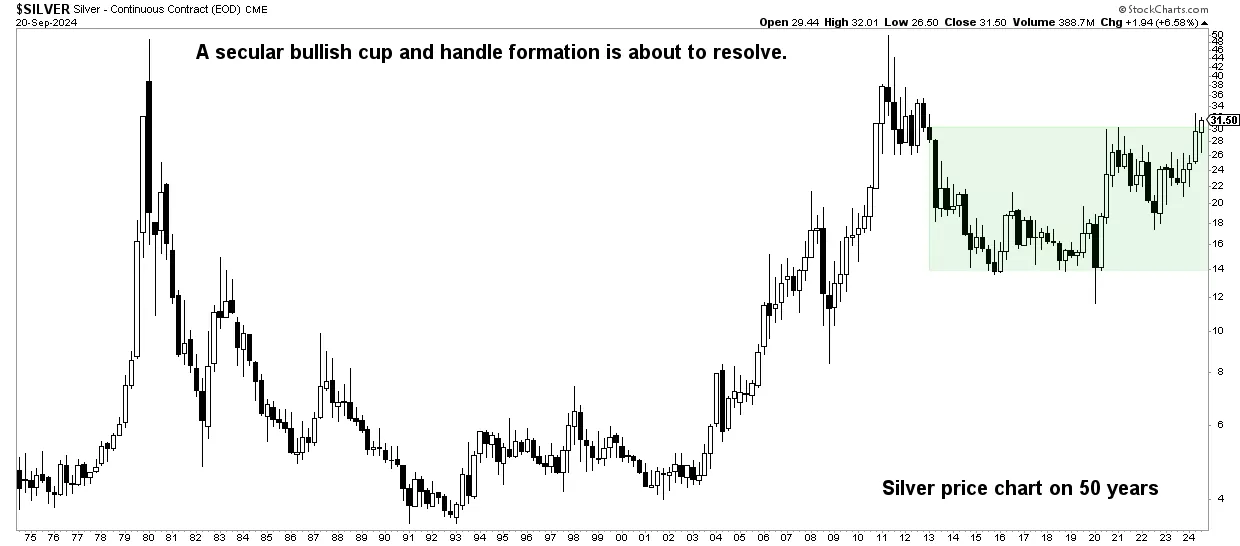

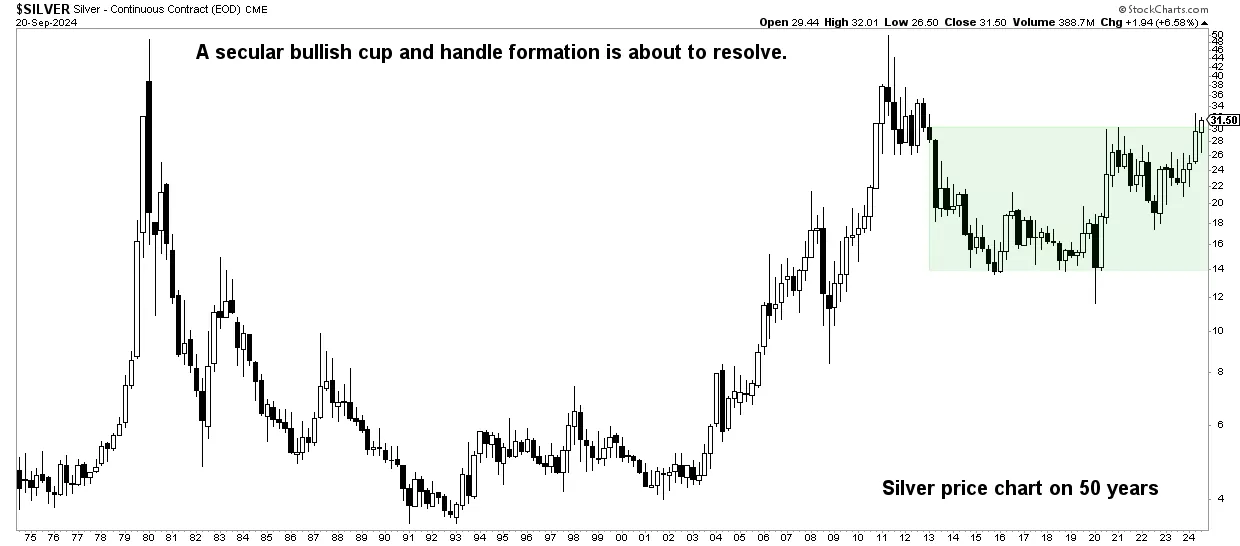

The silver price chart has one of the strongest bullish patterns imaginable: a 44-year cup and handle

. The chart dynamics are now taking control of the price – we’re right bee

the turning point – this silver chart pattern will dominate the price (and not the other way around).

As said: Gold at ATH, Silver 42% below ATH.

The 50-year silver price chart shows an unusually bullish trend

#4. Short positions well below historical extremes

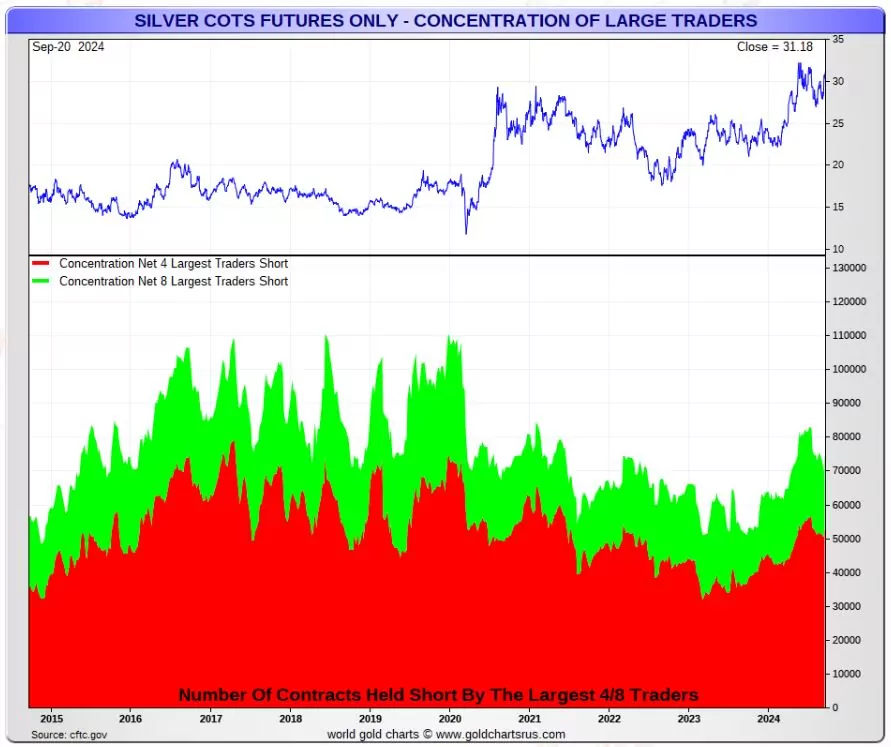

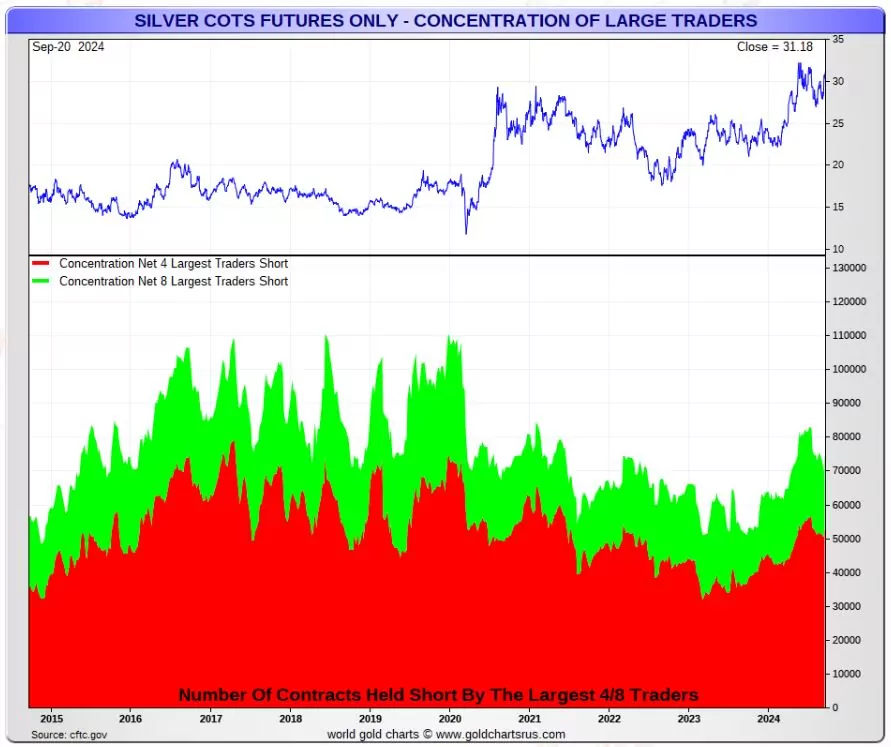

There is a lot of talk and whining about short positions.

Although short positions are normal, in any market it is about concentration.

The concentration of the largest short traders is what really matters. TIP

– We discuss the chart below, along with many other data points and leading indicators, in our weekly silver price analysis, a premium membership to InvestingHaven.

As we have seen, the concentration of the largest short traders is nowhere near extreme. Because we consider this a ‘stretch indicator’ for the silver price, it implies that there is sufficient upside potential in the silver price.

The concentration of the largest positions shorting silver is well below ATH, allowing for much more upside potential in the silver price

#5. Fuel: the human mentality

Last but not least, the human mentality will help silver immensely.

This is why:

“The stock market is an instrument to transfer money from the impatient to the patient.” – Warren Buffett.

Mr. Buffett is right: the vast majority of investors are impatient. The patient investor is usually rewarded if he chooses the right market.

Combined with all the other data points outlined in this article, we believe #5 will be the fuel silver needs to rise to $50.

Sooner or later, most investors will be fooled and buy silver as the price approaches $50, which is the point at which we will recommend taking profits. Sign up here to receive our timely silver alerts >>

Correction made on September 24, 2024. We initially wrote 24 years, but the reality is that the cup and handle span more than 44 years (1980 to present). This was a typo.

Source link